Question

Amber's employer, Lavender, Inc., uses a 5 401(k) plan that permits salary deferral elections by its employees. Amber's salary is $99,000, and her marginal

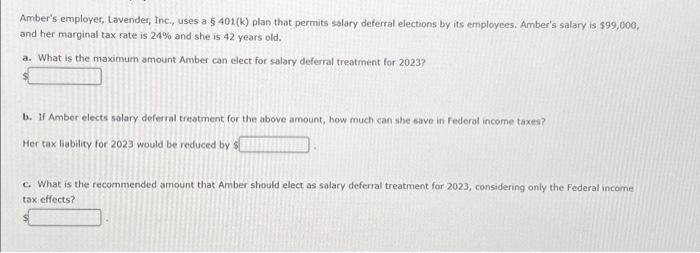

Amber's employer, Lavender, Inc., uses a 5 401(k) plan that permits salary deferral elections by its employees. Amber's salary is $99,000, and her marginal tax rate is 24% and she is 42 years old. a. What is the maximum amount Amber can elect for salary deferral treatment for 2023? b. If Amber elects salary deferral treatment for the above amount, how much can she save in Federal income taxes? Her tax liability for 2023 would be reduced by s c. What is the recommended amount that Amber should elect as salary deferral treatment for 2023, considering only the Federal income tax effects?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Maximum Amount for Salary Deferral The maximum employee contribution to a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

11th Edition

9780538480901, 9781111525774, 538480890, 538480904, 1111525773, 978-0538480895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App