Answered step by step

Verified Expert Solution

Question

1 Approved Answer

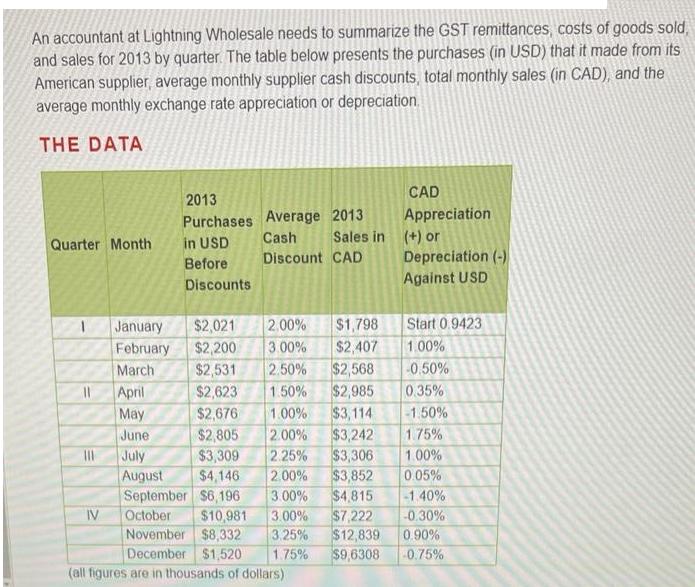

An accountant at Lightning Wholesale needs to summarize the GST remittances, costs of goods sold, and sales for 2013 by quarter. The table below

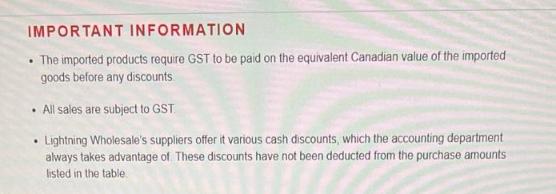

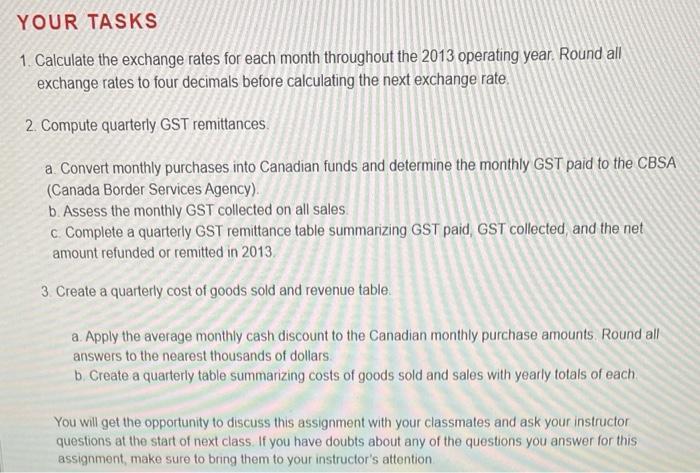

An accountant at Lightning Wholesale needs to summarize the GST remittances, costs of goods sold, and sales for 2013 by quarter. The table below presents the purchases (in USD) that it made from its American supplier, average monthly supplier cash discounts, total monthly sales (in CAD), and the average monthly exchange rate appreciation or depreciation. THE DATA Quarter Month 11 ||| IV 2013 Purchases in USD Before Discounts Average 2013 Cash Discount CAD Sales in (+) or January $2,021 2.00% $1,798 February $2,200 3.00% $2,407 March $2,531 2.50% $2,568 April $2,623 1.50% $2,985 May $2,676 1.00% June $2,805 2.00% July $3,309 2.25% August $4,146 2.00% $3,852 September $6,196 3.00% $4,815 October (all figures are in thousands of dollars) $3,114 $3,242 $3,306 $10,981 3.00% $7,222 November $8,332 3.25% $12,839 December $1,520 1.75% $9,6308 CAD Appreciation Depreciation (-) Against USD Start 0.9423 1.00% -0.50% 0.35% -1.50% 1.75% 1.00% 0.05% -1.40% -0.30% 0.90% -0.75% IMPORTANT INFORMATION The imported products require GST to be paid on the equivalent Canadian value of the imported goods before any discounts All sales are subject to GST Lightning Wholesale's suppliers offer it various cash discounts, which the accounting department always takes advantage of These discounts have not been deducted from the purchase amounts listed in the table YOUR TASKS 1. Calculate the exchange rates for each month throughout the 2013 operating year. Round all exchange rates to four decimals before calculating the next exchange rate. 2. Compute quarterly GST remittances. a Convert monthly purchases into Canadian funds and determine the monthly GST paid to the CBSA (Canada Border Services Agency). b. Assess the monthly GST collected on all sales. c. Complete a quarterly GST remittance table summarizing GST paid, GST collected, and the net amount refunded or remitted in 2013. 3. Create a quarterly cost of goods sold and revenue table. a. Apply the average monthly cash discount to the Canadian monthly purchase amounts. Round all answers to the nearest thousands of dollars. b. Create a quarterly table summarizing costs of goods sold and sales with yearly totals of each You will get the opportunity to discuss this assignment with your classmates and ask your instructor questions at the start of next class. If you have doubts about any of the questions you answer for this assignment, make sure to bring them to your instructor's attention.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Exchange Rates for Each Month in 2013 To calculate the exchange rates for each month in 2013 we start with the given starting exchange ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started