Answered step by step

Verified Expert Solution

Question

1 Approved Answer

American Corporation has two equal shareholders, Mr. Freedom and Brave, Incorporated. In addition to their investments in American stock, both shareholders have made substantial loans

American Corporation has two equal shareholders, Mr. Freedom and Brave, Incorporated. In addition to their investments in American stock, both shareholders have made substantial loans to American. During the current year, American paid $140,000 interest each to Mr. Freedom and Brave, Incorporated. Assume that American and Brave have 21 percent tax rates, and Mr. Freedoms marginal tax rate on ordinary income is 37 percent.

Required:

Slove for F:

Recalculate Mr. Freedoms tax cost and after-tax earnings assuming his receipt of interest from American is treated as a constructive dividend.

constructive dividend.

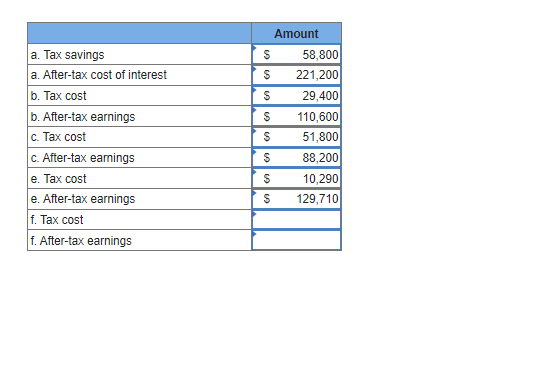

\begin{tabular}{|l|rr|} \hline & \multicolumn{2}{|c|}{ Amount } \\ \hline a. Tax savings & $ & 58,800 \\ \hline a. After-tax cost of interest & $ & 221,200 \\ \hline b. Tax cost & $ & 29,400 \\ \hline b. After-tax earnings & $ & 110,600 \\ \hline c. Tax cost & $ & 51,800 \\ \hline c. After-tax earnings & $ & 88,200 \\ \hline e. Tax cost & $ & 10,290 \\ \hline e. After-tax earnings & & 129,710 \\ \hline f. Tax cost & & \\ \hline f. After-tax earnings & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started