Question

Amy has asked you what lump-sum would need to be invested today to fund the children's future college costs. She asked you to assume each

Amy has asked you what lump-sum would need to be invested today to fund the children's future college costs. She asked you to assume each child will begin college at age 18 and graduate in four years. Assume current costs are $23,000 per year and are expected to increase by 4% per year. Any inherited funds will not be considered for college funding at this time. The Coopers would like you to use the 7% investment return assumption that is referenced under Investment Data for this goal. They would also like you to assume all funds will be invested in a Section 529 plan.

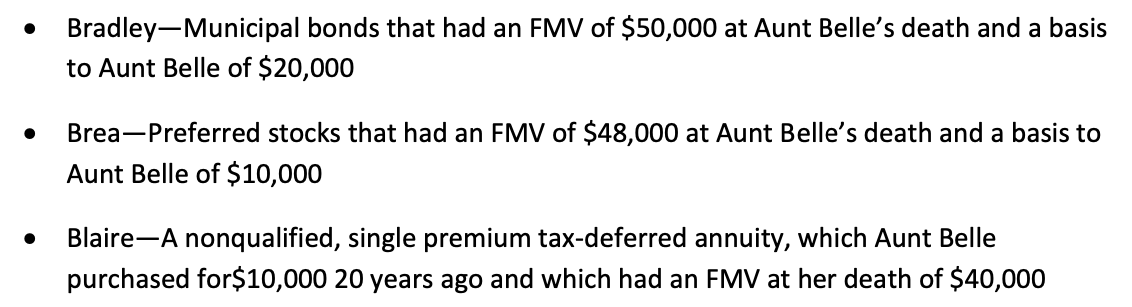

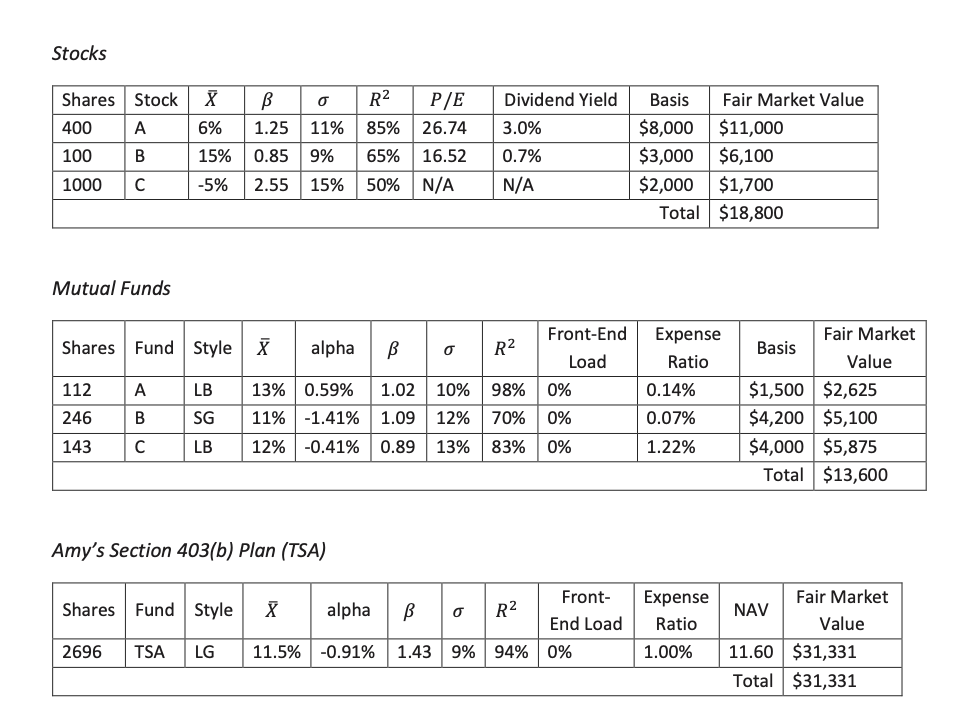

- Bradley-Municipal bonds that had an FMV of $50,000 at Aunt Belle's death and a basis to Aunt Belle of $20,000 - Brea-Preferred stocks that had an FMV of $48,000 at Aunt Belle's death and a basis to Aunt Belle of $10,000 - Blaire-A nonqualified, single premium tax-deferred annuity, which Aunt Belle purchased for $10,00020 years ago and which had an FMV at her death of $40,000 Stocks Mutual Funds Amy's Section 403(b) Plan (TSA)

- Bradley-Municipal bonds that had an FMV of $50,000 at Aunt Belle's death and a basis to Aunt Belle of $20,000 - Brea-Preferred stocks that had an FMV of $48,000 at Aunt Belle's death and a basis to Aunt Belle of $10,000 - Blaire-A nonqualified, single premium tax-deferred annuity, which Aunt Belle purchased for $10,00020 years ago and which had an FMV at her death of $40,000 Stocks Mutual Funds Amy's Section 403(b) Plan (TSA) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started