Answered step by step

Verified Expert Solution

Question

1 Approved Answer

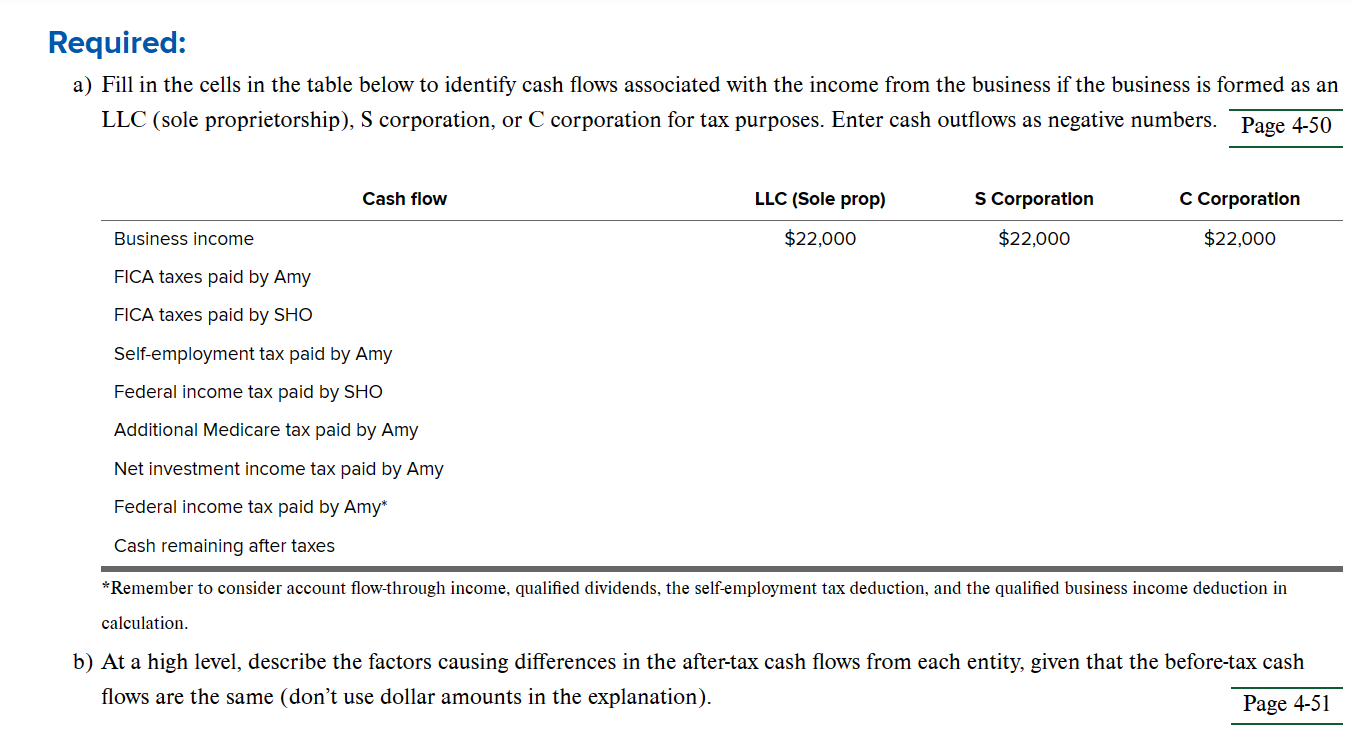

. Amy is evaluating the cash flow consequences of organizing her business entity SHO as an LLC ( taxed as a sole proprietorship ) ,

Amy is evaluating the cash flow consequences of organizing her business entity SHO as an LLC taxed as a sole proprietorship an S

corporation, or a C corporation. She used the following assumptions to make her calculations:

a For all entity types, the business reports $ of business income before deducting compensation paid to Amy and payroll taxes

SHO pays on Amy's behalf.

b All entities use the cash method of accounting.

c If Amy organizes SHO as an S corporation or a C corporation, SHO will pay Amy a $ annual salary assume the salary is

reasonable for purposes of this problem For both the S and C corporations, Amy will pay percent FICA tax on her salary and

SHO will also pay percent FICA tax on Amy's salary the FICA tax paid by the entity is deductible by the entity

d Amy's marginal ordinary income tax rate is percent, and her income tax rate on qualified dividends and net capital gains is

percent.

e Amy's marginal selfemployment tax rate is percent.

f Amy pays a percent additional Medicare tax on salary and net earnings from selfemployment ie her salary and net earnings

from selfemployment are over the threshold for the tax

g Amy pays a percent net investment income tax on dividends and net capital gains ie AGI on her joint tax return is over the

threshold by more than any net investment income she receives

h Assume that for purposes of the qualified business income deduction, the business income is not from a specified service and

neither the wagebased limitation nor the taxable income limitation applies to limit the deduction.

i If SHO is formed as an S corporation or a C corporation, SHO will distribute all of its earnings after paying entity level taxes and

after deducting salary and related FICA taxes paid to Amy.

Check photo for questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started