Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) What amount of gain or loss does BLI recognize if the transaction is structured as a direct asset sale to Amy and Brian? What

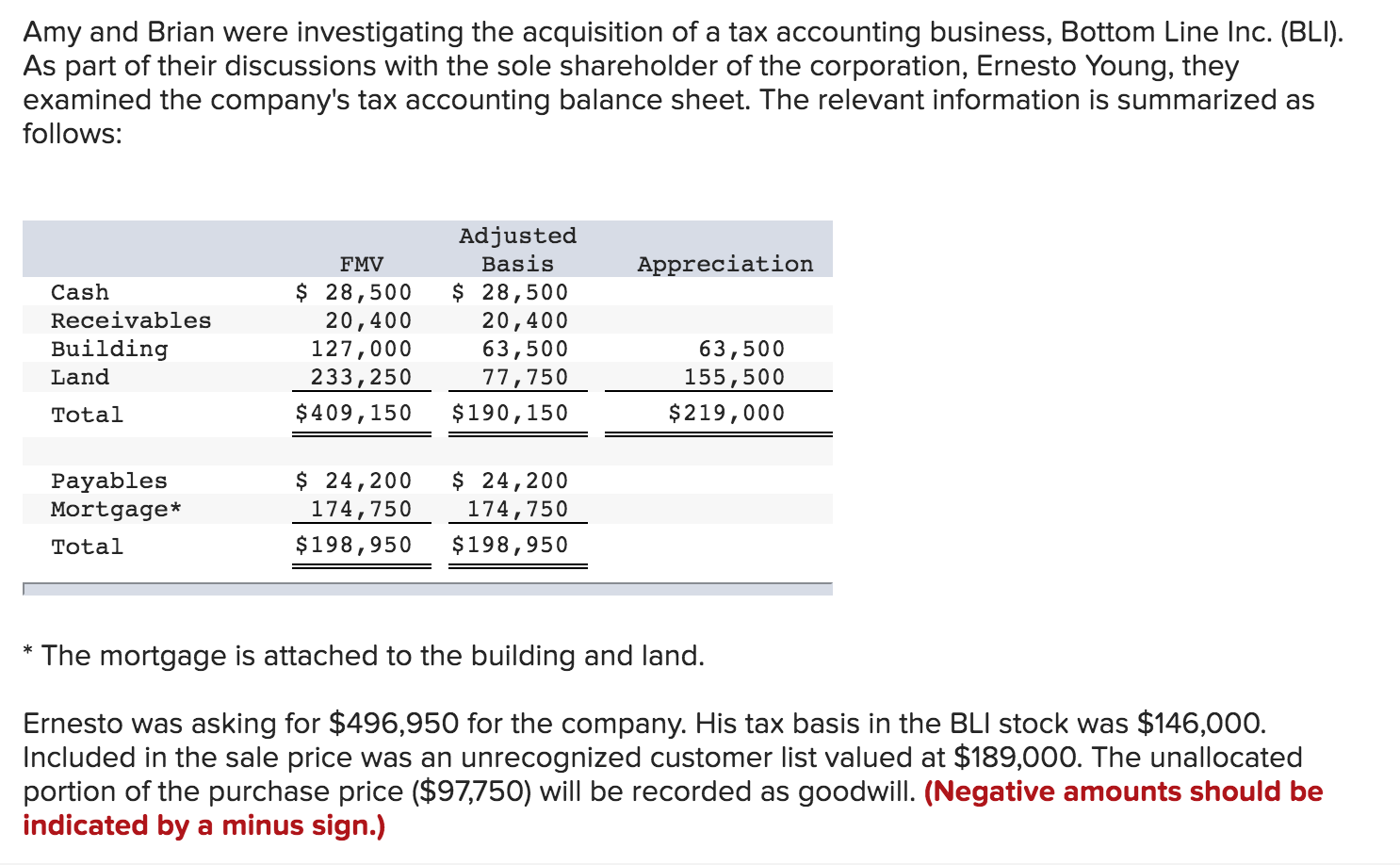

Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc. (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: * Cash Receivables Building Land Total Payables Mortgage* Total Adjusted Basis $ 28,500 20,400 63,500 77,750 FMV $ 28,500 20,400 127,000 233,250 $409,150 $190,150 $ 24,200 174,750 $198,950 $ 24,200 174,750 $198,950 Appreciation 63,500 155,500 $219,000 The mortgage is attached to the building and land. Ernesto was asking for $496,950 for the company. His tax basis in the BLI stock was $146,000. Included in the sale price was an unrecognized customer list valued at $189,000. The unallocated portion of the purchase price ($97,750) will be recorded as goodwill. (Negative amounts should be indicated by a minus sign.)

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a What amount of gain or loss does BLI recognize if the transaction is structured as a direct asset sale to Amy and Brian To calculate the gain or loss recognized by BLI in a direct asset sale we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started