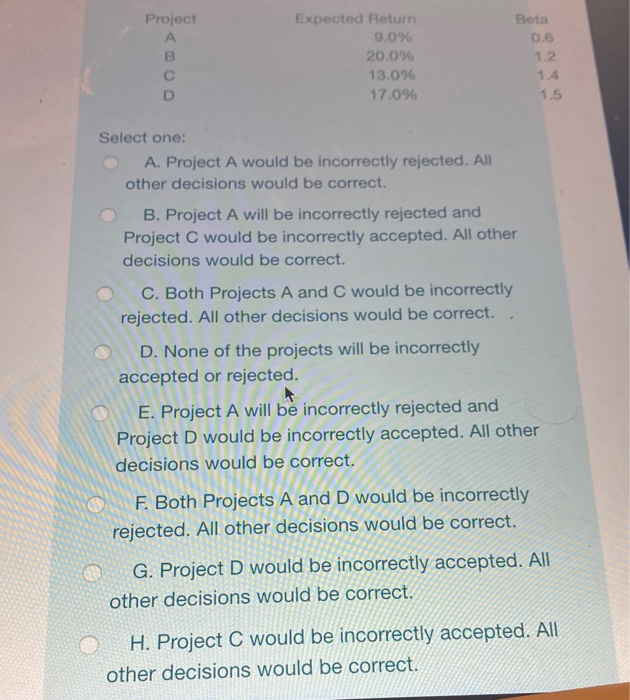

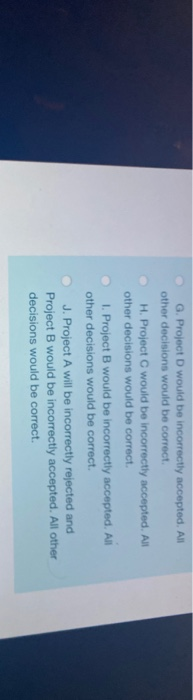

An all-equity firmi considering the prodh a follows the ball rato peront premium is 7 percent. If the firmuosis current WACO of 12 percent to evaluate these projects, which project(s), if any, will be incorrectly accepted or rejected? Project Expected Return 9.0% 20.0% 13.0% 17.0% Beta 0.6 1.2 Select one: A. Project A would be incorrectly rejected. All other decisions would be correct. B. Project A will be incorrectly rejected and Project C would be incorrectly accepted. All other decisions would be correct. C. Both Projects A and C would be incorrectly rejected. All other decisions would be correct. D. None of the projects will be incorrectly accepted or rejected. OLE. Project A will be incorrectly rejected and Project D would be incorrectly accepted. All other decisions would be correct. F. Both Projects A and D would be incorrectly rejected. All other decisions would be correct. G. Project D would be incorrectly accepted. All other decisions would be correct. H. Project C would be incorrectly accepted. All other decisions would be correct. O O G. Project D would be incorrectly accepted. All other decisions would be correct. H. Project C would be incorrectly accepted. All other decisions would be correct. 1. Project B would be incorrectly accepted. All other decisions would be correct. J. Project A will be incorrectly rejected and Project B would be incorrectly accepted. All other decisions would be correct. An all-equity firmi considering the prodh a follows the ball rato peront premium is 7 percent. If the firmuosis current WACO of 12 percent to evaluate these projects, which project(s), if any, will be incorrectly accepted or rejected? Project Expected Return 9.0% 20.0% 13.0% 17.0% Beta 0.6 1.2 Select one: A. Project A would be incorrectly rejected. All other decisions would be correct. B. Project A will be incorrectly rejected and Project C would be incorrectly accepted. All other decisions would be correct. C. Both Projects A and C would be incorrectly rejected. All other decisions would be correct. D. None of the projects will be incorrectly accepted or rejected. OLE. Project A will be incorrectly rejected and Project D would be incorrectly accepted. All other decisions would be correct. F. Both Projects A and D would be incorrectly rejected. All other decisions would be correct. G. Project D would be incorrectly accepted. All other decisions would be correct. H. Project C would be incorrectly accepted. All other decisions would be correct. O O G. Project D would be incorrectly accepted. All other decisions would be correct. H. Project C would be incorrectly accepted. All other decisions would be correct. 1. Project B would be incorrectly accepted. All other decisions would be correct. J. Project A will be incorrectly rejected and Project B would be incorrectly accepted. All other decisions would be correct