Answered step by step

Verified Expert Solution

Question

1 Approved Answer

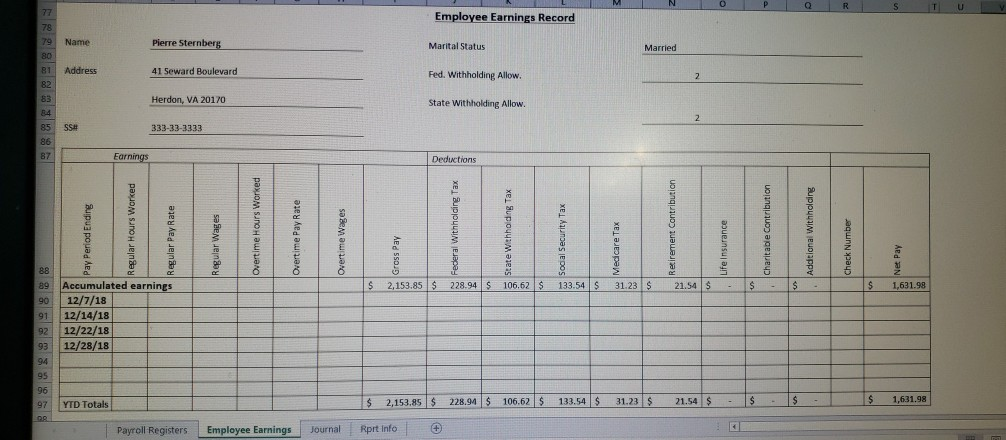

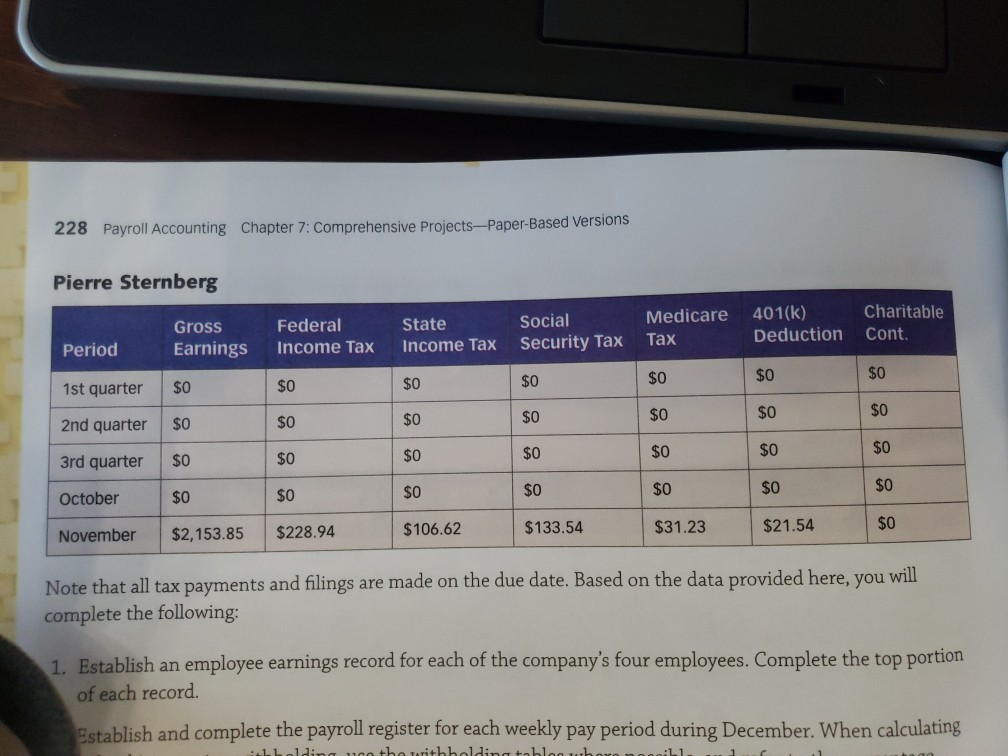

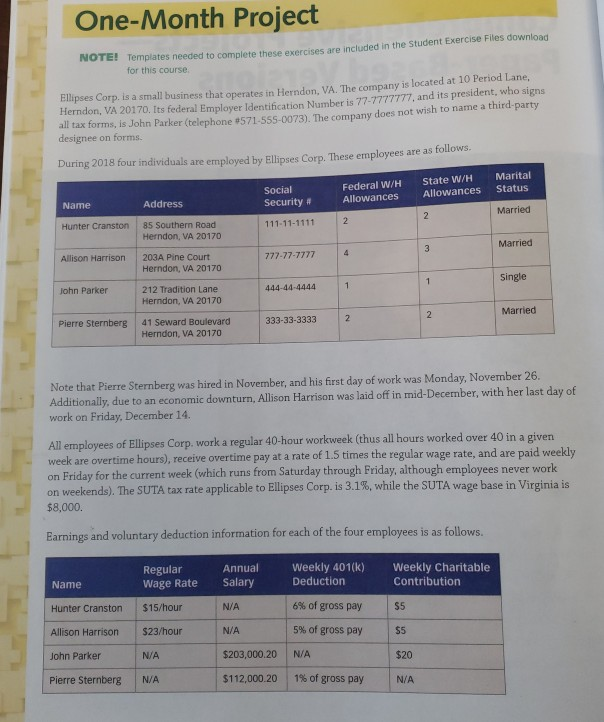

amounts are determined based on the weekly pay dates. 3. Complete the employee earnings records for December for each of the four employees. Divide the

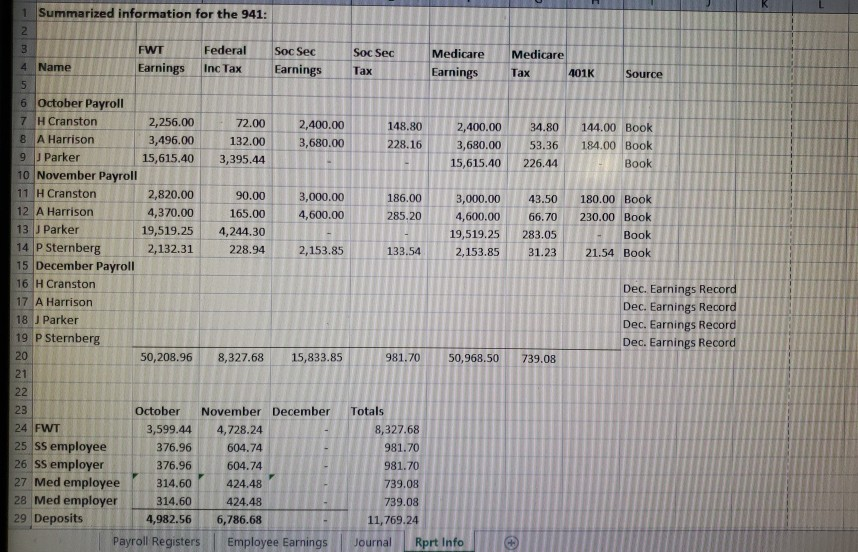

amounts are determined based on the weekly pay dates. 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. 228 Payroll Accounting Chapter 7: Comprehensive Projects-Paper-Based Versions Pierre Sternberg Gross Earnings Federal Income Tax State Income Tax Social Security Tax Medicare Tax Period 401(k) Deduction Charitable Cont. 1st quarter $0 $0 50 $0 $0 $0 2nd quarter $0 $0 $0 3rd quarter $0 $0 $0 October $0 $0 $0 $0 $0 $0 $0 November $2,153.85 $228.94 $106.62 $133.54 $31.23 $21.54 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record Establish and complete the payroll register for each weekly pay period during December. When calculating La varieholdi l .... One-Month Project Nore! Templates needed to complete these exercises are included in the Student Exercise Fes download for this course Ellipses Corp. is a small business that operates in Herndon VA. The company is located at 10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777, and its president, who signs all tax forms, is John Parker (telephone #571-555-0073). The company does not wish to name a third-party designee on forms. During 2018 four individuals are employed by Ellipses Corp. These employees are as follows. Social Security # Federal W/H Allowances State W/H Allowances Marital Status Name Address Married Hunter Cranston 111-11-1111 85 Southern Road Herndon, VA 20170 Married Allison Harrison 777-77-7777 203A Pine Court Herndon, VA 20170 Single John Parker 444-44-4444 1 40-4444 212 Tradition Lane Herndon, VA 20170 Married Pierre Sternberg 333-33-3333 2 41 Seward Boulevard Herndon, VA 20170 Note that Pierre Sternberg was hired in November, and his first day of work was Monday, November 26. Additionally, due to an economic downturn, Allison Harrison was laid off in mid-December, with her last day of work on Friday, December 14. All employees of Ellipses Corp. work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Friday for the current week (which runs from Saturday through Friday, although employees never work on weekends). The SUTA tax rate applicable to Ellipses Corp. is 3.1%, while the SUTA wage base in Virginia is $8,000. Earnings and voluntary deduction information for each of the four employees is as follows. Regular Wage Rate Annual Salary Weekly 401(K) Deduction Weekly Charitable Contribution Name N/A $5 Hunter Cranston Allison Harrison $15/hour $23/hour N/A 55 6% of gross pay 5% of gross pay NA 1% of gross pay John Parker N/A $203,000.20 $20 /A Pierre Sternberg N/A $112,000.20 N 1 Summarized information for the 941: FWT Earnings Federal Inc Tax Soc Sec Earnings Soc Sec Tax Medicare Earnings Medicare Tax 4 Name 101K Source 72.00 132.00 3,395.44 2,400.00 3,680.00 148.80 228.16 2,400.00 3,680.00 15,615.40 34.80 53.36 226.44 144.00 Book 184.00 Book Book 3,000.00 4,600.00 186.00 285.20 6 October Payroll 7 H Cranston 2,256.00 8 A Harrison 3,496.00 9 J Parker 15,615.40 10 November Payroll 11 H Cranston 2,820.00 12 A Harrison 4,370.00 13 J Parker 19,519.25 14 P Sternberg 2,132.31 15 December Payroll 16 H Cranston 17 A Harrison 18 Parker 19 P Sternberg 50,208.96 90.00 165.00 4,244.30 228.94 3,000.00 4,600.00 19,519.25 2,153.85 43.50 66.70 283.05 31.23 180.00 Book 230.00 Book Book 21.54 Book 2,153.85 133.54 Dec. Earnings Record Dec. Earnings Record Dec. Earnings Record Dec. Earnings Record 8,327.68 15,833.85 981.70 50,968.50 739.08 21 October November December 24 FWT 3,599.44 4,728.24 25 SS employee 376.96 604.74 26 SS employer 376.96 604.74 27 Med employee 314.60 424.48 28 Med employer 314.60 424.48 29 Deposits 4,982.56 6,786.68 Payroll Registers Employee Earnings Totals 8,327.68 981.70 981.70 739.08 739.08 11,769.24 Journal Rprt Info amounts are determined based on the weekly pay dates. 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. 228 Payroll Accounting Chapter 7: Comprehensive Projects-Paper-Based Versions Pierre Sternberg Gross Earnings Federal Income Tax State Income Tax Social Security Tax Medicare Tax Period 401(k) Deduction Charitable Cont. 1st quarter $0 $0 50 $0 $0 $0 2nd quarter $0 $0 $0 3rd quarter $0 $0 $0 October $0 $0 $0 $0 $0 $0 $0 November $2,153.85 $228.94 $106.62 $133.54 $31.23 $21.54 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record Establish and complete the payroll register for each weekly pay period during December. When calculating La varieholdi l .... One-Month Project Nore! Templates needed to complete these exercises are included in the Student Exercise Fes download for this course Ellipses Corp. is a small business that operates in Herndon VA. The company is located at 10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777, and its president, who signs all tax forms, is John Parker (telephone #571-555-0073). The company does not wish to name a third-party designee on forms. During 2018 four individuals are employed by Ellipses Corp. These employees are as follows. Social Security # Federal W/H Allowances State W/H Allowances Marital Status Name Address Married Hunter Cranston 111-11-1111 85 Southern Road Herndon, VA 20170 Married Allison Harrison 777-77-7777 203A Pine Court Herndon, VA 20170 Single John Parker 444-44-4444 1 40-4444 212 Tradition Lane Herndon, VA 20170 Married Pierre Sternberg 333-33-3333 2 41 Seward Boulevard Herndon, VA 20170 Note that Pierre Sternberg was hired in November, and his first day of work was Monday, November 26. Additionally, due to an economic downturn, Allison Harrison was laid off in mid-December, with her last day of work on Friday, December 14. All employees of Ellipses Corp. work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Friday for the current week (which runs from Saturday through Friday, although employees never work on weekends). The SUTA tax rate applicable to Ellipses Corp. is 3.1%, while the SUTA wage base in Virginia is $8,000. Earnings and voluntary deduction information for each of the four employees is as follows. Regular Wage Rate Annual Salary Weekly 401(K) Deduction Weekly Charitable Contribution Name N/A $5 Hunter Cranston Allison Harrison $15/hour $23/hour N/A 55 6% of gross pay 5% of gross pay NA 1% of gross pay John Parker N/A $203,000.20 $20 /A Pierre Sternberg N/A $112,000.20 N 1 Summarized information for the 941: FWT Earnings Federal Inc Tax Soc Sec Earnings Soc Sec Tax Medicare Earnings Medicare Tax 4 Name 101K Source 72.00 132.00 3,395.44 2,400.00 3,680.00 148.80 228.16 2,400.00 3,680.00 15,615.40 34.80 53.36 226.44 144.00 Book 184.00 Book Book 3,000.00 4,600.00 186.00 285.20 6 October Payroll 7 H Cranston 2,256.00 8 A Harrison 3,496.00 9 J Parker 15,615.40 10 November Payroll 11 H Cranston 2,820.00 12 A Harrison 4,370.00 13 J Parker 19,519.25 14 P Sternberg 2,132.31 15 December Payroll 16 H Cranston 17 A Harrison 18 Parker 19 P Sternberg 50,208.96 90.00 165.00 4,244.30 228.94 3,000.00 4,600.00 19,519.25 2,153.85 43.50 66.70 283.05 31.23 180.00 Book 230.00 Book Book 21.54 Book 2,153.85 133.54 Dec. Earnings Record Dec. Earnings Record Dec. Earnings Record Dec. Earnings Record 8,327.68 15,833.85 981.70 50,968.50 739.08 21 October November December 24 FWT 3,599.44 4,728.24 25 SS employee 376.96 604.74 26 SS employer 376.96 604.74 27 Med employee 314.60 424.48 28 Med employer 314.60 424.48 29 Deposits 4,982.56 6,786.68 Payroll Registers Employee Earnings Totals 8,327.68 981.70 981.70 739.08 739.08 11,769.24 Journal Rprt Info

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started