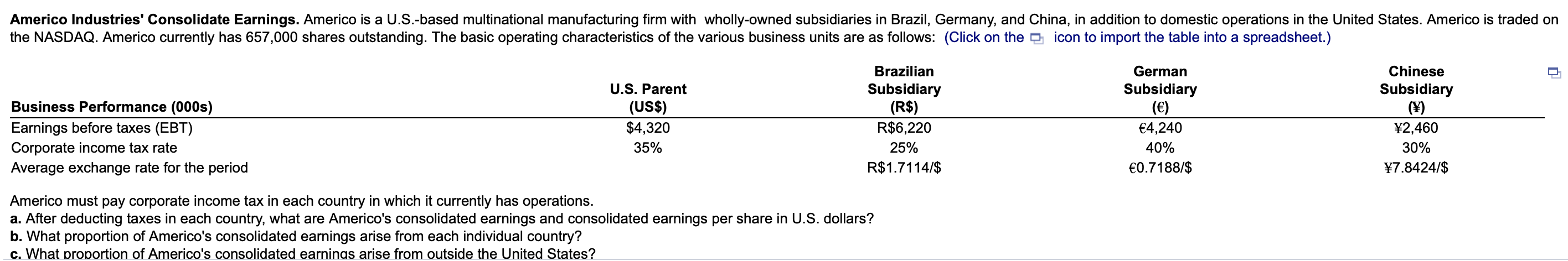

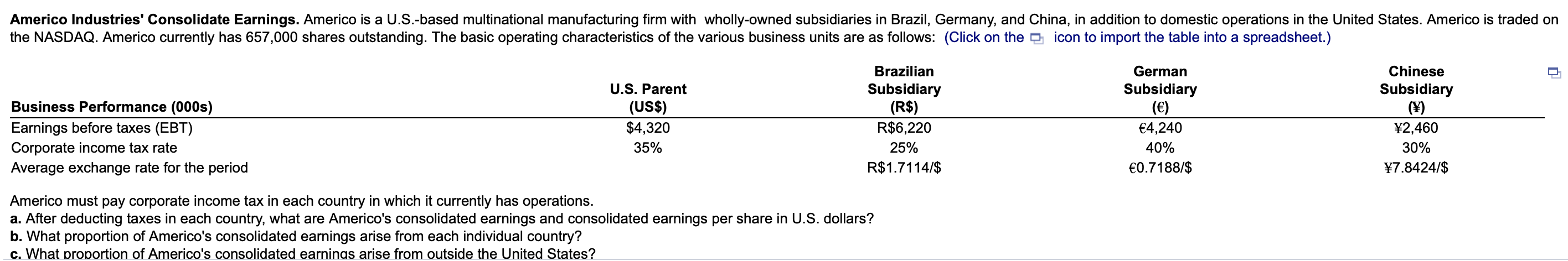

Americo Industries' Consolidate Earnings. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 657,000 shares outstanding. The basic operating characteristics of the various business units are as follows: (Click on the icon to import the table into a spreadsheet.) Chinese Subsidiary Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,320 35% Brazilian Subsidiary (R$) R$ 6,220 25% R$ 1.7114/$ German Subsidiary () 4,240 40% 0.7188/$ 2,460 30% 7.8424/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What proportion of Americo's consolidated earnings arise from each individual country? c. What proportion of Americo's consolidated earnings arise from outside the United States? Americo Industries' Consolidate Earnings. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 657,000 shares outstanding. The basic operating characteristics of the various business units are as follows: (Click on the icon to import the table into a spreadsheet.) Chinese Subsidiary Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,320 35% Brazilian Subsidiary (R$) R$ 6,220 25% R$ 1.7114/$ German Subsidiary () 4,240 40% 0.7188/$ 2,460 30% 7.8424/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What proportion of Americo's consolidated earnings arise from each individual country? c. What proportion of Americo's consolidated earnings arise from outside the United States