Question

An agreement with East Rivers Bank allows you to borrow in increments of $1,000 at the beginning of each month, up to a total loan

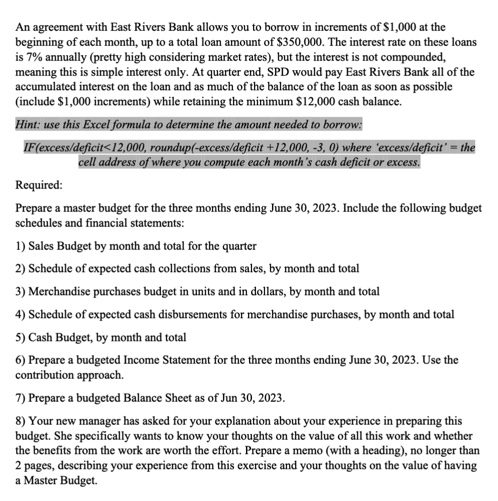

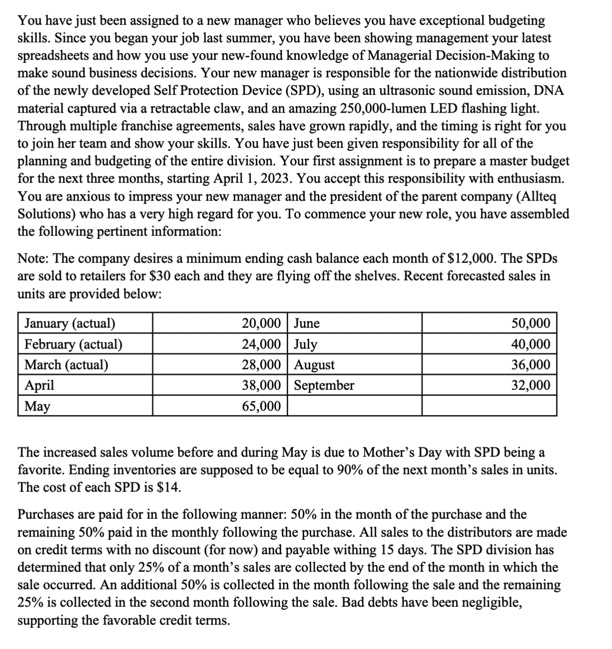

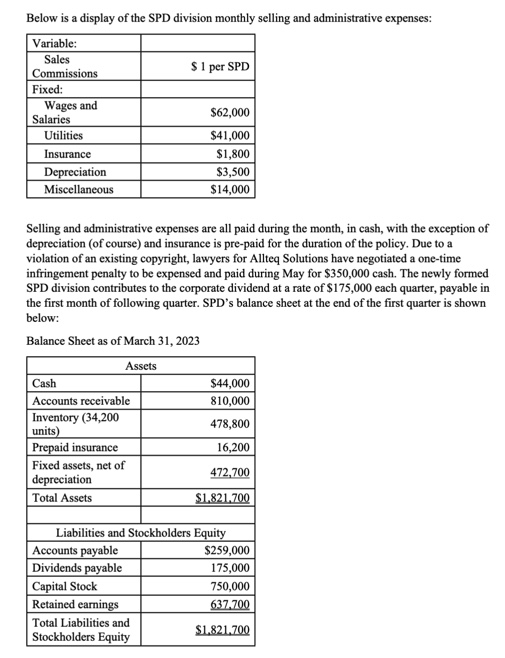

An agreement with East Rivers Bank allows you to borrow in increments of $1,000 at the beginning of each month, up to a total loan amount of $350,000. The interest rate on these loans is 7% annually (pretty high considering market rates), but the interest is not compounded, meaning this is simple interest only. At quarter end, SPD would pay East Rivers Bank all of the accumulated interest on the loan and as much of the balance of the loan as soon as possible (include $1,000 increments) while retaining the minimum $12,000 cash balance.

Hint: use this Excel formula to determine the amount needed to borrow: IF(excess/deficit

PLEASE HELP WITH 1-8! THANK YOU

An agreement with East Rivers Bank allows you to borrow in increments of $1,000 at the beginning of each month, up to a total loan amount of $350,000. The interest rate on these loans is 7% annually (pretty high considering market rates), but the interest is not compounded, meaning this is simple interest only. At quarter end, SPD would pay East Rivers Bank all of the accumulated interest on the loan and as much of the balance of the loan as soon as possible (include $1,000 increments) while retaining the minimum $12,000 cash balance. Hint: use this Excel formula to determine the amount needed to borrow: IF (excess/deficit

An agreement with East Rivers Bank allows you to borrow in increments of $1,000 at the beginning of each month, up to a total loan amount of $350,000. The interest rate on these loans is 7% annually (pretty high considering market rates), but the interest is not compounded, meaning this is simple interest only. At quarter end, SPD would pay East Rivers Bank all of the accumulated interest on the loan and as much of the balance of the loan as soon as possible (include $1,000 increments) while retaining the minimum $12,000 cash balance. Hint: use this Excel formula to determine the amount needed to borrow: IF (excess/deficit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started