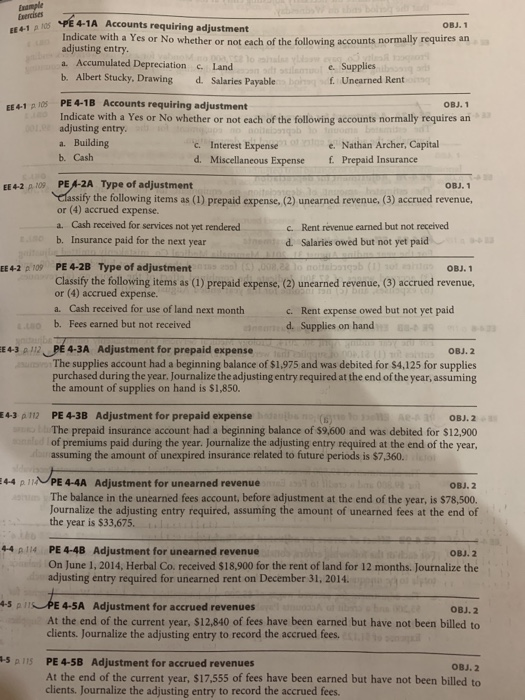

Question: ample Eercises EE 4-105 PE 4-1A Accounts requiring adjustment OBJ. 1 Indicate with a Yes or No whether or not each of the following accounts

ample Eercises EE 4-105 PE 4-1A Accounts requiring adjustment OBJ. 1 Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry, a. Accumulated Depreciation c. Land b. Albert Stucky, Drawing al or muol e Supplies as f. Unearned Rent no 00, C2o mi n sd d. Salaries Payable PE 4-1B Accounts requiring adjustment OBJ. 1 EE 4-1 105 Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry. 01. apa no noliebngabo oms mi d c. Interest Expense e. Nathan Archer, Capital d. Miscellaneous Expense Building b. Cash a. f. Prepaid Insurance PEA-2A Type of adjustment Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense. a. Cash received for services not yet rendered OBJ. 1 EE 4-2 A 109 c. Rent revenue earned but not received emd. Salaries owed but not yet paid b. Insurance paid for the next year ww.&ma l (),008,22 lo notabangab Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, PE 4-2B Type of adjustment EE 4-2 p 109 OBJ. 1 or (4) accrued expense. a. Cash received for use of land next month c. Rent expense owed but not yet paid b. Fees earned but not received dne d Supplies on hand EE 4-312, PE 4-3A Adjustment for prepaid expense ta qgo 001 OBJ. 2 esas u The supplies account had a beginning balance of $1,975 and was debited for $4,125 for supplies purchased during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of supplies on hand is $1,850. E 4-3 p112 PE 4-3B Adjustment for prepaid expensehdaue The prepaid insurance account had a beginning balance of $9,600 and was debited for $12,900 sonaled I of premiums paid during the year. Journalize the adjusting entry required at the end of the year, daassuming the amount of unexpired insurance related to future periods is $7,360. ldevisn 4-4 p 11 PE 4-4A Adjustment for unearned revenueme o as The balance in the unearned fees account, before adjustment at the end of the year, is $78,500. Journalize the adjusting entry required, assuming the amount of unearned fees at the end of the year is $33,675 Ae-A 30 OBJ. 2 OBJ. 2 44 p114 PE 4-48 Adjustment for unearned revenue On June 1, 2014, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 2014. OBJ. 2 4-5 p 11 PE 4-5A Adjustment for accrued revenues OBJ. 2 At the end of the current year, $12,840 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. 4-5 p115 PE 4-5B Adjustment for accrued revenues At the end of the current year, $17,555 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. OBJ. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts