Question

Amy Baker, a retired banker, born June 1, 1945, (SS# 111-11-1111), died from injuries resulting from a boating accident on May 6 th 2020. She

Amy Baker, a retired banker, born June 1, 1945, (SS# 111-11-1111), died from injuries resulting from a boating accident on May 6th 2020. She lived at 333 Dolphin Drive, Miami, FL 33010 since January 1st, 1995. Her husband, Chase Baker (SS# 123-45-6789), died February 2, 2005. She did not remarry. She is survived by two adult children: Danny Baker (SS# 222-22-2222) who lives at 333 Typhoon Way, Miami, FL 33010 and Emily Baker (SS# 333-33-3333) who lives at 333 Hurricane Hill, Miami, FL 33010. The following is information related to Amy’s estate.

- Chase’s will created a marital trust for Amy which was worth $1,500,000 at the time of Chase’s death. In order to secure a marital deduction at Chase’s death, his executor made a QTIP election. The trust provided Amy with all the income for her life. Upon her death all the corpus of the trust is required to be paid to her two children. On Amy’s date of death the trust is valued at $4,000,000.

- Amy owned three insurance policies with The Big Insurance Company; one on her life (policy # 5555) and one on the life of each of her children: policy #4444 for Emily and policy #3333 for Danny). The death benefit of her policy is $1,000,000 and the death benefit of each of the children’s policies is $200,000. Her estate is the beneficiary of the policy on her life and received the $1,000,000 soon after her death. The other two policies had a value of $50,000 each at Amy’s death.

- Amy owned raw land in Dade County valued at $2,000,000 at her death. She had an outstanding mortgage on this property of $400,000. Five years ago, she paid $600,000 for this property.

- Amy inherited a Daytona Beach rental property from Chase which was worth $700,000 when he died. On her date of death, the rental property was worth $1,500,000.

- A cabin in the mountains of Utah was owned as equal joint tenants with right of survivorship in the names of Amy and her two children. The property was purchased for $500,000 10 years ago. Each child paid $200,000 while Amy paid $100,000 of the purchase price. The cabin was valued at $700,000 when Amy died.

- Amy was the sole owner of her home on Dolphin Drive and it was worth $1,500,000 when she died.

- The boating accident that caused Amy’s death was caused by a yacht recklessly captained. The boat was owned by The Ocean Touring Company and the captain was an employee of said company. The company offered Amy’s estate $3,000,000. $500,000 was to settle all claims of pain and suffering and medical expenses of Amy as a result of the accident and the residue, $2,500,000, was to settle all wrongful death claims the children may have against the company. Amy’s executor signed a release and agreement to the $500,000 pain, suffering and medical expense settlement. Danny and Emily executed an agreement and release accepting the $2,500,000 wrongful death settlement.

- Amy had $20,000 in her checking account at Miami Savings & Loan.

- She owned a State of Florida municipal bond with accrued interest up to date of death valued at $2,100,000. Additionally, the bond accrued $500 of interest since the death of Amy.

- Her personal effects (car, jewelry, clothing, furniture, appliances, etc.) were valued at $80,000.

- The estate is awaiting receipt of a $3,500 federal income tax refund from overpayment of taxes on Amy’s prior year federal income tax return.

- Amy had the following liabilities and expenses:

- Credit card debt and other outstanding bills $20,000.

- Federal income tax liability on final Form 1040 $30,000.

- Funeral expenses $12,000.

- Attorney fees $15,000.

- Accounting fees $10,000.

- Probate court costs and appraisal fees $8,000.

- Before Amy died, she signed a pledge to contribute $35,000 to the Southern Baptist Church. She paid $10,000 of the pledge within 2 weeks of making the commitment. She intended to pay the remaining $25,000 on May 15th. However, she was killed on May 6th preventing her from fulfilling her pledge commitment.

In Amy’s will her daughter, Emily, is named as the executor of Amy’s estate. Danny and Emily are the sole and equal beneficiaries of the estate. Her will provides that all expenses of the estate must be paid from estate assets prior to any distributions to named beneficiaries. Because Emily is a practicing attorney she will serve as the estate’s representative before the IRS. Her CAF # is 987654 and her phone number is (666) 777-8888. The estate is required to be probated in the Dade County Probate Court. The probate court case number is 888330. Her death certificate number is 987654321.

REQUIREMENTS

Please complete the following:

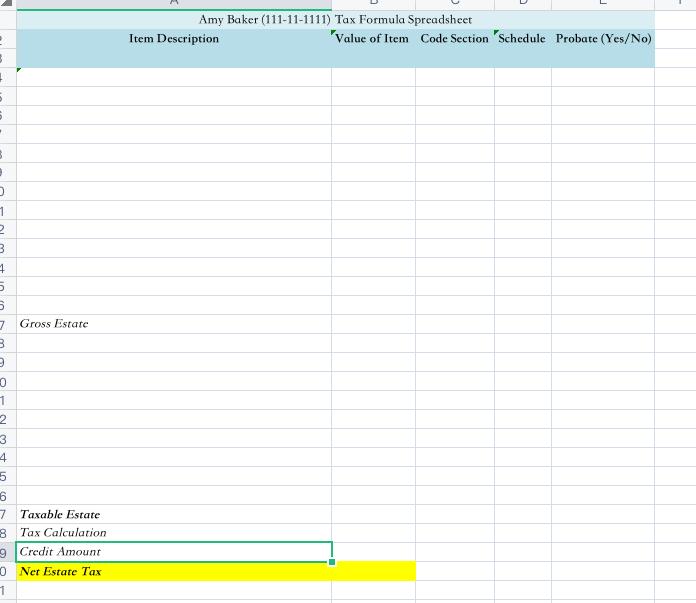

1. A tax formula spreadsheet. Include the following 5 columns:

- Description of item,

- Value of item included or deducted,

- Code Section requiring inclusion or providing for deduction,

- Reference to Form 706 Schedule that the item is reported on, and

- Whether or not the item of inclusion is probated (indicate yes or no)

2. An estate Tax Return for Amy Baker including:

- Form 706 and

- Form 706 Schedules A, B, C, D, E, F, J, and K

- No tax preparation software is allowed in preparing this return

CHECK FIGURES

Form 706, line 1 and Spreadsheet Gross Estate: $12,943,500

Form 706, line 20 and Spreadsheet Net Estate Tax: $337,400

GRADING

This tax return assignment is worth 100 points. Each tax form is assigned a set number of points as listed below. Grade will be determined by taking the total number of points earned divided by total number of points available multiplied by 100 points.

Item Points

Form 706 page 1 28

Form 706 page 2 29

Form 706 page 3 27

Form 706 page 4 3

Schedule A 9

Schedule B 5

Schedule C 5

Schedule D 5

Schedule E 11

Schedule F 18

Schedule J 14

Schedule K 14

Tax Formula Spreadsheet 47

TOTAL POINTS AVAILABLE 215

, 1 2 3 5 7 Gross Estate B 9 0 1 2 3. 4. 5 6 7 Taxable Estate 8 Tax Calculation 9 Credit Amount 10 Net Estate Tax 1 Amy Baker (111-11-1111) Tax Formula Spreadsheet Item Description "Value of Item Code Section Schedule Probate (Yes/No) , 1 2 3 5 7 Gross Estate B 9 0 1 2 3. 4. 5 6 7 Taxable Estate 8 Tax Calculation 9 Credit Amount 10 Net Estate Tax 1 Amy Baker (111-11-1111) Tax Formula Spreadsheet Item Description "Value of Item Code Section Schedule Probate (Yes/No)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Amy Baker 111111111 Tax Formula Spreadsheet Item Description Value of Item Code Section Schedule Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started