Answered step by step

Verified Expert Solution

Question

1 Approved Answer

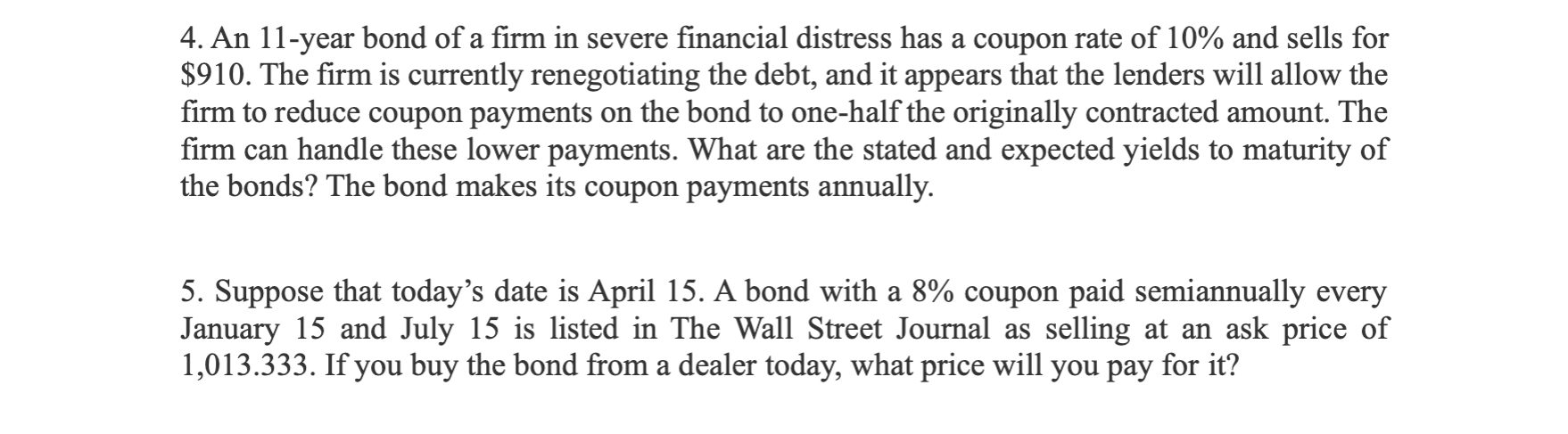

An 1 1 - year bond of a firm in severe financial distress has a coupon rate of 1 0 % and sells for $

An year bond of a firm in severe financial distress has a coupon rate of and sells for

$ The firm is currently renegotiating the debt, and it appears that the lenders will allow the

firm to reduce coupon payments on the bond to onehalf the originally contracted amount. The

firm can handle these lower payments. What are the stated and expected yields to maturity of

the bonds? The bond makes its coupon payments annually.

Suppose that today's date is April A bond with a coupon paid semiannually every

January and July is listed in The Wall Street Journal as selling at an ask price of

If you buy the bond from a dealer today, what price will you pay for it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started