Answered step by step

Verified Expert Solution

Question

1 Approved Answer

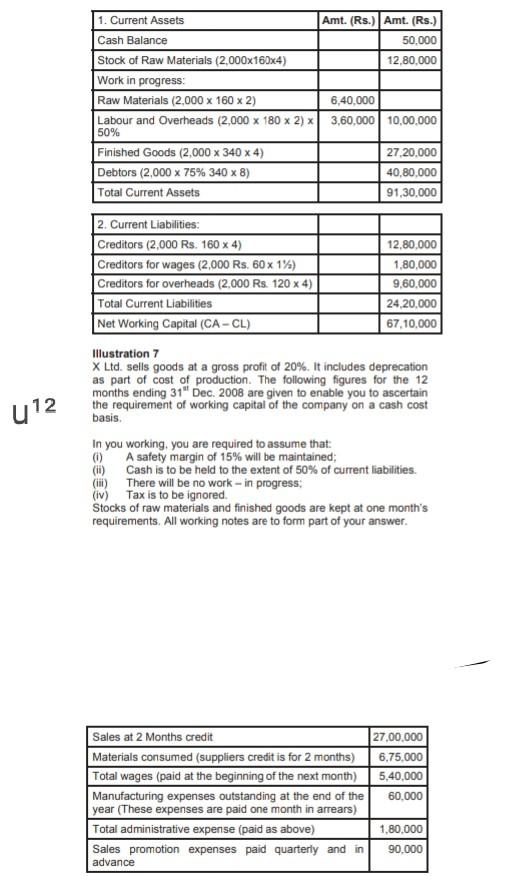

Amt. (Rs.) Amt. (Rs.) 50.000 12,80,000 1. Current Assets Cash Balance Stock of Raw Materials (2,000x160x4) Work in progress: Raw Materials (2,000 x 160 x

Amt. (Rs.) Amt. (Rs.) 50.000 12,80,000 1. Current Assets Cash Balance Stock of Raw Materials (2,000x160x4) Work in progress: Raw Materials (2,000 x 160 x 2) Labour and Overheads (2,000 x 180 x 2) 50% Finished Goods (2,000 x 340 x 4) Debtors (2,000 x 75% 340 x 8) Total Current Assets 6,40,000 3,60.000 10,00.000 27.20.000 40,80,000 91,30,000 2. Current Liabilities: Creditors (2,000 Rs. 160 X 4) 12,80.000 Creditors for wages (2,000 Rs. 60 x 1%) 1,80,000 Creditors for overheads (2.000 Rs. 120 x 4) 9,60,000 Total Current Liabilities 24,20,000 Net Working Capital (CA-CL) 67,10,000 Illustration 7 X Ltd. sells goods at a gross profit of 20%. It includes deprecation as part of cost of production. The following figures for the 12 months ending 31" Dec 2008 are given to enable you to ascertain the requirement of working capital of the company on a cash cost basis. In you working, you are required to assume that: (1) A safety margin of 15% will be maintained (1) Cash is to be held to the extent of 50% of current liabilities. (ii) There will be no work in progress, (iv) Tax is to be ignored. Stocks of raw materials and finished goods are kept at one month's requirements. All working notes are to form part of your answer. u 12 Sales at 2 Months credit 27,00.000 Materials consumed (suppliers credit is for 2 months) 6,75,000 Total wages (paid at the beginning of the next month) 5,40,000 Manufacturing expenses outstanding at the end of the 60.000 year (These expenses are paid one month in arrears) Total administrative expense (paid as above) 1,80,000 Sales promotion expenses paid quarterly and in 90,000 advance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started