Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An agent with wealth level Yo = $100 lives for two periods. In period 1, he invests $20 in a risk free bond, consumes

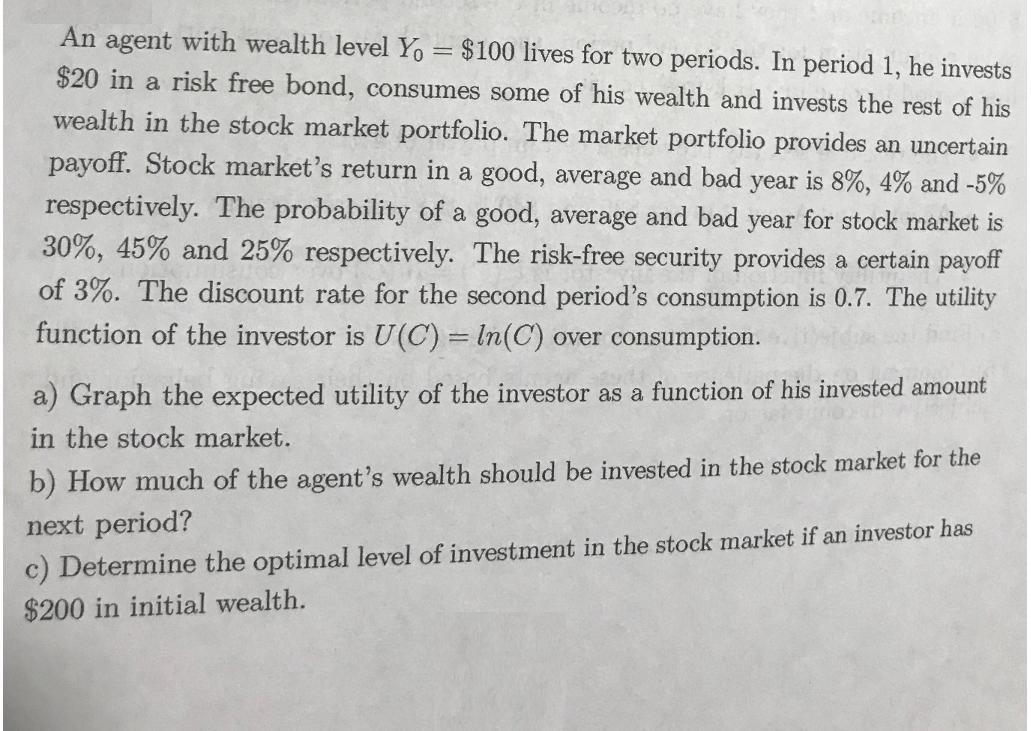

An agent with wealth level Yo = $100 lives for two periods. In period 1, he invests $20 in a risk free bond, consumes some of his wealth and invests the rest of his wealth in the stock market portfolio. The market portfolio provides an uncertain payoff. Stock market's return in a good, average and bad year is 8%, 4% and -5% respectively. The probability of a good, average and bad year for stock market is 30%, 45% and 25% respectively. The risk-free security provides a certain payoff of 3%. The discount rate for the second period's consumption is 0.7. The utility function of the investor is U(C) = ln(C) over consumption. a) Graph the expected utility of the investor as a function of his invested amount in the stock market. b) How much of the agent's wealth should be invested in the stock market for the next period? c) Determine the optimal level of investment in the stock market if an investor has $200 in initial wealth.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the expected utility for different levels of investment in the stock market Heres how we can approach it a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started