Answered step by step

Verified Expert Solution

Question

1 Approved Answer

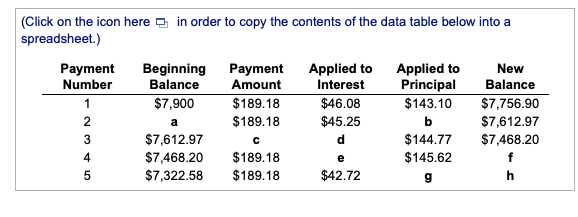

Amortization. Beth has just borrowed $7,900 on a four-year loan at 7% simple interest. Complete the amortization table, . for the first five months

Amortization. Beth has just borrowed $7,900 on a four-year loan at 7% simple interest. Complete the amortization table, . for the first five months of the loan. a. The beginning balance of the loan for month 2 is $. (Round to the nearest cent.) b. The amount applied to principal in month 2 is $ (Round to the nearest cent.) c. The amount of the monthly payment is $. (Round to the nearest cent.) d. The amount applied to interest in month 3 is $. (Round to the nearest cent.) e. The amount applied to interest in month 4 is $ 1. (Round to the nearest cent.) f. For month 4, with a beginning balance of $7,468.20, the new balance is $. (Round to the nearest cent.) g. The amount applied to principal in month 5 is $. (Round to the nearest cent.) h. For month 5, with a beginning balance of $7,322.58, and the amount applied to principal of $146.46, the new balance is $. (Round to the nearest cent.) (Click on the icon here a in order to copy the contents of the data table below into a spreadsheet.) Payment Number Beginning Payment Balance Applied to Interest Applied to Principal New Amount Balance 1 $7,900 $189.18 $46.08 $143.10 $7,756.90 $189.18 $45.25 b $7,612.97 $7,468.20 a 3 $7,612.97 $7,468.20 $7,322.58 d. $144.77 4 $189.18 e $145.62 $189.18 $42.72 h

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Payment Beginning Payment Applied to Applied to Number Balance amount Interest Principal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started