Answered step by step

Verified Expert Solution

Question

1 Approved Answer

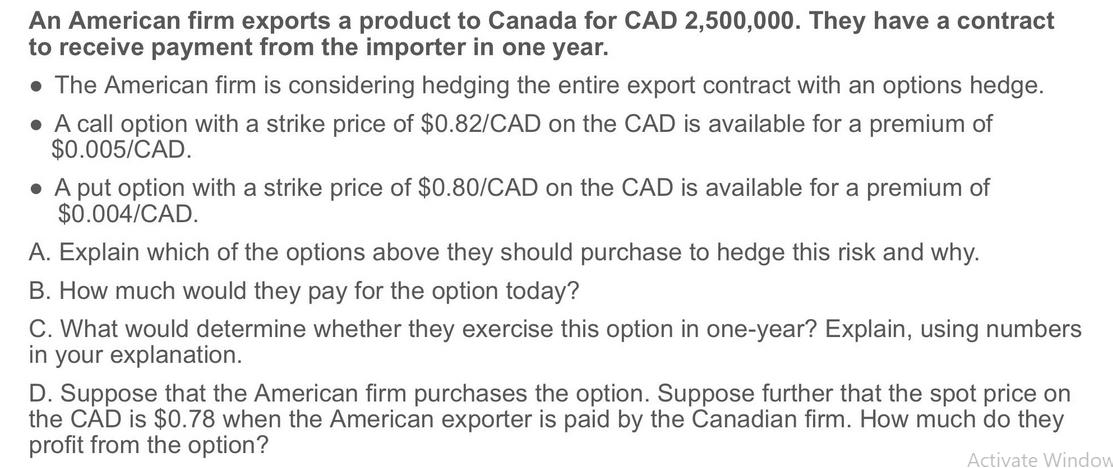

An American firm exports a product to Canada for CAD 2,500,000. They have a contract to receive payment from the importer in one year.

An American firm exports a product to Canada for CAD 2,500,000. They have a contract to receive payment from the importer in one year. The American firm is considering hedging the entire export contract with an options hedge. A call option with a strike price of $0.82/CAD on the CAD is available for a premium of $0.005/CAD. A put option with a strike price of $0.80/CAD on the CAD is available for a premium of $0.004/CAD. A. Explain which of the options above they should purchase to hedge this risk and why. B. How much would they pay for the option today? C. What would determine whether they exercise this option in one-year? Explain, using numbers in your explanation. D. Suppose that the American firm purchases the option. Suppose further that the spot price on the CAD is $0.78 when the American exporter is paid by the Canadian firm. How much do they profit from the option? Activate Window

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started