Answered step by step

Verified Expert Solution

Question

1 Approved Answer

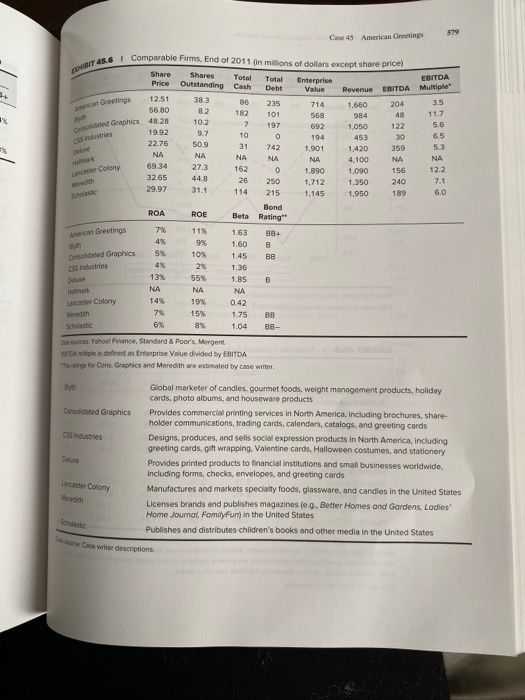

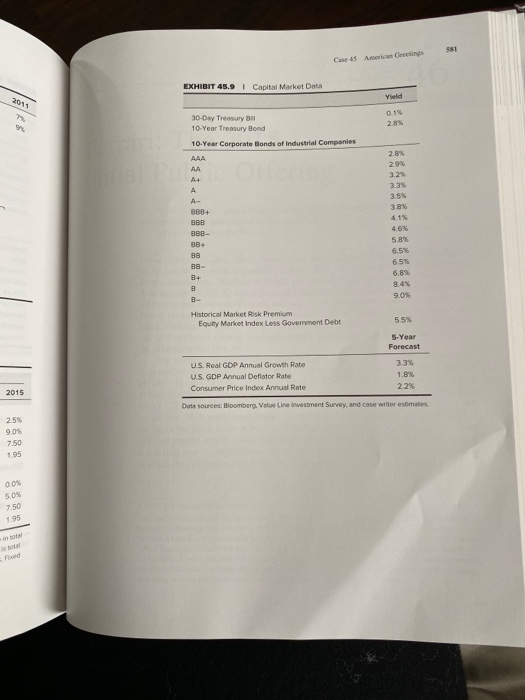

American Greeting Case Study Question: 3) Figure out the weighted average cost of capital (WACC) based on Exhibits 45.6 and 45.9. CASE 45 American Greetings

American Greeting Case Study

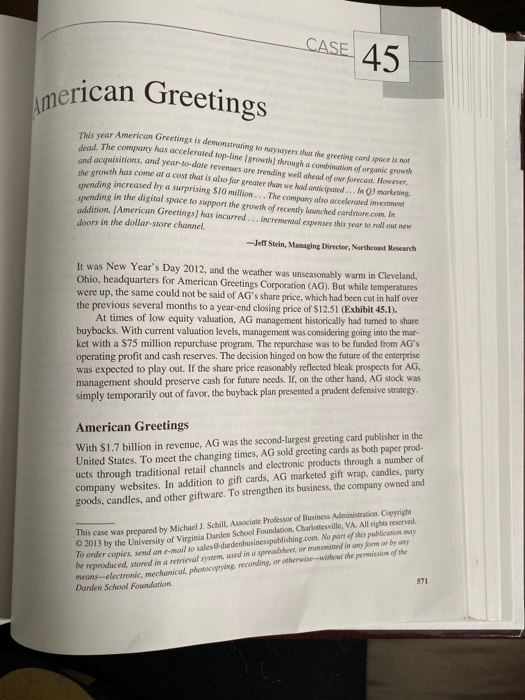

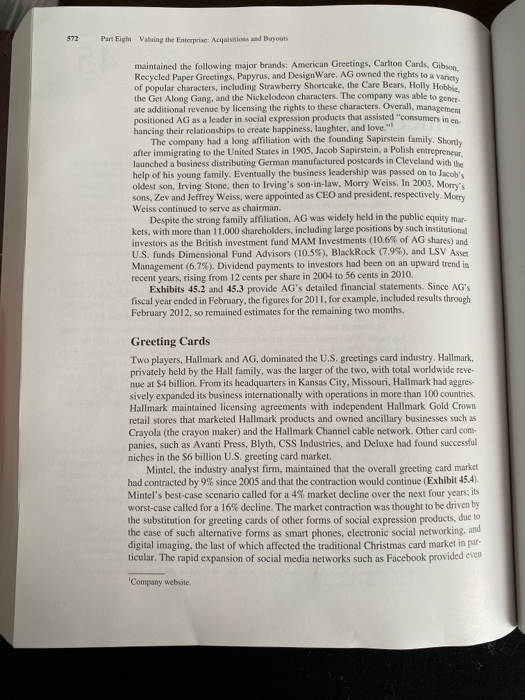

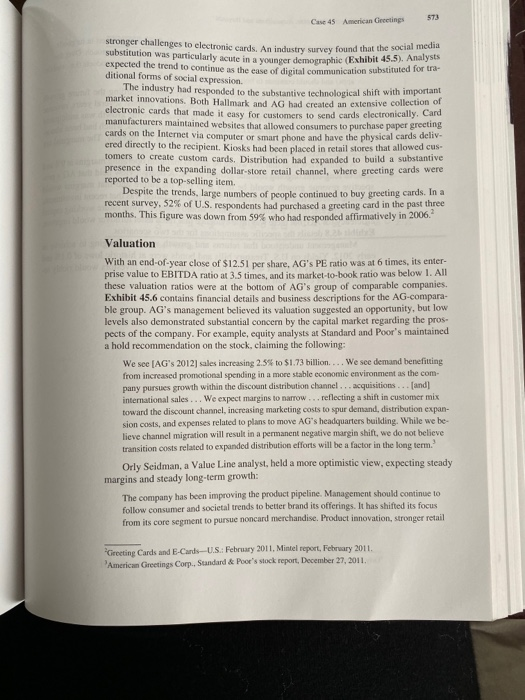

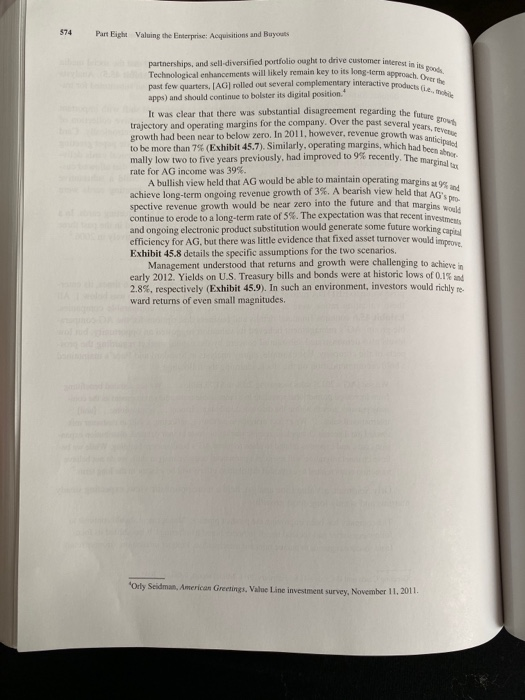

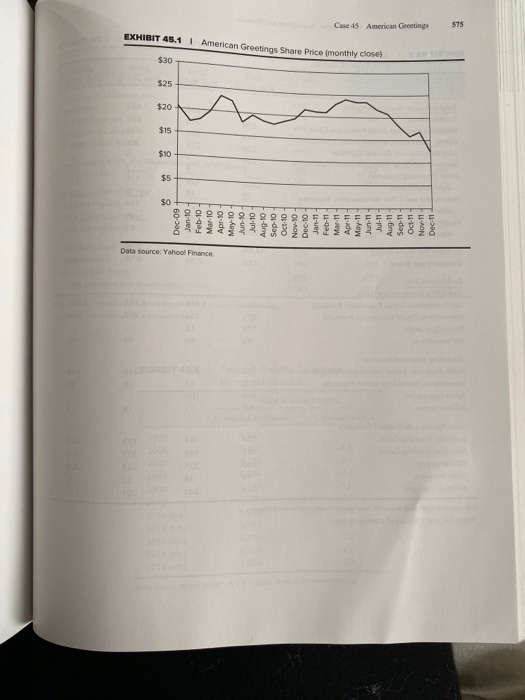

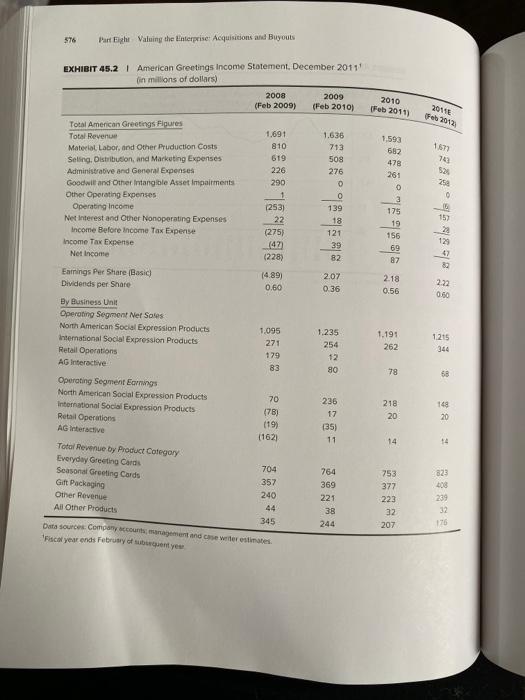

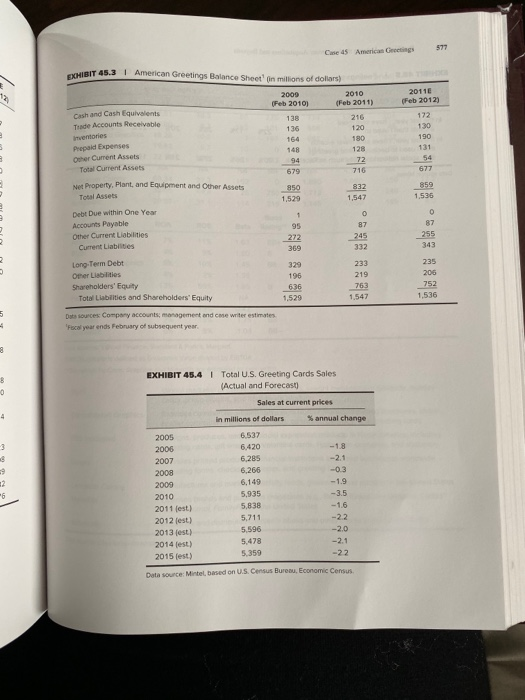

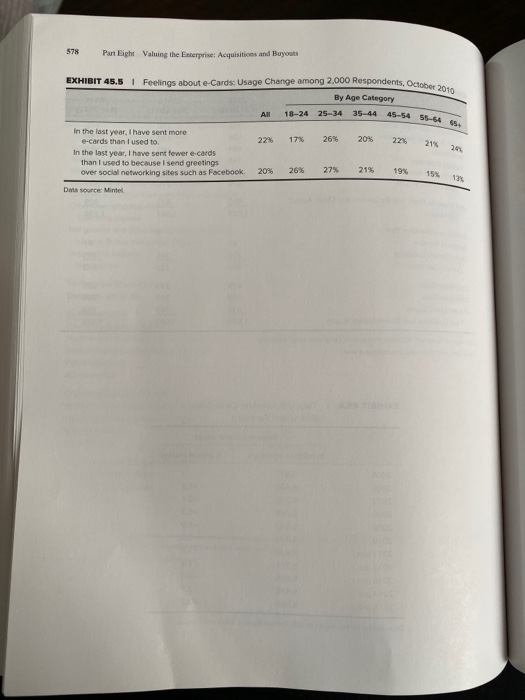

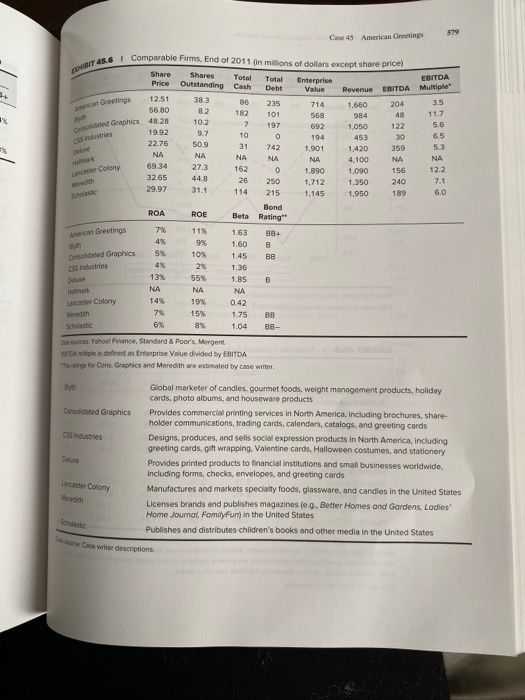

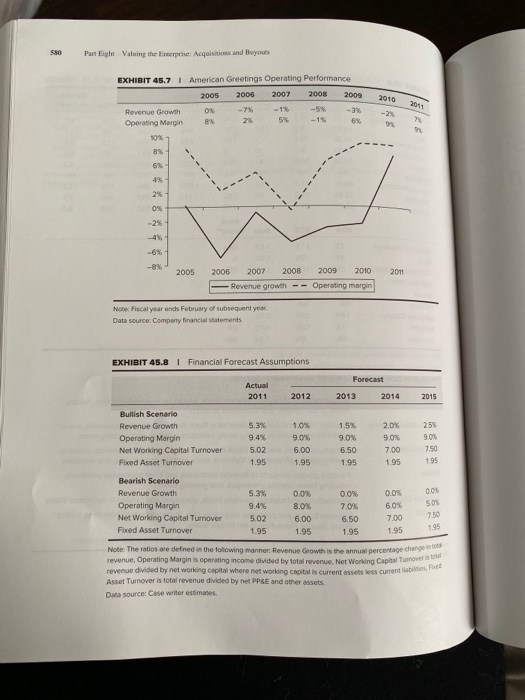

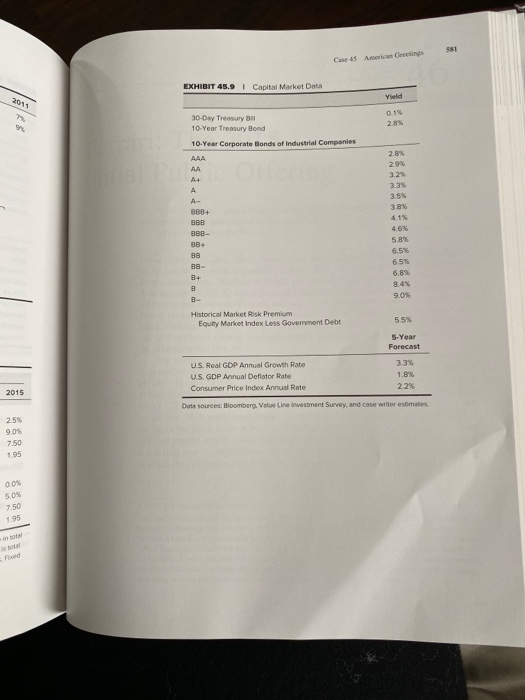

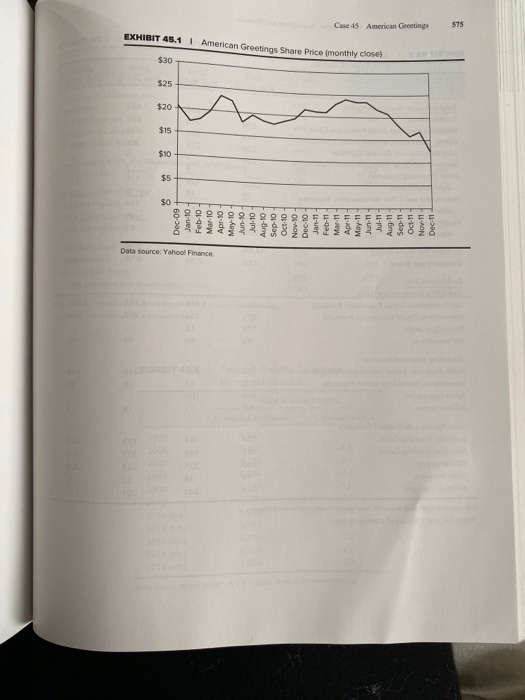

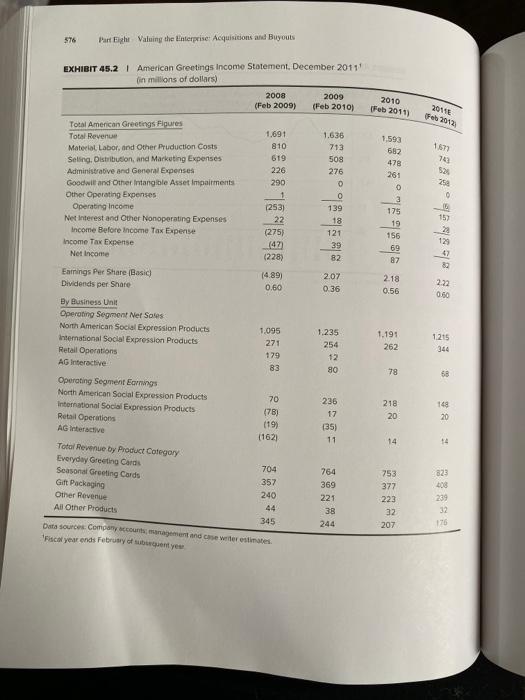

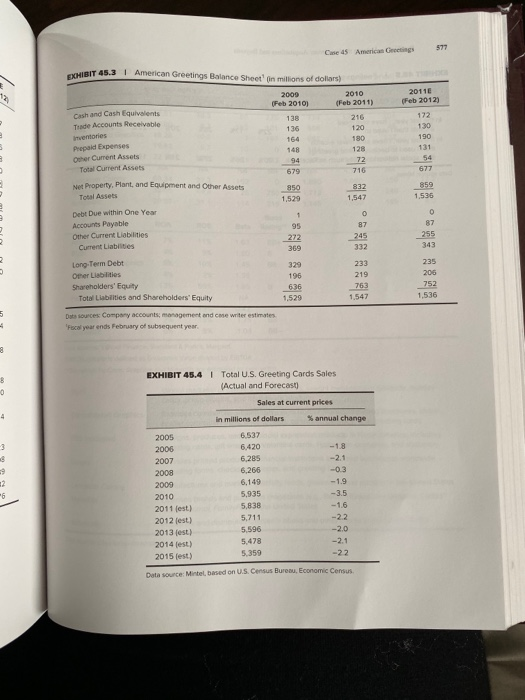

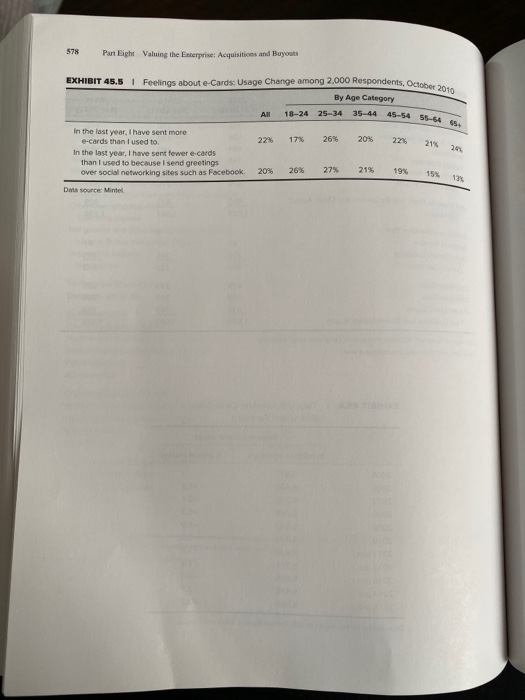

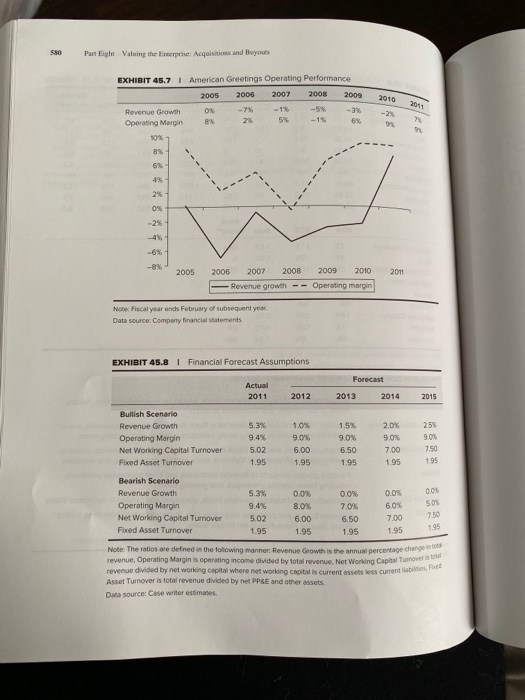

CASE 45 American Greetings This year American Greetings is demonstrating to naysayers that the greeting card space is not dead. The company has accelerated top-line growth through a combination of organic growth and acquisitions, and year-to-date revenues are trending well ahead of our forecast. However, the growth has come at a cost that is also far greater than we had anticipated... In marketing, sending increased by a surprising $10 million. The company also accelerated investment spending in the digital space to support the growth of recently louched cardstore.com. In addition. (American Greetings) has incurred... Incremental expenses this year to roll our new doors in the dollar store channel -Jeff Stein, Managing Director, Northcoast Research It was New Year's Day 2012, and the weather was unseasonably warm in Cleveland, Ohio, headquarters for American Greetings Corporation (AG). But while temperatures were up, the same could not be said of AG's share price, which had been cut in half over the previous several months to a year-end closing price of $12.51 (Exhibit 45.1). At times of low equity valuation, AG management historically had turned to share buybacks. With current valuation levels, management was considering going into the mar- ket with a $75 million repurchase program. The repurchase was to be funded from AG's operating profit and cash reserves. The decision hinged on how the future of the enterprise was expected to play out. If the share price reasonably reflected bleak prospects for AG, management should preserve cash for future needs. If, on the other hand, AG stock was simply temporarily out of favor, the buyback plan presented a prudent defensive strategy American Greetings With $1.7 billion in revenue, AG was the second-largest greeting card publisher in the United States. To meet the changing times, AG sold greeting cards as both paper prod. ucts through traditional retail channels and electronic products through a number of company websites. In addition to gift cards, AG marketed gift wrap, candies, party goods, candles, and other giftware. To strengthen its business, the company owned and This case was prepared by Michael J. Schill, Associate Professor of Business Administration. Copyright 2013 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an email to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, sed in a spreadsheet, or transmitted in any form or by any means electronic, mechanical photocopying, recording, or otherwis-without the permissie ofthe Darden School Foundation 571 572 Part Fight Valuing the Enterprise: Acquisitions and Buyouts maintained the following major brands: American Greetings, Carlton Cards, Gibson Recycled Paper Greetings, Papyrus, and Design Ware. AG owned the rights to a variety of popular characters, including Strawberry Shortcake, the Care Bears, Holly Hobbie the Get Along Gang, and the Nickelodeon characters. The company was able to gener ate additional revenue by licensing the rights to these characters. Overall, management positioned AG as a leader in social expression products that assisted "consumers in en hancing their relationships to create happiness, laughter, and love." The company had a long affiliation with the founding Sapirstein family. Shortly after immigrating to the United States in 1905, Jacob Sapirstein, a Polish entrepreneur launched a business distributing German manufactured postcards in Cleveland with the help of his young family. Eventually the business leadership was passed on to Jacob's oldest son, Irving Stone, then to Irving's son-in-law, Morry Weiss. In 2003, Morry's sons, Zev and Jeffrey Weiss, were appointed as CEO and president, respectively. Morry Weiss continued to serve as chairman. Despite the strong family affiliation, AG was widely held in the public equity mar- kets, with more than 11,000 shareholders, including large positions by such institutional investors as the British investment fund MAM Investments (10.6% of AG shares) and U.S. funds Dimensional Fund Advisors (10.5%), BlackRock (7.95), and LSV Asset Management (6.7%). Dividend payments to investors had been on an upward trend in recent years, rising from 12 cents per share in 2004 to 56 cents in 2010. Exhibits 45.2 and 45.3 provide AG's detailed financial statements. Since AG's fiscal year ended in February, the figures for 2011, for example, included results through February 2012, so remained estimates for the remaining two months. Greeting Cards Two players, Hallmark and AG, dominated the U.S. greetings card industry. Hallmark, privately held by the Hall family, was the larger of the two, with total worldwide reve- nue at $4 billion. From its headquarters in Kansas City, Missouri, Hallmark had aggres sively expanded its business internationally with operations in more than 100 countries. Hallmark maintained licensing agreements with independent Hallmark Gold Crown retail stores that marketed Hallmark products and owned ancillary businesses such as Crayola (the crayon maker) and the Hallmark Channel cable network. Other card com- panies, such as Avanti Press, Blyth, CSS Industries, and Deluxe had found successful niches in the S6 billion U.S. greeting card market. Mintel, the industry analyst firm, maintained that the overall greeting card market had contracted by 9% since 2005 and that the contraction would continue (Exhibit 45.4) Mintel's best-case scenario called for a 4% market decline over the next four years, its worst-case called for a 16% decline. The market contraction was thought to be driven by the substitution for greeting cards of other forms of social expression products, due to the case of such alternative forms as smart phones, electronic social networking, and digital imaging, the last of which affected the traditional Christmas card market in par ticular. The rapid expansion of social media networks such as Facebook provided even Company website Case 45 American Greetings 573 stronger challenges to electronic cards. An industry survey found that the social media substitution was particularly acute in a younger demographic (Exhibit 45.5). Analysts expected the trend to continue as the ease of digital communication substituted for tra- ditional forms of social expression. The industry had responded to the substantive technological shift with important market innovations. Both Hallmark and AG had created an extensive collection of electronic cards that made it easy for customers to send cards electronically, Card manufacturers maintained websites that allowed consumers to purchase paper greeting cards on the Internet via computer or smart phone and have the physical cards deliv- ered directly to the recipient. Kiosks had been placed in retail stores that allowed cus- tomers to create custom cards. Distribution had expanded to build a substantive presence in the expanding dollar-store retail channel, where greeting cards were reported to be a top-selling item. Despite the trends, large numbers of people continued to buy greeting cards. In a recent survey, 52% of U.S. respondents had purchased a greeting card in the past three months. This figure was down from 59% who had responded affirmatively in 2006. Valuation With an end-of-year close of $12.51 per share, AG's PE ratio was at 6 times, its enter- prise value to EBITDA ratio at 3.5 times, and its market-to-book ratio was below 1. All these valuation ratios were at the bottom of AG's group of comparable companies. Exhibit 45.6 contains financial details and business descriptions for the AG-compara- ble group. AG's management believed its valuation suggested an opportunity, but low levels also demonstrated substantial concern by the capital market regarding the pros. pects of the company. For example, equity analysts at Standard and Poor's maintained a hold recommendation on the stock, claiming the following: We see [AG's 2012) sales increasing 2.5 to $1.73 billion.... We see demand benefitting from increased promotional spending in a more stable economic environment as the com- pany pursues growth within the discount distribution channel... acquisitions. [and] international sales... We expect margins to narrow...reflecting a shift in customer mix toward the discount channel, increasing marketing costs to spur demand, distribution expan- sion costs, and expenses related to plans to move AG's headquarters building. While we be- lieve channel migration will result in a permanent negative margin shift, we do not believe transition costs related to expanded distribution efforts will be a factor in the long term. Orly Seidman, a Value Line analyst, held a more optimistic view, expecting steady margins and steady long-term growth: The company has been improving the product pipeline. Management should continue to follow consumer and societal trends to better brand its offerings. It has shifted its focus from its core segment to pursue noncard merchandise. Product innovation, stronger retail Greeting Cards and E-Cards--U.S.: February 2011, Minel report, February 2011 American Greetings Corp., Standard & Poor's stock report, December 27, 2011. 374 Part Eight Valuing the Enterprise: Acquisitions and Buyouts partnerships, and sell-diversified portfolio ought to drive customer interest in its goods Technological enhancements will likely remain key to its long-term approach. On the past few quarters, (AG] rolled out several complementary interactive products, apps) and should continue to bolster its digital position." It was clear that there was substantial disagreement regarding the future grow trajectory and operating margins for the company. Over the past several years, to be more than 7 (Exhibit 45.7). Similarly, operating margins, which had been the growth had been near to below zero. In 2011, however, revenue growth was and mally low two to five years previously, had improved to 9% recently. The marginalus rate for AG income was 39%. A bullish view held that AG would be able to maintain operating margins at 9% and achieve long-term ongoing revenue growth of 3. A bearish view held that AG's spective revenue growth would be near zero into the future and that margins would continue to erode to a long-term rate of 5%. The expectation was that recent investments and ongoing electronic product substitution would generate some future working capie efficiency for AG, but there was little evidence that fixed asset turnover would improve Exhibit 45.8 details the specific assumptions for the two scenarios, Management understood that returns and growth were challenging to achieve in early 2012. Yields on U.S. Treasury bills and bonds were at historic lows of 0.1% and 2.8%, respectively (Exhibit 45.9). In such an environment, investors would richly re- ward returns of even small magnitudes. Orly Seidman, American Greetings. Value Line investment survey, November 11, 2011 Data source: Yahool Finance $0 S$ $10 $15 $20 $25 DES Dec 09 Jan-10 Feb-10 Mar-10 Apr 10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec 10 Jan-11 EXHIBIT 45.1 American Greetings Share Price (monthly close Mar. 11 Apr-11 May 11 Jun-11 Aug-11 Case 45 American Greetings Sep-11 Oct-11 Nov 11 Dec-11 575 576 Part Fight Valuing the Enterprise: Acquisitions and Buyouts EXHIBIT 45.2 American Greetings Income Statement. December 2011 in millions of dollars) 2008 (Feb 2009) 2009 (Feb 2010) 2010 (Feb 2011) 2011 Feb 2012 1,691 810 619 226 290 1 (253) 22 (275) 1.636 713 508 276 0 0 1.577 743 526 258 1.593 682 478 261 o 3 175 19 156 69 87 139 Total American Greetings Figures Total Revenue Material Labor, and Other Pruduction Costs Selling, Distribution, and Marketing Expenses Administrative and General Expenses Goodwill and Other Intangible Asset Impairments Other Operating Expenses Operating Income Net Interest and Other Nonoperating Expenses Income Before Income Tax Expense Income Tax Expense Net Income Earnings Per Share (Basic) Dividends per Share By Business Unit Operating Segment Net Sales North American Social Expression Products International Social Expression Products Retail Operations AG Interactive 153 18 121 39 82 129 (228) 82 (4.89) 0.60 2.07 0.36 2.18 0.56 2.22 0.60 1.095 271 179 83 1.191 262 1,235 254 12 80 1.215 344 78 68 70 (78) (19) (162) 236 17 (35) 11 218 20 Operating Segment Earnings North American Social Expression Products International Social Expression Products Retail Operations AG Interactive Total Revenue by Product Category Everyday Greeting Cards Seasonal Greeting Cards Gift Packaging Other Revenue All Other Products 148 20 14 14 823 704 357 240 44 345 764 369 221 38 244 753 377 223 32 207 239 32 176 Data sources Company account management and case writer estimates Fiscal year ends February of subye Case 45 American Greetings EXHIBIT 45.3 | American Greetings Balance Sheet in millions of dollars) 2010 (Feb 2011) Cash and Cash Equivalents Trade Accounts Receivable inventories Prepaid Expenses Other Current Assets Total Current Assets 2009 (Feb 2010) 138 136 164 148 216 120 180 128 72 716 2011 (Feb 2012) 172 130 190 131 54 677 679 Net Property, Plant, and Equipment and Other Assets 850 1,529 Total Assets 832 1.547 859 1.536 1 0 87 Debt Due within One Year Accounts Payable Other Current Liabilities Current Liabilities 0 87 255 343 245 272 369 332 2 U Long-Term Debt Orer Libilities Shareholders' Equity Total Liabilities and Shareholders' Equity Dsts sources Company accounts, management and cose writer estimates 'Fiscal year ends February of subsequent year 329 196 636 1.520 233 219 763 1.547 235 206 752 1,536 55 - 3 8 0 -3 2 EXHIBIT 45.4 | Total U.S. Greeting Cards Sales (Actual and Forecast Sales at current prices in millions of dollars % annual change 2005 6.537 2006 6.420 -1.8 2007 6,285 -2.1 2008 6.266 -0.3 2009 6,149 -1.9 2010 5,935 -3.5 2011 (est) 5,838 -1.6 2012 let) 5.711 -22 2013 (est) 5.596 -2.0 2014 (est) 5.478 -2.1 2015 (est) 5,359 -22 42 6 Data source: Mintel, based on U.S. Census Bureau, Economic Census 578 Part Eight Valuing the Enterprise: Acquisitions and Buyouts EXHIBIT 45.5 I Feelings about e-Cards: Usage Change among 2.000 Respondents. October 2010 By Age Category AL 18-24 25-34 35 44 45-54 55-54 55 17 26% 20% 22 21% 245 In the last year, I have sent more e-cards than I used to In the last year, I have sent fewer e-cards than I used to because I send greetings over social networking sites such as Facebook 20% 26% 27% 21% 19% 15% 12 Data source: Mintel 579 Case 45 American Greetings Shares A Greetings Gated Graphics 48.28 arture Laser Colony ww BUT 45.6 Comparable Firms. End of 2011 in millions of dollars except share price) Share Total Total Price EBITDA Outstanding Enterprise Cash Debt Value Revenue EBITDA Multiple 12.51 38.3 86 235 714 56.80 35 204 1.660 8.2 182 101 568 984 11.7 10.2 7 197 692 1.050 122 5.6 19.92 9.7 10 0 194 453 30 6.5 22.76 50.9 31 742 1.901 1.420 359 NA NA NA NA NA 4.100 NA NA 69.34 27.3 162 0 1.890 1.090 156 12.2 32.65 44.8 26 250 1.712 1,350 240 7.1 29.92 31.1 114 215 1,145 1.950 189 6.0 Bond ROA ROE Beta Rating" 7% 11% 1.63 38+ 49 9% 1.60 B 5% 10% 1.45 2% 1.36 13% 55% 1.85 B NA NA NA Lancaster Colony 14% 0.42 7% 15% 1.75 88 Scholastic 8% 1.04 88- Artan Greetings Consolidated Graphics SS industries 19% Det source: Yahoo Finance, Standard & Poor's, Mergent 80 miles defined as Enterprise Value divided by EBITDA herings for Cons. Graphics and Meredith are estimated by case writer Consolidated Graphics CSS Industries Global marketer of candles, gourmet foods, weight management products, holiday cards, photo albums, and houseware products Provides commercial printing services in North America, including brochures, share- holder communications, trading cards, calendars, catalogs, and greeting cards Designs, produces, and sells social expression products in North America, including greeting cards, gift wrapping, Valentine cards, Halloween costumes, and stationery Provides printed products to financial institutions and small businesses worldwide including forms, checks, envelopes, and greeting cards Manufactures and markets specialty foods, glassware, and candles in the United States Licenses brands and publishes magazines (eg. Better Homes and Gardens, Ladies' Home Journal, Family Fun) in the United States Publishes and distributes children's books and other media in the United States Lancaster Colony Sesto De Case writer descriptions 550 Part Eight Valuing the interprise: Acquisitions and Buyouts EXHIBIT 45.7 | American Greetings Operating Performance 2005 2006 2007 2008 2010 2009 -3 2011 -15 Revenue Growth Operating Margin 0 8% -7% 2 -1% 50% 8% 6% 2% 0% -6% 2005 2008 2011 2006 2007 Revenue growth 2009 2010 -- Operating margin Note Fiscal year ends February of subsequent year. Data source Company financial statements EXHIBIT 45.8 Financial Forecast Assumptions Forecast Actual 2011 2012 2013 2014 2015 Bullish Scenario Revenue Growth 5.3% 1.0% 1.5% 2.0% 25 Operating Margin 9.4% 9.0% 9.0% 9.0% 9.0% Net Working Capital Turnover 5.02 6.00 6.50 7.00 7.50 Fixed Asset Turnover 1.95 1.95 1.95 1.95 195 Bearish Scenario Revenue Growth 5.3% 0.0% 0.0% 0.0% Operating Margin 9.4% 8.0% 7.0% 6.0% Net Working Capital Turnover 5.02 6.00 6.50 7.00 Fixed Asset Turnover 1.95 1.95 1.95 1.95 Note: The ratios are defined in the following manner. Revenue Growth is the annual percentage change in to revenue, Operating Margin is operating income divided by total revenue. Net Working Capital Turnover is to revenue divided by not working capital where net working capital is current assets less current liabities. Pues Asset Tumover is total revenue divided by net PPE and other assets. Data source: Case writer estimates 00% SO 750 195 Case 5 American Creetings EXHIBIT 45.9 Capital Market Data Yield 2014 0.156 2.00% 30-Day Treasury B 10-Year Treasury Bond 10-Year Corporate Bonds of Industrial Companies AAA AA 2.8% 2.9% A 3.25 335 3.5% 38 4.19 BB3+ BBB BBB- BB BB 5.8% 6.5% 6.5% 6.8 8.4% 9.0% B+ Historical Market Risk Premium Equity Market Index Less Government Debt 5.5% 5-Year Forecast 33% U.S. Real GDP Annual Growth Rate U.S. GDP Annual Deflator Rate Consumer Price Index Annual Rate 1.8% 2.25 2015 Data sources Bloomberg, Value Line Investment Survey, and case wiiter estimates 2.5% 90% 7.50 195 0.0% 50 7.50 1.95 CASE 45 American Greetings This year American Greetings is demonstrating to naysayers that the greeting card space is not dead. The company has accelerated top-line growth through a combination of organic growth and acquisitions, and year-to-date revenues are trending well ahead of our forecast. However, the growth has come at a cost that is also far greater than we had anticipated... In marketing, sending increased by a surprising $10 million. The company also accelerated investment spending in the digital space to support the growth of recently louched cardstore.com. In addition. (American Greetings) has incurred... Incremental expenses this year to roll our new doors in the dollar store channel -Jeff Stein, Managing Director, Northcoast Research It was New Year's Day 2012, and the weather was unseasonably warm in Cleveland, Ohio, headquarters for American Greetings Corporation (AG). But while temperatures were up, the same could not be said of AG's share price, which had been cut in half over the previous several months to a year-end closing price of $12.51 (Exhibit 45.1). At times of low equity valuation, AG management historically had turned to share buybacks. With current valuation levels, management was considering going into the mar- ket with a $75 million repurchase program. The repurchase was to be funded from AG's operating profit and cash reserves. The decision hinged on how the future of the enterprise was expected to play out. If the share price reasonably reflected bleak prospects for AG, management should preserve cash for future needs. If, on the other hand, AG stock was simply temporarily out of favor, the buyback plan presented a prudent defensive strategy American Greetings With $1.7 billion in revenue, AG was the second-largest greeting card publisher in the United States. To meet the changing times, AG sold greeting cards as both paper prod. ucts through traditional retail channels and electronic products through a number of company websites. In addition to gift cards, AG marketed gift wrap, candies, party goods, candles, and other giftware. To strengthen its business, the company owned and This case was prepared by Michael J. Schill, Associate Professor of Business Administration. Copyright 2013 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an email to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, sed in a spreadsheet, or transmitted in any form or by any means electronic, mechanical photocopying, recording, or otherwis-without the permissie ofthe Darden School Foundation 571 572 Part Fight Valuing the Enterprise: Acquisitions and Buyouts maintained the following major brands: American Greetings, Carlton Cards, Gibson Recycled Paper Greetings, Papyrus, and Design Ware. AG owned the rights to a variety of popular characters, including Strawberry Shortcake, the Care Bears, Holly Hobbie the Get Along Gang, and the Nickelodeon characters. The company was able to gener ate additional revenue by licensing the rights to these characters. Overall, management positioned AG as a leader in social expression products that assisted "consumers in en hancing their relationships to create happiness, laughter, and love." The company had a long affiliation with the founding Sapirstein family. Shortly after immigrating to the United States in 1905, Jacob Sapirstein, a Polish entrepreneur launched a business distributing German manufactured postcards in Cleveland with the help of his young family. Eventually the business leadership was passed on to Jacob's oldest son, Irving Stone, then to Irving's son-in-law, Morry Weiss. In 2003, Morry's sons, Zev and Jeffrey Weiss, were appointed as CEO and president, respectively. Morry Weiss continued to serve as chairman. Despite the strong family affiliation, AG was widely held in the public equity mar- kets, with more than 11,000 shareholders, including large positions by such institutional investors as the British investment fund MAM Investments (10.6% of AG shares) and U.S. funds Dimensional Fund Advisors (10.5%), BlackRock (7.95), and LSV Asset Management (6.7%). Dividend payments to investors had been on an upward trend in recent years, rising from 12 cents per share in 2004 to 56 cents in 2010. Exhibits 45.2 and 45.3 provide AG's detailed financial statements. Since AG's fiscal year ended in February, the figures for 2011, for example, included results through February 2012, so remained estimates for the remaining two months. Greeting Cards Two players, Hallmark and AG, dominated the U.S. greetings card industry. Hallmark, privately held by the Hall family, was the larger of the two, with total worldwide reve- nue at $4 billion. From its headquarters in Kansas City, Missouri, Hallmark had aggres sively expanded its business internationally with operations in more than 100 countries. Hallmark maintained licensing agreements with independent Hallmark Gold Crown retail stores that marketed Hallmark products and owned ancillary businesses such as Crayola (the crayon maker) and the Hallmark Channel cable network. Other card com- panies, such as Avanti Press, Blyth, CSS Industries, and Deluxe had found successful niches in the S6 billion U.S. greeting card market. Mintel, the industry analyst firm, maintained that the overall greeting card market had contracted by 9% since 2005 and that the contraction would continue (Exhibit 45.4) Mintel's best-case scenario called for a 4% market decline over the next four years, its worst-case called for a 16% decline. The market contraction was thought to be driven by the substitution for greeting cards of other forms of social expression products, due to the case of such alternative forms as smart phones, electronic social networking, and digital imaging, the last of which affected the traditional Christmas card market in par ticular. The rapid expansion of social media networks such as Facebook provided even Company website Case 45 American Greetings 573 stronger challenges to electronic cards. An industry survey found that the social media substitution was particularly acute in a younger demographic (Exhibit 45.5). Analysts expected the trend to continue as the ease of digital communication substituted for tra- ditional forms of social expression. The industry had responded to the substantive technological shift with important market innovations. Both Hallmark and AG had created an extensive collection of electronic cards that made it easy for customers to send cards electronically, Card manufacturers maintained websites that allowed consumers to purchase paper greeting cards on the Internet via computer or smart phone and have the physical cards deliv- ered directly to the recipient. Kiosks had been placed in retail stores that allowed cus- tomers to create custom cards. Distribution had expanded to build a substantive presence in the expanding dollar-store retail channel, where greeting cards were reported to be a top-selling item. Despite the trends, large numbers of people continued to buy greeting cards. In a recent survey, 52% of U.S. respondents had purchased a greeting card in the past three months. This figure was down from 59% who had responded affirmatively in 2006. Valuation With an end-of-year close of $12.51 per share, AG's PE ratio was at 6 times, its enter- prise value to EBITDA ratio at 3.5 times, and its market-to-book ratio was below 1. All these valuation ratios were at the bottom of AG's group of comparable companies. Exhibit 45.6 contains financial details and business descriptions for the AG-compara- ble group. AG's management believed its valuation suggested an opportunity, but low levels also demonstrated substantial concern by the capital market regarding the pros. pects of the company. For example, equity analysts at Standard and Poor's maintained a hold recommendation on the stock, claiming the following: We see [AG's 2012) sales increasing 2.5 to $1.73 billion.... We see demand benefitting from increased promotional spending in a more stable economic environment as the com- pany pursues growth within the discount distribution channel... acquisitions. [and] international sales... We expect margins to narrow...reflecting a shift in customer mix toward the discount channel, increasing marketing costs to spur demand, distribution expan- sion costs, and expenses related to plans to move AG's headquarters building. While we be- lieve channel migration will result in a permanent negative margin shift, we do not believe transition costs related to expanded distribution efforts will be a factor in the long term. Orly Seidman, a Value Line analyst, held a more optimistic view, expecting steady margins and steady long-term growth: The company has been improving the product pipeline. Management should continue to follow consumer and societal trends to better brand its offerings. It has shifted its focus from its core segment to pursue noncard merchandise. Product innovation, stronger retail Greeting Cards and E-Cards--U.S.: February 2011, Minel report, February 2011 American Greetings Corp., Standard & Poor's stock report, December 27, 2011. 374 Part Eight Valuing the Enterprise: Acquisitions and Buyouts partnerships, and sell-diversified portfolio ought to drive customer interest in its goods Technological enhancements will likely remain key to its long-term approach. On the past few quarters, (AG] rolled out several complementary interactive products, apps) and should continue to bolster its digital position." It was clear that there was substantial disagreement regarding the future grow trajectory and operating margins for the company. Over the past several years, to be more than 7 (Exhibit 45.7). Similarly, operating margins, which had been the growth had been near to below zero. In 2011, however, revenue growth was and mally low two to five years previously, had improved to 9% recently. The marginalus rate for AG income was 39%. A bullish view held that AG would be able to maintain operating margins at 9% and achieve long-term ongoing revenue growth of 3. A bearish view held that AG's spective revenue growth would be near zero into the future and that margins would continue to erode to a long-term rate of 5%. The expectation was that recent investments and ongoing electronic product substitution would generate some future working capie efficiency for AG, but there was little evidence that fixed asset turnover would improve Exhibit 45.8 details the specific assumptions for the two scenarios, Management understood that returns and growth were challenging to achieve in early 2012. Yields on U.S. Treasury bills and bonds were at historic lows of 0.1% and 2.8%, respectively (Exhibit 45.9). In such an environment, investors would richly re- ward returns of even small magnitudes. Orly Seidman, American Greetings. Value Line investment survey, November 11, 2011 Data source: Yahool Finance $0 S$ $10 $15 $20 $25 DES Dec 09 Jan-10 Feb-10 Mar-10 Apr 10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec 10 Jan-11 EXHIBIT 45.1 American Greetings Share Price (monthly close Mar. 11 Apr-11 May 11 Jun-11 Aug-11 Case 45 American Greetings Sep-11 Oct-11 Nov 11 Dec-11 575 576 Part Fight Valuing the Enterprise: Acquisitions and Buyouts EXHIBIT 45.2 American Greetings Income Statement. December 2011 in millions of dollars) 2008 (Feb 2009) 2009 (Feb 2010) 2010 (Feb 2011) 2011 Feb 2012 1,691 810 619 226 290 1 (253) 22 (275) 1.636 713 508 276 0 0 1.577 743 526 258 1.593 682 478 261 o 3 175 19 156 69 87 139 Total American Greetings Figures Total Revenue Material Labor, and Other Pruduction Costs Selling, Distribution, and Marketing Expenses Administrative and General Expenses Goodwill and Other Intangible Asset Impairments Other Operating Expenses Operating Income Net Interest and Other Nonoperating Expenses Income Before Income Tax Expense Income Tax Expense Net Income Earnings Per Share (Basic) Dividends per Share By Business Unit Operating Segment Net Sales North American Social Expression Products International Social Expression Products Retail Operations AG Interactive 153 18 121 39 82 129 (228) 82 (4.89) 0.60 2.07 0.36 2.18 0.56 2.22 0.60 1.095 271 179 83 1.191 262 1,235 254 12 80 1.215 344 78 68 70 (78) (19) (162) 236 17 (35) 11 218 20 Operating Segment Earnings North American Social Expression Products International Social Expression Products Retail Operations AG Interactive Total Revenue by Product Category Everyday Greeting Cards Seasonal Greeting Cards Gift Packaging Other Revenue All Other Products 148 20 14 14 823 704 357 240 44 345 764 369 221 38 244 753 377 223 32 207 239 32 176 Data sources Company account management and case writer estimates Fiscal year ends February of subye Case 45 American Greetings EXHIBIT 45.3 | American Greetings Balance Sheet in millions of dollars) 2010 (Feb 2011) Cash and Cash Equivalents Trade Accounts Receivable inventories Prepaid Expenses Other Current Assets Total Current Assets 2009 (Feb 2010) 138 136 164 148 216 120 180 128 72 716 2011 (Feb 2012) 172 130 190 131 54 677 679 Net Property, Plant, and Equipment and Other Assets 850 1,529 Total Assets 832 1.547 859 1.536 1 0 87 Debt Due within One Year Accounts Payable Other Current Liabilities Current Liabilities 0 87 255 343 245 272 369 332 2 U Long-Term Debt Orer Libilities Shareholders' Equity Total Liabilities and Shareholders' Equity Dsts sources Company accounts, management and cose writer estimates 'Fiscal year ends February of subsequent year 329 196 636 1.520 233 219 763 1.547 235 206 752 1,536 55 - 3 8 0 -3 2 EXHIBIT 45.4 | Total U.S. Greeting Cards Sales (Actual and Forecast Sales at current prices in millions of dollars % annual change 2005 6.537 2006 6.420 -1.8 2007 6,285 -2.1 2008 6.266 -0.3 2009 6,149 -1.9 2010 5,935 -3.5 2011 (est) 5,838 -1.6 2012 let) 5.711 -22 2013 (est) 5.596 -2.0 2014 (est) 5.478 -2.1 2015 (est) 5,359 -22 42 6 Data source: Mintel, based on U.S. Census Bureau, Economic Census 578 Part Eight Valuing the Enterprise: Acquisitions and Buyouts EXHIBIT 45.5 I Feelings about e-Cards: Usage Change among 2.000 Respondents. October 2010 By Age Category AL 18-24 25-34 35 44 45-54 55-54 55 17 26% 20% 22 21% 245 In the last year, I have sent more e-cards than I used to In the last year, I have sent fewer e-cards than I used to because I send greetings over social networking sites such as Facebook 20% 26% 27% 21% 19% 15% 12 Data source: Mintel 579 Case 45 American Greetings Shares A Greetings Gated Graphics 48.28 arture Laser Colony ww BUT 45.6 Comparable Firms. End of 2011 in millions of dollars except share price) Share Total Total Price EBITDA Outstanding Enterprise Cash Debt Value Revenue EBITDA Multiple 12.51 38.3 86 235 714 56.80 35 204 1.660 8.2 182 101 568 984 11.7 10.2 7 197 692 1.050 122 5.6 19.92 9.7 10 0 194 453 30 6.5 22.76 50.9 31 742 1.901 1.420 359 NA NA NA NA NA 4.100 NA NA 69.34 27.3 162 0 1.890 1.090 156 12.2 32.65 44.8 26 250 1.712 1,350 240 7.1 29.92 31.1 114 215 1,145 1.950 189 6.0 Bond ROA ROE Beta Rating" 7% 11% 1.63 38+ 49 9% 1.60 B 5% 10% 1.45 2% 1.36 13% 55% 1.85 B NA NA NA Lancaster Colony 14% 0.42 7% 15% 1.75 88 Scholastic 8% 1.04 88- Artan Greetings Consolidated Graphics SS industries 19% Det source: Yahoo Finance, Standard & Poor's, Mergent 80 miles defined as Enterprise Value divided by EBITDA herings for Cons. Graphics and Meredith are estimated by case writer Consolidated Graphics CSS Industries Global marketer of candles, gourmet foods, weight management products, holiday cards, photo albums, and houseware products Provides commercial printing services in North America, including brochures, share- holder communications, trading cards, calendars, catalogs, and greeting cards Designs, produces, and sells social expression products in North America, including greeting cards, gift wrapping, Valentine cards, Halloween costumes, and stationery Provides printed products to financial institutions and small businesses worldwide including forms, checks, envelopes, and greeting cards Manufactures and markets specialty foods, glassware, and candles in the United States Licenses brands and publishes magazines (eg. Better Homes and Gardens, Ladies' Home Journal, Family Fun) in the United States Publishes and distributes children's books and other media in the United States Lancaster Colony Sesto De Case writer descriptions 550 Part Eight Valuing the interprise: Acquisitions and Buyouts EXHIBIT 45.7 | American Greetings Operating Performance 2005 2006 2007 2008 2010 2009 -3 2011 -15 Revenue Growth Operating Margin 0 8% -7% 2 -1% 50% 8% 6% 2% 0% -6% 2005 2008 2011 2006 2007 Revenue growth 2009 2010 -- Operating margin Note Fiscal year ends February of subsequent year. Data source Company financial statements EXHIBIT 45.8 Financial Forecast Assumptions Forecast Actual 2011 2012 2013 2014 2015 Bullish Scenario Revenue Growth 5.3% 1.0% 1.5% 2.0% 25 Operating Margin 9.4% 9.0% 9.0% 9.0% 9.0% Net Working Capital Turnover 5.02 6.00 6.50 7.00 7.50 Fixed Asset Turnover 1.95 1.95 1.95 1.95 195 Bearish Scenario Revenue Growth 5.3% 0.0% 0.0% 0.0% Operating Margin 9.4% 8.0% 7.0% 6.0% Net Working Capital Turnover 5.02 6.00 6.50 7.00 Fixed Asset Turnover 1.95 1.95 1.95 1.95 Note: The ratios are defined in the following manner. Revenue Growth is the annual percentage change in to revenue, Operating Margin is operating income divided by total revenue. Net Working Capital Turnover is to revenue divided by not working capital where net working capital is current assets less current liabities. Pues Asset Tumover is total revenue divided by net PPE and other assets. Data source: Case writer estimates 00% SO 750 195 Case 5 American Creetings EXHIBIT 45.9 Capital Market Data Yield 2014 0.156 2.00% 30-Day Treasury B 10-Year Treasury Bond 10-Year Corporate Bonds of Industrial Companies AAA AA 2.8% 2.9% A 3.25 335 3.5% 38 4.19 BB3+ BBB BBB- BB BB 5.8% 6.5% 6.5% 6.8 8.4% 9.0% B+ Historical Market Risk Premium Equity Market Index Less Government Debt 5.5% 5-Year Forecast 33% U.S. Real GDP Annual Growth Rate U.S. GDP Annual Deflator Rate Consumer Price Index Annual Rate 1.8% 2.25 2015 Data sources Bloomberg, Value Line Investment Survey, and case wiiter estimates 2.5% 90% 7.50 195 0.0% 50 7.50 1.95 Question: 3) Figure out the weighted average cost of capital (WACC) based on Exhibits 45.6 and 45.9.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started