Answered step by step

Verified Expert Solution

Question

1 Approved Answer

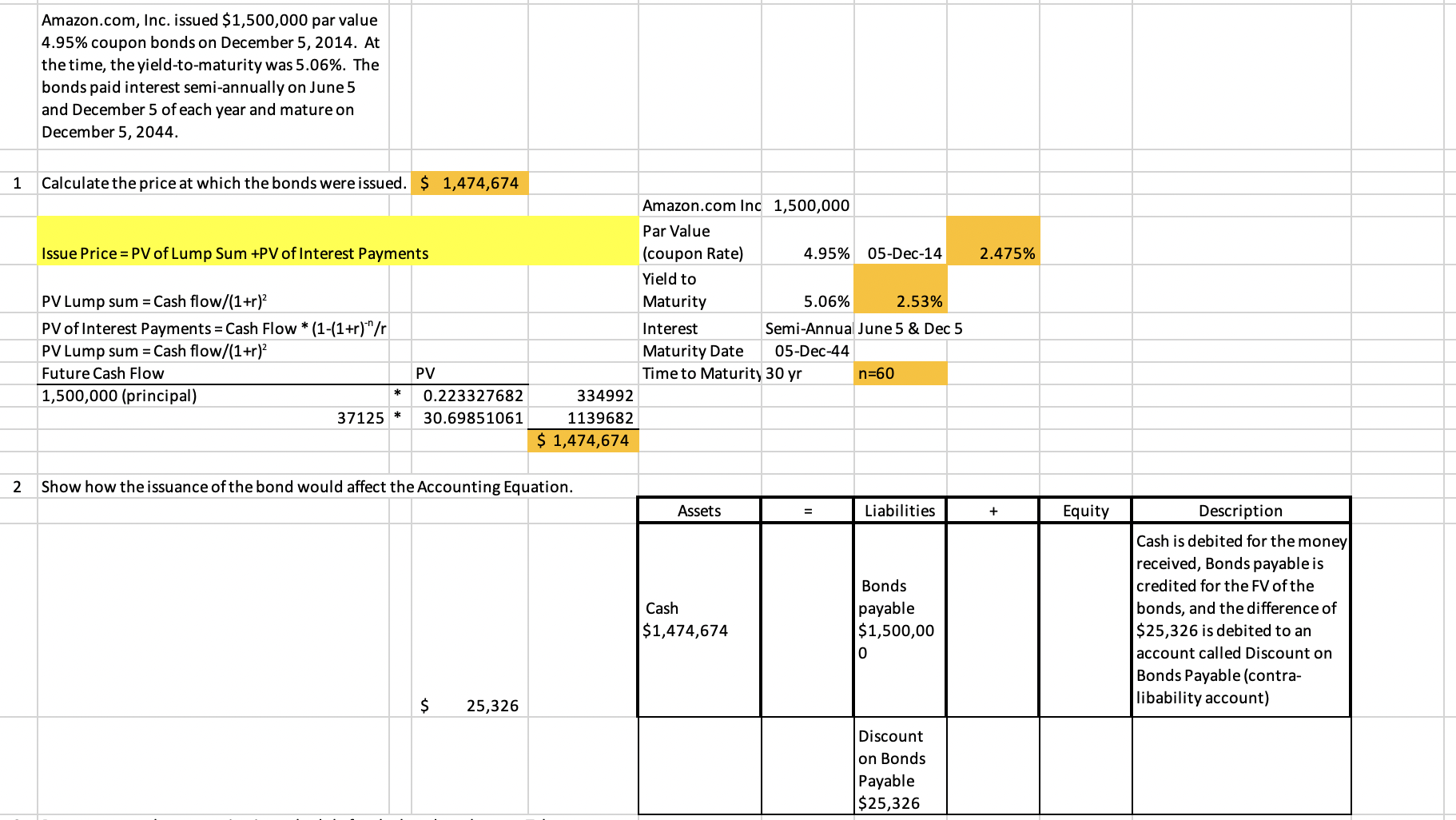

Amazon.com, Inc. issued $1,500,000 par value 4.95% coupon bonds on December 5, 2014. At the time, the yield-to-maturity was 5.06%. The bonds paid interest semi-annually

Amazon.com, Inc. issued $1,500,000 par value 4.95% coupon bonds on December 5, 2014. At the time, the yield-to-maturity was 5.06%. The bonds paid interest semi-annually on June 5 and December 5 of each year and mature on December 5, 2044. Bonds were issued at a price of $1474674.

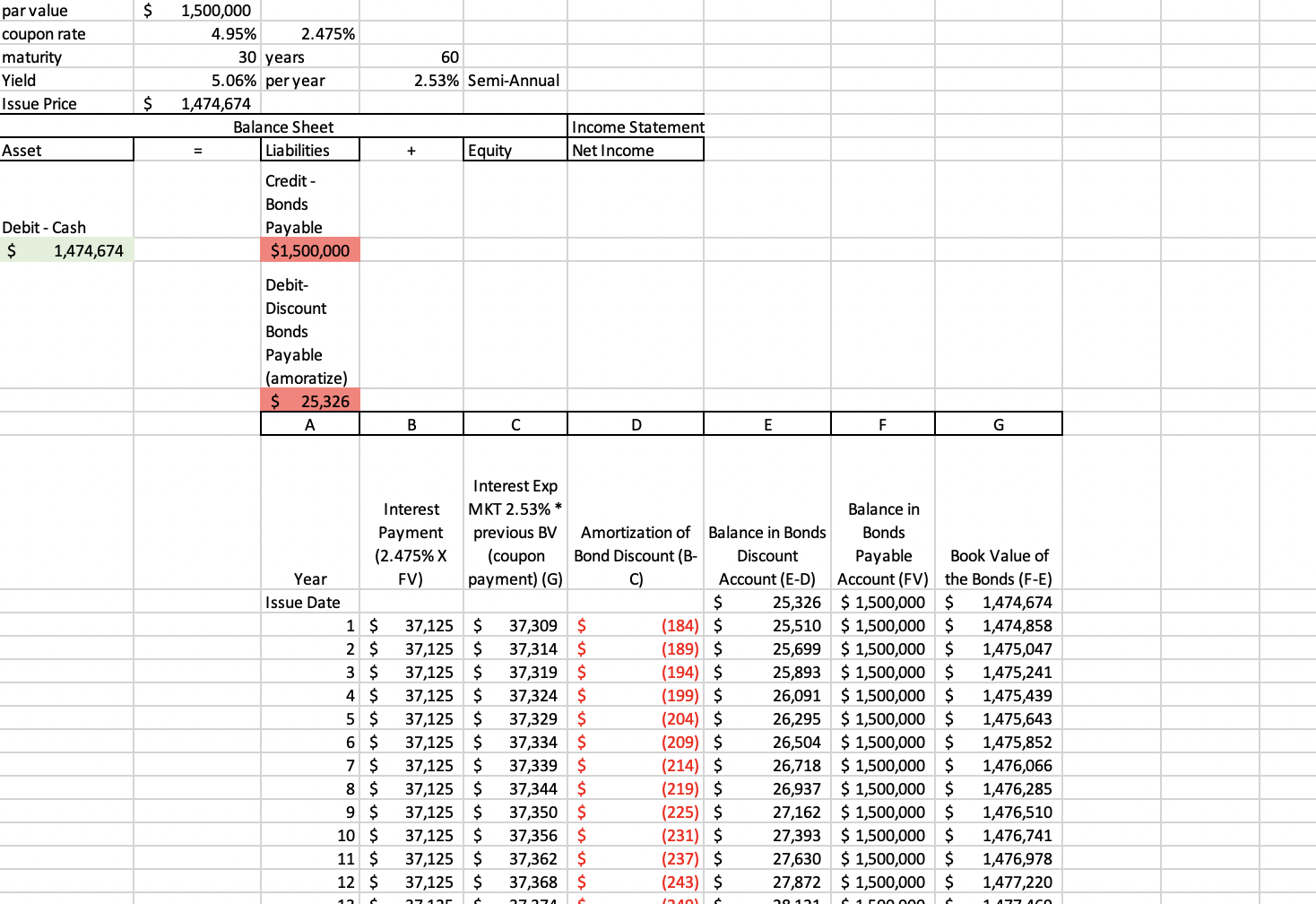

2.475% 60 2.53% Semi-Annual par value $ 1,500,000 coupon rate 4.95% maturity 30 years Yield 5.06% per year Issue Price $ 1,474,674 Balance Sheet Asset = Income Statement Liabilities + Equity Net Income Credit - Bonds Payable Debit - Cash $ 1,474,674 $1,500,000 Debit- Discount Bonds Payable (amoratize) $ 25,326 A B C D E F G Interest Exp Interest MKT 2.53%* Balance in Payment previous BV (2.475% X Year FV) (coupon payment) (G) Amortization of Bond Discount (B- c) Balance in Bonds Discount Account (E-D) Bonds Payable Book Value of Account (FV) the Bonds (F-E) Issue Date $ 25,326 $1,500,000 $ 1,474,674 1 $ 37,125 $ 37,309 $ (184) $ 25,510 $1,500,000 $ 1,474,858 2 $ 37,125 $ 37,314 $ (189) $ 25,699 $1,500,000 $ 1,475,047 3 $ 37,125 $ 37,319 $ (194) $ 25,893 $ 1,500,000 $ 1,475,241 4 $ 37,125 $ 37,324 $ (199) $ 26,091 $1,500,000 $ 1,475,439 5 $ 37,125 $ 37,329 $ (204) $ 26,295 $ 1,500,000 $ 1,475,643 6 $ 37,125 $ 37,334 $ (209) $ 26,504 $ 1,500,000 $ 1,475,852 7 $ 37,125 $ 37,339 $ (214) $ 26,718 $1,500,000 $ 1,476,066 8 $ 37,125 $ 37,344 $ (219) $ 26,937 $1,500,000 $ 1,476,285 9 $ 37,125 $ 37,350 $ (225) $ 27,162 $1,500,000 $ 1,476,510 10 $ 37,125 $ 37,356 $ (231) $ 27,393 $1,500,000 $ 1,476,741 11 $ 37,125 $ 37,362 $ (237) $ 27,630 $1,500,000 $ 1,476,978 12 $ 37,125 $ 37,368 $ (243) $ 27,872 $ 1,500,000 $ 1,477,220 17 12401 121 1 477 CO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started