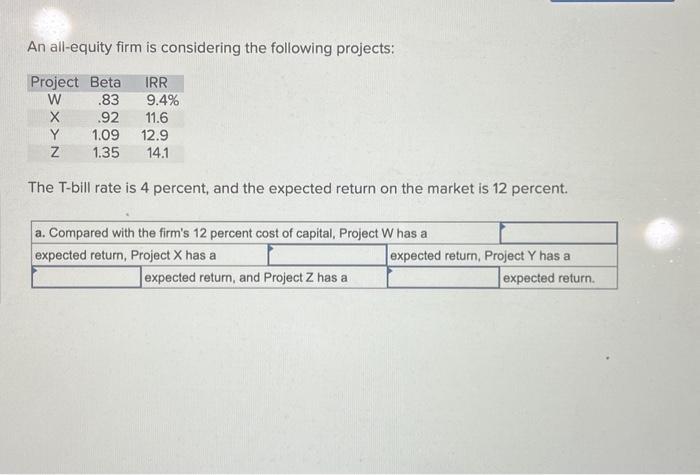

An all-equity firm is considering the following projects: Project Beta IRR W 83 9.4% X 92 11.6 Y 1.09 12.9 Z 1.35 14.1 The

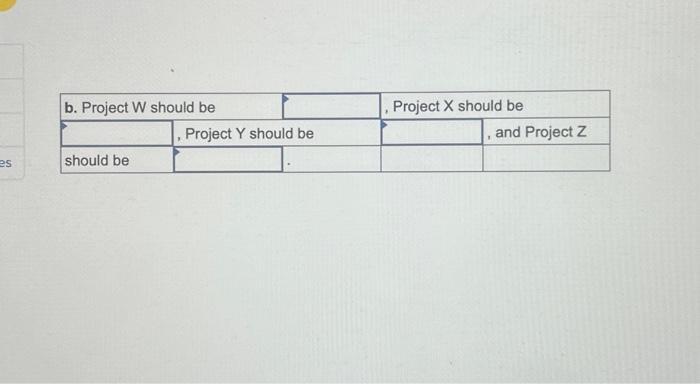

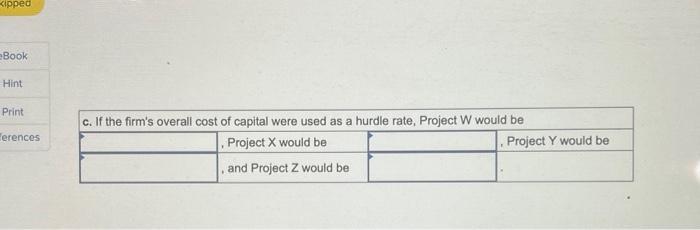

An all-equity firm is considering the following projects: Project Beta IRR W 83 9.4% X 92 11.6 Y 1.09 12.9 Z 1.35 14.1 The T-bill rate is 4 percent, and the expected return on the market is 12 percent. a. Compared with the firm's 12 percent cost of capital, Project W has a expected return, Project X has a expected return, and Project Z has a expected return, Project Y has a expected return. es b. Project W should be should be Y Project Y should be , Project X should be and Project Z

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Expected return can be calculated as Riskfree rate Beta Required returnRiskfree return Substituting ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started