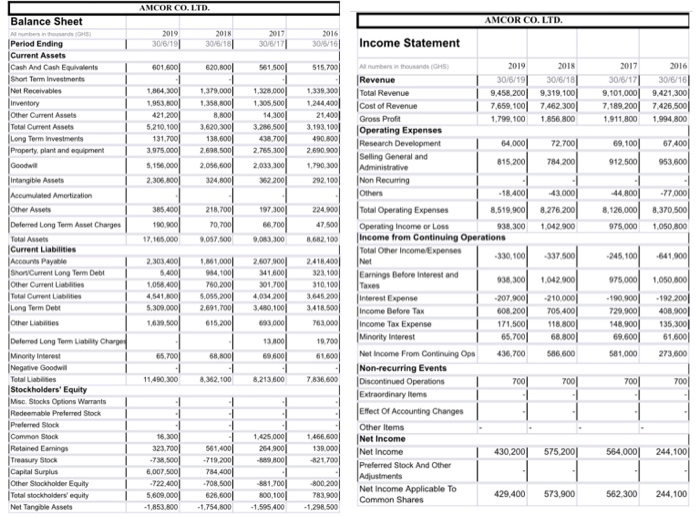

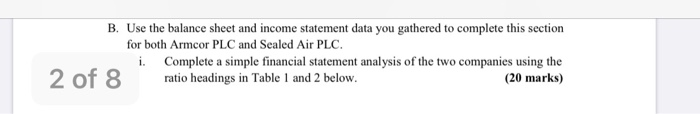

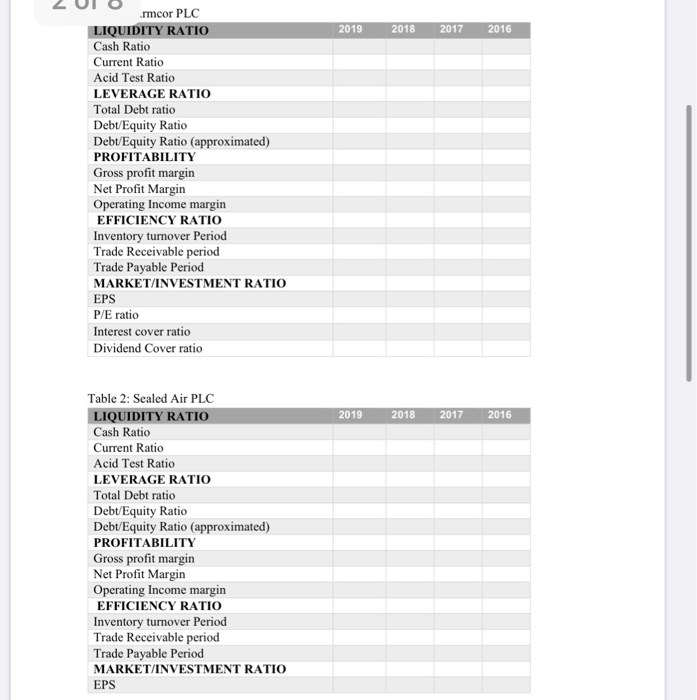

AMCOR CO. LTD. AMCOR CO. LTD. 2019 30/6/19 2018 30/6/161 2017 30/6/17 2016 30/6/161 Income Statement 601,6001 620,8001 561.500 515.7001 2017 30/6/171 9,101,000 7.189.2001 1,911,800 2016 30/6/16 9.421,300 7.426,500 1.994 800 1,864,3001 1,953,8001 421.2001 5.210.100 131,7001 3,975.000 5.156.000 2,306,8001 1.379.0001 1,358,8001 8,8001 3.620,3001 138.6001 2.698,500 2.056.600 324,8001 1,328.0001 1,305.500 14.3001 3.2865001 438.700 2.7653001 2,033.300 362.200 1.3393001 1.244.400 21.4001 3.193.1001 490,8001 2,690,9001 1.790.3001 292.1001 69.100 67.4001 912.500 953,600 44.800 -77.000 8,370,500 8,126.000 385.4001 190.900 17,165.000 218.7001 70,700 2.057,500 1973001 66.700 9.033.300 224.9001 47.500 8.682.100 975,000 1.050.800 -245.100 -641.900 Balance Sheet Anumbers in the Period Ending Current Assets Cash And Cash Equivalents Short Term Investments Not Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property, plant and equipment Goodwin Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets Current Liabilities Accounts Payable Son Current Long Term Debt Other Current Liabilities Total Current Labi Long Term Debt Other Libilities Deferred Long Term Liability Charge Minority interest Negative Goodwill Total Liabilities Stockholders' Equity Misc. Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total stockholders equity Net Tangible Assets 2.303.4001 5.4001 1,058.4001 4,541.00 5.300.000 1,630.500 1.361,0001 984,1001 760,2001 5.055,2001 2.691,7001 615,200 2.607.000 341.600 301.7001 4,034 2001 3,480,100 693.000 2418.400 323.1001 310.1001 3.645.2001 3.418.5001 763.000 Al numbers in the GHS 2019 2018 Revenue 30/6/191 30/6/181 Total Revenue 9,458.2009,319,100 Cost of Revenue 7,659,1001 7.462.300 Gross Profit 1,799, 100 1.856 800 Operating Expenses Research Development 64.000 72.7001 Selling General and 815.200 784 2001 Administrative Non Recurring Others -18.4001 -43.0001 Total Operating Expenses 8,519,900 8.276.200 Operating Income or Loss 938,300 1.042.900 Income from Continuing Operations Total Other Income Expenses -330,100 Net -337.500 Earnings Before Interest and 936,3001 1,042.900 Taxes Interest Expense -207,9001 -210.000 Income Before Tax 608.2001 706.400 Income Tax Expense 171.5001 118.800 Minority interest 65.700 68.800 Net Income From Continuing Ops 436.700 586.600 Non-recurring Events Discontinued Operations 7001 700 Extraordinary items Effect of Accounting Changes Other Items Net Income Net Income 430,2001 575,200 Preferred Stock And Other Adjustments Net Income Applicable to 429.400 573.900 Common Shares 975,000 - 190,900 729,9001 148,9001 69.6001 581.000 1,050,000 - 192.2001 408,9001 135,3001 61,600 273,600 19.7001 616001 65.7001 13.800 89.600 1 8.213.600 68,800 - 11,490,300 8,362,100 7.836.600 7001 700 -1 1.425.000 204.900 -589 100 564,000 244,100 16,3001 323.700 -738.500 6,007,5001 -722.4001 5,609,000 -1,853.800 561,400 -719.2001 784,4001 -708,500 626,600 -1.754,800 1.466.500 139.000 -8217001 -1 -800 2001 783.900 -1,298.500 -581,700 8001001 -1.595.400 562 300 244,100 B. Use the balance sheet and income statement data you gathered to complete this section for both Armcor PLC and Sealed Air PLC. i. Complete a simple financial statement analysis of the two companies using the 2 of 8 ratio headings in Table 1 and 2 below. (20 marks) 2019 2018 2017 2016 .mmcor PLC LIQUIDITY RATIO Cash Ratio Current Ratio Acid Test Ratio LEVERAGE RATIO Total Debt ratio Debt/Equity Ratio Debt/Equity Ratio (approximated) PROFITABILITY Gross profit margin Net Profit Margin Operating Income margin EFFICIENCY RATIO Inventory turnover Period Trade Receivable period Trade Payable Period MARKET/INVESTMENT RATIO EPS P/E ratio Interest cover ratio Dividend Cover ratio 2019 2018 2017 2016 Table 2: Sealed Air PLC LIQUIDITY RATIO Cash Ratio Current Ratio Acid Test Ratio LEVERAGE RATIO Total Debt ratio Debt/Equity Ratio Debt/Equity Ratio (approximated) PROFITABILITY Gross profit margin Net Profit Margin Operating Income margin EFFICIENCY RATIO Inventory turnover Period Trade Receivable period Trade Payable Period MARKET/INVESTMENT RATIO EPS P/E ratio Interest cover ratio Dividend Cover ratio ii. Analyze the results of the two companies. Your discussion should focus on the changes in relation to the ratios computed in B(i) above. (Avel Can someone else please answer the question for me AMCOR CO. LTD. AMCOR CO. LTD. 2019 30/6/19 2018 30/6/161 2017 30/6/17 2016 30/6/161 Income Statement 601,6001 620,8001 561.500 515.7001 2017 30/6/171 9,101,000 7.189.2001 1,911,800 2016 30/6/16 9.421,300 7.426,500 1.994 800 1,864,3001 1,953,8001 421.2001 5.210.100 131,7001 3,975.000 5.156.000 2,306,8001 1.379.0001 1,358,8001 8,8001 3.620,3001 138.6001 2.698,500 2.056.600 324,8001 1,328.0001 1,305.500 14.3001 3.2865001 438.700 2.7653001 2,033.300 362.200 1.3393001 1.244.400 21.4001 3.193.1001 490,8001 2,690,9001 1.790.3001 292.1001 69.100 67.4001 912.500 953,600 44.800 -77.000 8,370,500 8,126.000 385.4001 190.900 17,165.000 218.7001 70,700 2.057,500 1973001 66.700 9.033.300 224.9001 47.500 8.682.100 975,000 1.050.800 -245.100 -641.900 Balance Sheet Anumbers in the Period Ending Current Assets Cash And Cash Equivalents Short Term Investments Not Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property, plant and equipment Goodwin Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets Current Liabilities Accounts Payable Son Current Long Term Debt Other Current Liabilities Total Current Labi Long Term Debt Other Libilities Deferred Long Term Liability Charge Minority interest Negative Goodwill Total Liabilities Stockholders' Equity Misc. Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total stockholders equity Net Tangible Assets 2.303.4001 5.4001 1,058.4001 4,541.00 5.300.000 1,630.500 1.361,0001 984,1001 760,2001 5.055,2001 2.691,7001 615,200 2.607.000 341.600 301.7001 4,034 2001 3,480,100 693.000 2418.400 323.1001 310.1001 3.645.2001 3.418.5001 763.000 Al numbers in the GHS 2019 2018 Revenue 30/6/191 30/6/181 Total Revenue 9,458.2009,319,100 Cost of Revenue 7,659,1001 7.462.300 Gross Profit 1,799, 100 1.856 800 Operating Expenses Research Development 64.000 72.7001 Selling General and 815.200 784 2001 Administrative Non Recurring Others -18.4001 -43.0001 Total Operating Expenses 8,519,900 8.276.200 Operating Income or Loss 938,300 1.042.900 Income from Continuing Operations Total Other Income Expenses -330,100 Net -337.500 Earnings Before Interest and 936,3001 1,042.900 Taxes Interest Expense -207,9001 -210.000 Income Before Tax 608.2001 706.400 Income Tax Expense 171.5001 118.800 Minority interest 65.700 68.800 Net Income From Continuing Ops 436.700 586.600 Non-recurring Events Discontinued Operations 7001 700 Extraordinary items Effect of Accounting Changes Other Items Net Income Net Income 430,2001 575,200 Preferred Stock And Other Adjustments Net Income Applicable to 429.400 573.900 Common Shares 975,000 - 190,900 729,9001 148,9001 69.6001 581.000 1,050,000 - 192.2001 408,9001 135,3001 61,600 273,600 19.7001 616001 65.7001 13.800 89.600 1 8.213.600 68,800 - 11,490,300 8,362,100 7.836.600 7001 700 -1 1.425.000 204.900 -589 100 564,000 244,100 16,3001 323.700 -738.500 6,007,5001 -722.4001 5,609,000 -1,853.800 561,400 -719.2001 784,4001 -708,500 626,600 -1.754,800 1.466.500 139.000 -8217001 -1 -800 2001 783.900 -1,298.500 -581,700 8001001 -1.595.400 562 300 244,100 B. Use the balance sheet and income statement data you gathered to complete this section for both Armcor PLC and Sealed Air PLC. i. Complete a simple financial statement analysis of the two companies using the 2 of 8 ratio headings in Table 1 and 2 below. (20 marks) 2019 2018 2017 2016 .mmcor PLC LIQUIDITY RATIO Cash Ratio Current Ratio Acid Test Ratio LEVERAGE RATIO Total Debt ratio Debt/Equity Ratio Debt/Equity Ratio (approximated) PROFITABILITY Gross profit margin Net Profit Margin Operating Income margin EFFICIENCY RATIO Inventory turnover Period Trade Receivable period Trade Payable Period MARKET/INVESTMENT RATIO EPS P/E ratio Interest cover ratio Dividend Cover ratio 2019 2018 2017 2016 Table 2: Sealed Air PLC LIQUIDITY RATIO Cash Ratio Current Ratio Acid Test Ratio LEVERAGE RATIO Total Debt ratio Debt/Equity Ratio Debt/Equity Ratio (approximated) PROFITABILITY Gross profit margin Net Profit Margin Operating Income margin EFFICIENCY RATIO Inventory turnover Period Trade Receivable period Trade Payable Period MARKET/INVESTMENT RATIO EPS P/E ratio Interest cover ratio Dividend Cover ratio ii. Analyze the results of the two companies. Your discussion should focus on the changes in relation to the ratios computed in B(i) above. (Avel Can someone else please answer the question for me