Question

AMC Cleaning Ltd (AMC) is a privately-owned Manitoba-based company owned by Stuart Harkey. It specializes in manufacturing cleaning equipment, tools, and supplies that are primarily

AMC Cleaning Ltd (AMC) is a privately-owned Manitoba-based company owned by Stuart Harkey. It specializes in manufacturing cleaning equipment, tools, and supplies that are primarily used in commercial facilities and office buildings. As the founder of the company with an engineering degree, Mr. Harkey established AMC in 2017, and it experienced consistent earnings growth until 2019.

AMC faced a tough time during the COVID-19 pandemic and experienced substantial financial losses. However, the company has managed to overcome the challenges. The fiscal year 2022, which ended on April 30, 2023, was difficult for the company. As a result of the advancement of new technology, the company had to write off some of its old equipment. In early October 2022, AMC invested $5.6 million in advanced machinery, which required shutting down the production for installation, testing, and training. Unfortunately, supply chain problems caused the shutdown to last longer, as the required replacement parts arrived late. The machinery was fully operational in early January 2023, but the company incurred additional costs.

AMC currently uses the taxes payable method under accounting standards for private enterprises (ASPE) for corporate income taxes. However, its bank has requested that it switch to the deferred income taxes method (IFRS). To secure a $5 million, 5-year term loan for new equipment from the Bank of Province, AMC must meet specific financial covenants with financial results measured using specific required policies. AMC is compliant with all required accounting policies except for the tax accounting policy mandated by the bank.

AMC has certain financial obligations to meet as per the debt covenants due to its limited liquid assets. Two important balance sheet ratios need to be maintained: 1) The current ratio should be above 1, and 2) The total debt-to-equity ratio should be below 2. Failure to meet these covenants could result in a demand for loan repayment with a 30-day notice period. Moreover, it may also lead to increased financing costs, which are currently at prime plus 3%.

Mr. Harkey has asked you, an independent public accountant, to review the draft financial statements and make necessary adjustments to the statement of financial position per the new income tax policy. It is very important to Mr. Harkey that you explain how the revised statement of financial position may affect the bank loan. He also wants you to assess and adjust any accounting methods that may raise concerns during the banks credit review process. Your recommendations will help prevent any potential issues with the banks evaluation.

Please prepare a report addressing the concerns raised within one month.

Appendix: Other Information

- AMC provides a six-month warranty for specific products. Initially, warranty expenses were expensed only when claims were settled as the warranty program was new and challenging to estimate. Nevertheless, after several years of experience, Mr. Harkey believes that the warranty liability for the fiscal of 2022 would range from $30,000 to $50,000. However, no amount has been recorded as of yet.

- The company is currently facing a lawsuit regarding a product that has been found to be deficient. Mr. Harkey has sought counsel regarding the matter, and it appears that the company may have to pay a settlement bill ranging from $60,000 to $75,000. However, no information has been recorded on the financial statements yet. Mr. Harkey would like to hear your opinion on this issue.

- The UCC at the end of fiscal 2022, correctly calculated, was $8.2 million, including the new machinery, which was considered as eligible equipment for purposes of the Accelerated Investment Incentive

Financial Statement notes:

Note 1: In fiscal 2022, AMC paid $120,000 of tax instalments and recorded them as prepaid expenses on its April 30, 2023, draft statement of financial position.

Note 2: AMC capitalized $25,000 of interest on the bank loan during the period when the new machinery was being installed and tested. In addition, the company recorded an impairment loss of $180,000 on some of its old equipment. Finally, a full years depreciation was charged on all eligible assets, including the new machinery. This new machinery is being depreciated straight-line over its expected life of 10 years.

Note 3: For the year ending April 30, 2023, no tax expense or liability has been recorded yet. Accounting income was closed to retained earnings on a pre-tax basis to prepare the draft statement of the financial position.

Questions:

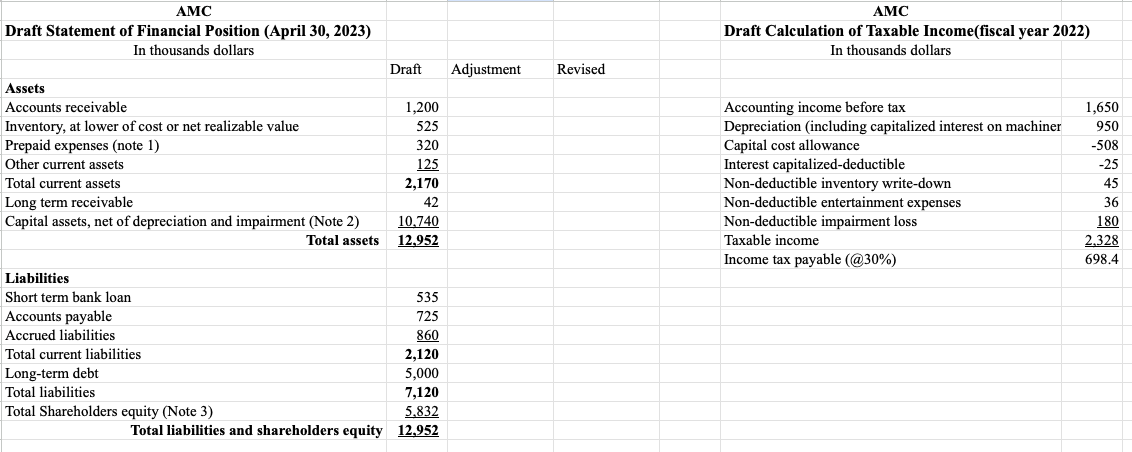

- The updated Statement of Financial Position, Be sure to include the calculated tax balances in the relevant section.

- All transactions that took place during the fiscal year have been reflected in the draft Statement of Financial Position unless noted otherwise.provide the adjusting entries. Your adjustments should be reflected in the Adjustment column noted above and backed up by the adjusting entries.

- Provided an updated calculation of the accounting income before tax, taxable income, and current income tax payable.

- Show your detailed calculations of the deferred income taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started