Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ampere Inc. develops, manufactures, and sells electric passenger vehicles. Last year, Ampere produced 100,000 vehicles and sold them at an average price of $50,000.

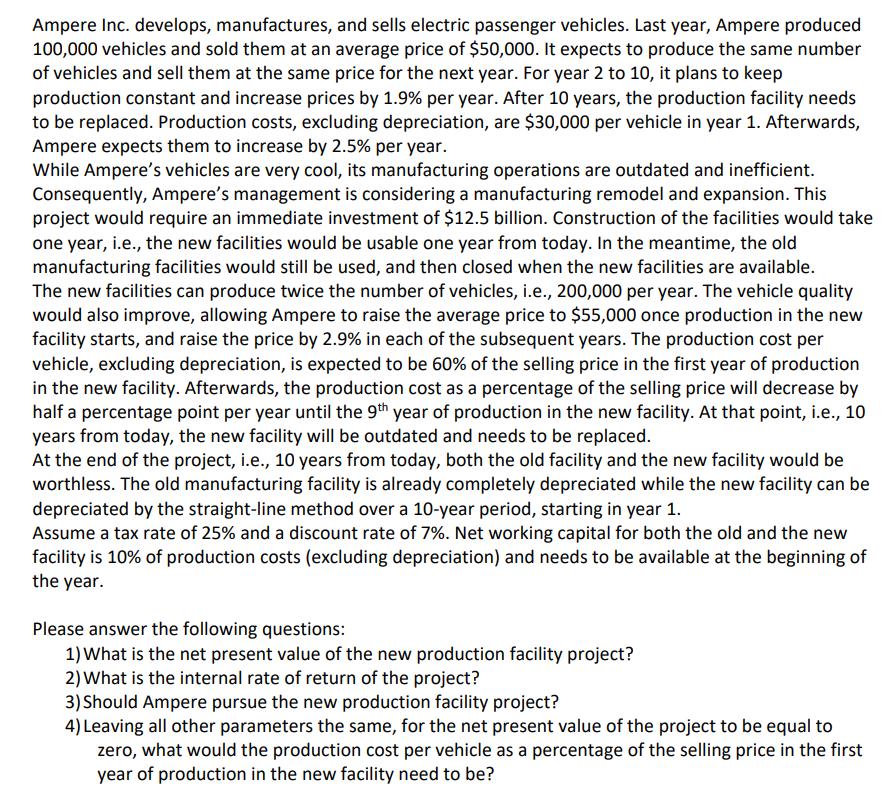

Ampere Inc. develops, manufactures, and sells electric passenger vehicles. Last year, Ampere produced 100,000 vehicles and sold them at an average price of $50,000. It expects to produce the same number of vehicles and sell them at the same price for the next year. For year 2 to 10, it plans to keep production constant and increase prices by 1.9% per year. After 10 years, the production facility needs to be replaced. Production costs, excluding depreciation, are $30,000 per vehicle in year 1. Afterwards, Ampere expects them to increase by 2.5% per year. While Ampere's vehicles are very cool, its manufacturing operations are outdated and inefficient. Consequently, Ampere's management is considering a manufacturing remodel and expansion. This project would require an immediate investment of $12.5 billion. Construction of the facilities would take one year, i.e., the new facilities would be usable one year from today. In the meantime, the old manufacturing facilities would still be used, and then closed when the new facilities are available. The new facilities can produce twice the number of vehicles, i.e., 200,000 per year. The vehicle quality would also improve, allowing Ampere to raise the average price to $55,000 once production in the new facility starts, and raise the price by 2.9% in each of the subsequent years. The production cost per vehicle, excluding depreciation, is expected to be 60% of the selling price in the first year of production in the new facility. Afterwards, the production cost as a percentage of the selling price will decrease by half a percentage point per year until the 9th year of production in the new facility. At that point, i.e., 10 years from today, the new facility will be outdated and needs to be replaced. At the end of the project, i.e., 10 years from today, both the old facility and the new facility would be worthless. The old manufacturing facility is already completely depreciated while the new facility can be depreciated by the straight-line method over a 10-year period, starting in year 1. Assume a tax rate of 25% and a discount rate of 7%. Net working capital for both the old and the new facility is 10% of production costs (excluding depreciation) and needs to be available at the beginning of the year. Please answer the following questions: 1) What is the net present value of the new production facility project? 2) What is the internal rate of return of the project? 3) Should Ampere pursue the new production facility project? 4) Leaving all other parameters the same, for the net present value of the project to be equal to zero, what would the production cost per vehicle as a percentage of the selling price in the first year of production in the new facility need to be?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV internal rate of return IRR and determine whether Ampere should pursue the new production facility project we need to calculate the cash flows associated with th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started