Answered step by step

Verified Expert Solution

Question

1 Approved Answer

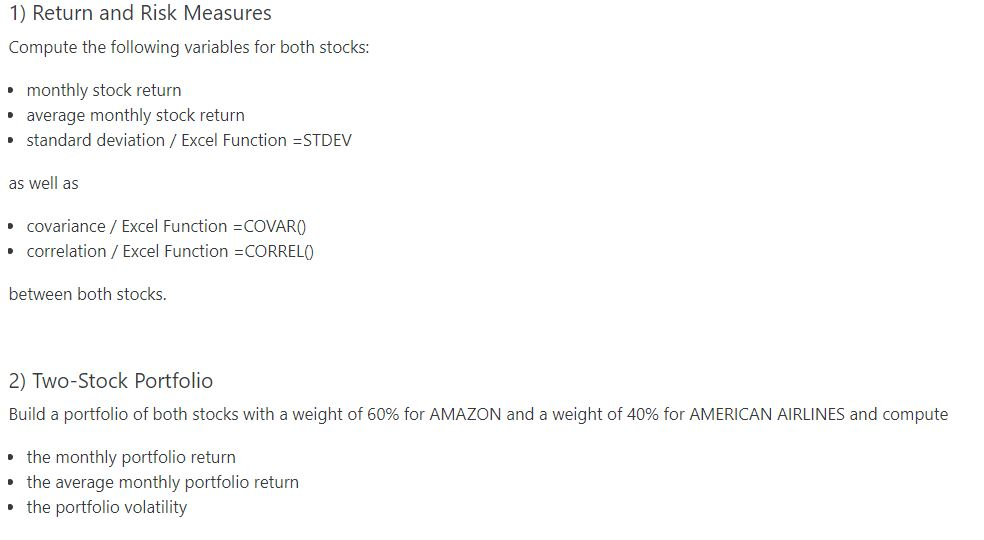

Amazon's monthly adjusted closing prices from 1.1.2018 - 31.12.2020 American Airline's monthly adjusted closing prices from 1.1.2018 - 31.12.2020 I would appreciate excel screenshots with

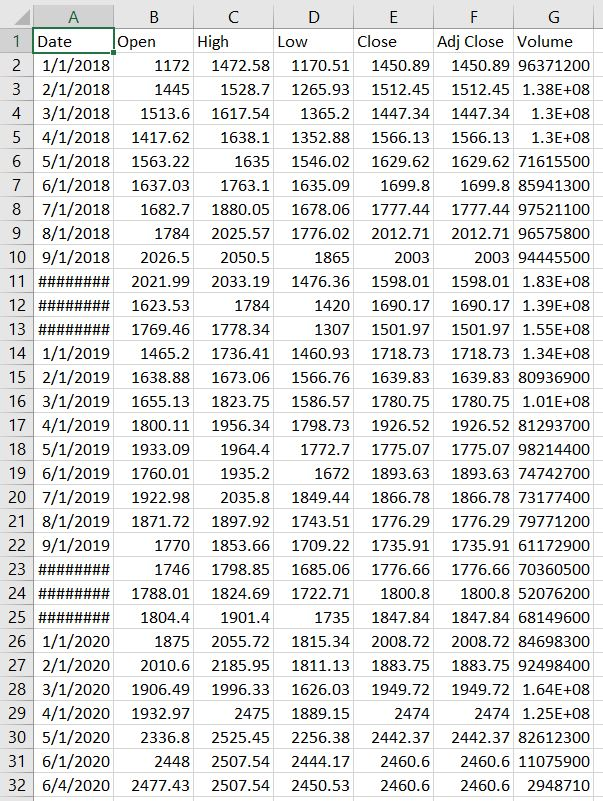

Amazon's monthly adjusted closing prices from 1.1.2018 - 31.12.2020

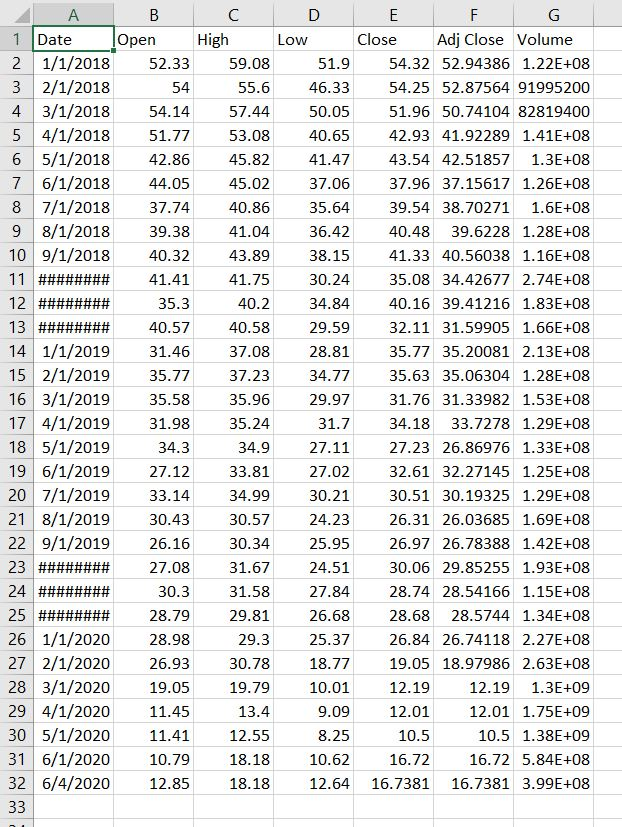

American Airline's monthly adjusted closing prices from 1.1.2018 - 31.12.2020

I would appreciate excel screenshots with a bit of explanation.

1) Return and Risk Measures Compute the following variables for both stocks: monthly stock return average monthly stock return standard deviation / Excel Function = STDEV as well as covariance / Excel Function =COVARO correlation / Excel Function =CORRELO between both stocks. 2) Two-Stock Portfolio Build a portfolio of both stocks with a weight of 60% for AMAZON and a weight of 40% for AMERICAN AIRLINES and compute the monthly portfolio return the average monthly portfolio return the portfolio volatility A B C E F G 1 Date Open High Low Close Adj Close Volume 2 1/1/2018 1172 1472.58 1170.51 1450.89 1450.89 96371200 3 2/1/2018 1445 1528.7 1265.93 1512.45 1512.45 1.38E+08 4 3/1/2018 1513.6 1617.54 1365.2 1447.34 1447.34 1.3E+08 5 4/1/2018 1417.62 1638.1 1352.88 1566.13 1566.13 1.3E+08 6 5/1/2018 1563.22 1635 1546.02 1629.62 1629.62 71615500 7 6/1/2018 1637.03 1763.1 1635.09 1699.8 1699.8 85941300 8 7/1/2018 1682.7 1880.05 1678.06 1777.44 1777.44 97521100 9 8/1/2018 1784 2025.57 1776.02 2012.71 2012.71 96575800 10 9/1/2018 2026.5 2050.5 1865 2003 2003 94445500 11 ######## 2021.99 2033.19 1476.36 1598.01 1598.01 1.83E+08 12 ######## 1623.53 1784 1420 1690.17 1690.17 1.39E+08 13 ######## 1769.46 1778.34 1307 1501.97 1501.97 1.55E+08 14 1/1/2019 1465.2 1736.41 1460.93 1718.73 1718.73 1.34E+08 15 2/1/2019 1638.88 1673.06 1566.76 1639.83 1639.83 80936900 16 3/1/2019 1655.13 1823.75 1586.57 1780.75 1780.75 1.01E+08 17 4/1/2019 1800.11 1956.34 1798.73 1926.52 1926.52 81293700 18 5/1/2019 1933.09 1964.4 1772.7 1775.07 1775.07 98214400 19 6/1/2019 1760.01 1935.2 1672 1893.63 1893.63 74742700 20 7/1/2019 1922.98 2035.8 1849.44 1866.78 1866.78 73177400 21 8/1/2019 1871.72 1897.92 1743.51 1776.29 1776.29 79771200 22 9/1/2019 1770 1853.66 1709.22 1735.91 1735.91 61172900 23 ##### 1746 1798.85 1685.06 1776.66 1776.66 70360500 24 1788.01 1824.69 1722.71 1800.8 1800.8 52076200 25 ######## 1804.4 1901.4 1735 1847.84 1847.84 68149600 26 1/1/2020 1875 2055.72 1815.34 2008.72 2008.72 84698300 27 2/1/2020 2010.6 2185.95 1811.13 1883.75 1883.75 92498400 28 3/1/2020 1906.49 1996.33 1626.03 1949.72 1949.72 1.64E+08 29 4/1/2020 1932.97 2475 1889.15 2474 2474 1.25E+08 30 5/1/2020 2336.8 2525.45 2256.38 2442.37 2442.37 82612300 31 6/1/2020 2448 2507.54 2444.17 2460.6 2460.6 11075900 32 6/4/2020 2477.43 2507.54 2450.53 2460.6 2460.6 2948710 B 1 D E F G Date Open High Low Close Adj Close Volume 2 1/1/2018 52.33 59.08 51.9 54.32 52.94386 1.22E+08 3 2/1/2018 54 55.6 46.33 54.25 52.87564 91995200 4 3/1/2018 54.14 57.44 50.05 51.96 50.74104 82819400 5 4/1/2018 51.77 53.08 40.65 42.93 41.92289 1.41E+08 6 5/1/2018 42.86 45.82 41.47 43.54 42.51857 1.3E+08 7 6/1/2018 44.05 45.02 37.06 37.96 37.15617 1.26E+08 8 7/1/2018 37.74 40.86 35.64 39.54 38.70271 1.6E+08 9 8/1/2018 39.38 41.04 36.42 40.48 39.6228 1.28E+08 10 9/1/2018 40.32 43.89 38.15 41.33 40.56038 1.16E+08 11 #### 41.41 41.75 30.24 35.08 34.42677 2.74E+08 12 35.3 40.2 34.84 40.16 39.41216 1.83E+08 13 #### 40.57 40.58 29.59 32.11 31.59905 1.66E+08 14 1/1/2019 31.46 37.08 28.81 35.77 35.20081 2.13E+08 15 2/1/2019 35.77 37.23 34.77 35.63 35.06304 1.28E+08 16 3/1/2019 35.58 35.96 29.97 31.76 31.33982 1.53E+08 17 4/1/2019 31.98 35.24 31.7 34.18 33.7278 1.29E+08 18 5/1/2019 34.3 34.9 27.11 27.23 26.86976 1.33E+08 19 6/1/2019 27.12 33.81 27.02 32.61 32.27145 1.25E+08 20 7/1/2019 33.14 34.99 30.21 30.51 30.19325 1.29E+08 21 8/1/2019 30.43 30.57 24.23 26.31 26.03685 1.69E+08 22 9/1/2019 26.16 30.34 25.95 26.97 26.78388 1.42E+08 23 #### 27.08 31.67 24.51 30.06 29.85255 1.93E+08 24 30.3 31.58 27.84 28.74 28.54166 1.15E+08 25 ### 28.79 29.81 26.68 28.68 28.5744 1.34E+08 26 1/1/2020 28.98 29.3 25.37 26.84 26.74118 2.27E+08 27 2/1/2020 26.93 30.78 18.77 19.05 18.97986 2.63E+08 28 3/1/2020 19.05 19.79 10.01 12.19 12.19 1.3E+09 29 4/1/2020 11.45 13.4 9.09 12.01 12.01 1.75E+09 30 5/1/2020 11.41 12.55 8.25 10.5 10.5 1.38E+09 31 6/1/2020 10.79 18.18 10.62 16.72 16.72 5.84E+08 32 6/4/2020 12.85 18.18 12.64 16.7381 16.7381 3.99E+08 33 1) Return and Risk Measures Compute the following variables for both stocks: monthly stock return average monthly stock return standard deviation / Excel Function = STDEV as well as covariance / Excel Function =COVARO correlation / Excel Function =CORRELO between both stocks. 2) Two-Stock Portfolio Build a portfolio of both stocks with a weight of 60% for AMAZON and a weight of 40% for AMERICAN AIRLINES and compute the monthly portfolio return the average monthly portfolio return the portfolio volatility A B C E F G 1 Date Open High Low Close Adj Close Volume 2 1/1/2018 1172 1472.58 1170.51 1450.89 1450.89 96371200 3 2/1/2018 1445 1528.7 1265.93 1512.45 1512.45 1.38E+08 4 3/1/2018 1513.6 1617.54 1365.2 1447.34 1447.34 1.3E+08 5 4/1/2018 1417.62 1638.1 1352.88 1566.13 1566.13 1.3E+08 6 5/1/2018 1563.22 1635 1546.02 1629.62 1629.62 71615500 7 6/1/2018 1637.03 1763.1 1635.09 1699.8 1699.8 85941300 8 7/1/2018 1682.7 1880.05 1678.06 1777.44 1777.44 97521100 9 8/1/2018 1784 2025.57 1776.02 2012.71 2012.71 96575800 10 9/1/2018 2026.5 2050.5 1865 2003 2003 94445500 11 ######## 2021.99 2033.19 1476.36 1598.01 1598.01 1.83E+08 12 ######## 1623.53 1784 1420 1690.17 1690.17 1.39E+08 13 ######## 1769.46 1778.34 1307 1501.97 1501.97 1.55E+08 14 1/1/2019 1465.2 1736.41 1460.93 1718.73 1718.73 1.34E+08 15 2/1/2019 1638.88 1673.06 1566.76 1639.83 1639.83 80936900 16 3/1/2019 1655.13 1823.75 1586.57 1780.75 1780.75 1.01E+08 17 4/1/2019 1800.11 1956.34 1798.73 1926.52 1926.52 81293700 18 5/1/2019 1933.09 1964.4 1772.7 1775.07 1775.07 98214400 19 6/1/2019 1760.01 1935.2 1672 1893.63 1893.63 74742700 20 7/1/2019 1922.98 2035.8 1849.44 1866.78 1866.78 73177400 21 8/1/2019 1871.72 1897.92 1743.51 1776.29 1776.29 79771200 22 9/1/2019 1770 1853.66 1709.22 1735.91 1735.91 61172900 23 ##### 1746 1798.85 1685.06 1776.66 1776.66 70360500 24 1788.01 1824.69 1722.71 1800.8 1800.8 52076200 25 ######## 1804.4 1901.4 1735 1847.84 1847.84 68149600 26 1/1/2020 1875 2055.72 1815.34 2008.72 2008.72 84698300 27 2/1/2020 2010.6 2185.95 1811.13 1883.75 1883.75 92498400 28 3/1/2020 1906.49 1996.33 1626.03 1949.72 1949.72 1.64E+08 29 4/1/2020 1932.97 2475 1889.15 2474 2474 1.25E+08 30 5/1/2020 2336.8 2525.45 2256.38 2442.37 2442.37 82612300 31 6/1/2020 2448 2507.54 2444.17 2460.6 2460.6 11075900 32 6/4/2020 2477.43 2507.54 2450.53 2460.6 2460.6 2948710 B 1 D E F G Date Open High Low Close Adj Close Volume 2 1/1/2018 52.33 59.08 51.9 54.32 52.94386 1.22E+08 3 2/1/2018 54 55.6 46.33 54.25 52.87564 91995200 4 3/1/2018 54.14 57.44 50.05 51.96 50.74104 82819400 5 4/1/2018 51.77 53.08 40.65 42.93 41.92289 1.41E+08 6 5/1/2018 42.86 45.82 41.47 43.54 42.51857 1.3E+08 7 6/1/2018 44.05 45.02 37.06 37.96 37.15617 1.26E+08 8 7/1/2018 37.74 40.86 35.64 39.54 38.70271 1.6E+08 9 8/1/2018 39.38 41.04 36.42 40.48 39.6228 1.28E+08 10 9/1/2018 40.32 43.89 38.15 41.33 40.56038 1.16E+08 11 #### 41.41 41.75 30.24 35.08 34.42677 2.74E+08 12 35.3 40.2 34.84 40.16 39.41216 1.83E+08 13 #### 40.57 40.58 29.59 32.11 31.59905 1.66E+08 14 1/1/2019 31.46 37.08 28.81 35.77 35.20081 2.13E+08 15 2/1/2019 35.77 37.23 34.77 35.63 35.06304 1.28E+08 16 3/1/2019 35.58 35.96 29.97 31.76 31.33982 1.53E+08 17 4/1/2019 31.98 35.24 31.7 34.18 33.7278 1.29E+08 18 5/1/2019 34.3 34.9 27.11 27.23 26.86976 1.33E+08 19 6/1/2019 27.12 33.81 27.02 32.61 32.27145 1.25E+08 20 7/1/2019 33.14 34.99 30.21 30.51 30.19325 1.29E+08 21 8/1/2019 30.43 30.57 24.23 26.31 26.03685 1.69E+08 22 9/1/2019 26.16 30.34 25.95 26.97 26.78388 1.42E+08 23 #### 27.08 31.67 24.51 30.06 29.85255 1.93E+08 24 30.3 31.58 27.84 28.74 28.54166 1.15E+08 25 ### 28.79 29.81 26.68 28.68 28.5744 1.34E+08 26 1/1/2020 28.98 29.3 25.37 26.84 26.74118 2.27E+08 27 2/1/2020 26.93 30.78 18.77 19.05 18.97986 2.63E+08 28 3/1/2020 19.05 19.79 10.01 12.19 12.19 1.3E+09 29 4/1/2020 11.45 13.4 9.09 12.01 12.01 1.75E+09 30 5/1/2020 11.41 12.55 8.25 10.5 10.5 1.38E+09 31 6/1/2020 10.79 18.18 10.62 16.72 16.72 5.84E+08 32 6/4/2020 12.85 18.18 12.64 16.7381 16.7381 3.99E+08 33Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started