Answered step by step

Verified Expert Solution

Question

1 Approved Answer

American Airlines just bought a new service vehicle on the 1st January, 2019. The purchase price of this service vehicle was $350,000. In addition,

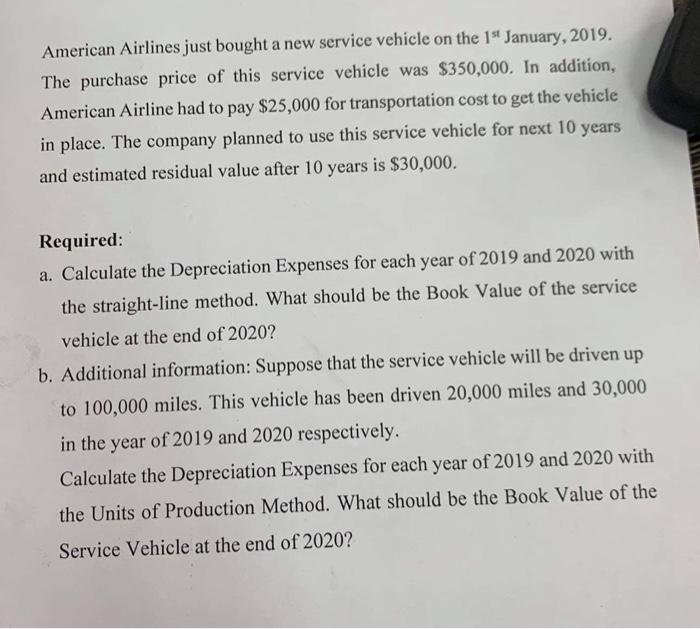

American Airlines just bought a new service vehicle on the 1st January, 2019. The purchase price of this service vehicle was $350,000. In addition, American Airline had to pay $25,000 for transportation cost to get the vehicle in place. The company planned to use this service vehicle for next 10 years and estimated residual value after 10 years is $30,000. Required: a. Calculate the Depreciation Expenses for each year of 2019 and 2020 with the straight-line method. What should be the Book Value of the service vehicle at the end of 2020? b. Additional information: Suppose that the service vehicle will be driven up to 100,000 miles. This vehicle has been driven 20,000 miles and 30,000 in the year of 2019 and 2020 respectively. Calculate the Depreciation Expenses for each year of 2019 and 2020 with the Units of Production Method. What should be the Book Value of the Service Vehicle at the end of 2020?

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Cost of asset purchase cost Add Transportation Capitalized cost 350000 25000 375000 Capitalize...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started