Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At 1 July 20X3 a limited liability company had an allowance for receivables of $83,000. During the year ended 30 June 20X4 debts totalling

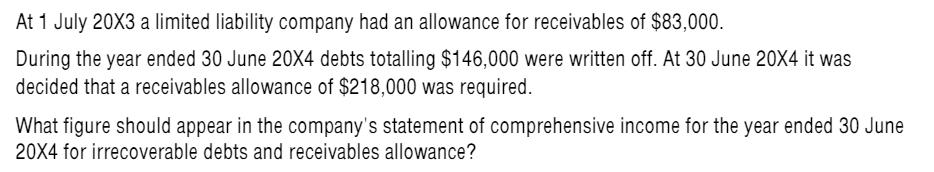

At 1 July 20X3 a limited liability company had an allowance for receivables of $83,000. During the year ended 30 June 20X4 debts totalling $146,000 were written off. At 30 June 20X4 it was decided that a receivables allowance of $218,000 was required. What figure should appear in the company's statement of comprehensive income for the year ended 30 June 20X4 for irrecoverable debts and receivables allowance?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Old allowance for receivable made in year 20X3 is the income for the year ending 20X4 whereas ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3cc1dcbdf_182842.pdf

180 KBs PDF File

635e3cc1dcbdf_182842.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started