Answered step by step

Verified Expert Solution

Question

1 Approved Answer

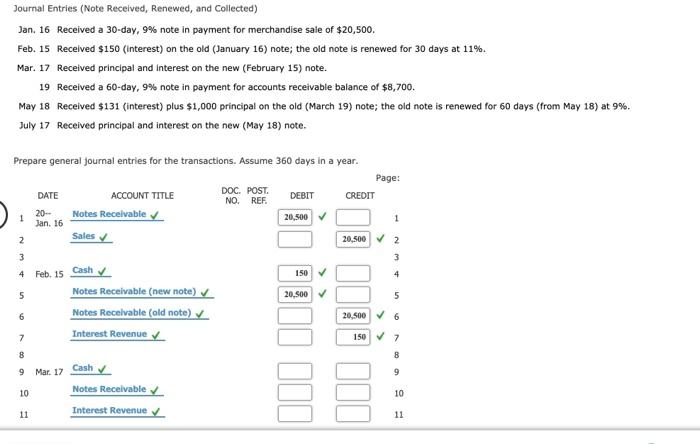

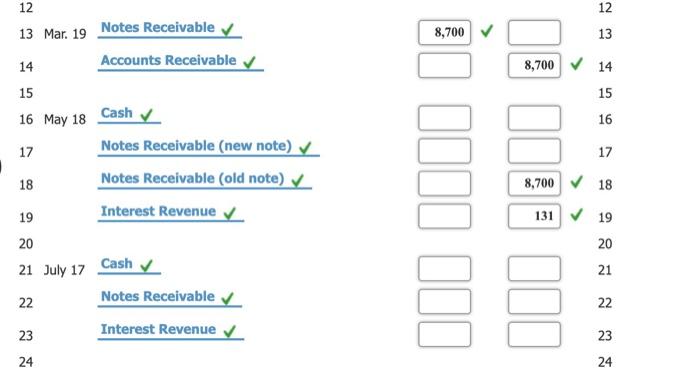

Journal Entries (Note Received, Renewed, and Collected) Jan. 16 Received a 30-day, 9% note in payment for merchandise sale of $20,500. Feb. 15 Received

Journal Entries (Note Received, Renewed, and Collected) Jan. 16 Received a 30-day, 9% note in payment for merchandise sale of $20,500. Feb. 15 Received $150 (interest) on the old (January 16) note; the old note is renewed for 30 days at 11%. Mar. 17 Received principal and interest on the new (February 15) note. 19 Received a 60-day, 9% note in payment for accounts receivable balance of $8,70o0. May 18 Received $131 (interest) plus $1,000 principal on the old (March 19) note; the old note is renewed for 60 days (from May 18) at 9%. July 17 Received principal and interest on the new (May 18) note. Prepare general journal entries for the transactions. Assume 360 days in a year. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20- Jan. 16 Notes Receivable 20,500 1 Sales 20,500 V 2 3. 4 Feb. 15 Cash 150 V 4 Notes Receivable (new note) V Notes Recelvable (ald note) Interest Revenue y 5 20,500 5 20,500 6. 150 v 7 8 9 Mar. 17 Cash v Notes Receivable Interest Revenue 9. 10 10 11 11 12 12 13 Mar. 19 Notes Receivable Accounts Receivable v 8,700 V 13 14 8,700 V 14 15 15 16 May 18 Cash 16 Notes Receivable (new note) v 17 17 Notes Receivable (old note) V 8,700 V 18 18 Interest Revenue v 131 V 19 19 20 20 21 July 17 Cash 21 Notes Receivable 22 Interest Revenue v 23 23 24 24 22

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution Answers Date Accounts title Debit Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d65fc296ba_175220.pdf

180 KBs PDF File

635d65fc296ba_175220.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started