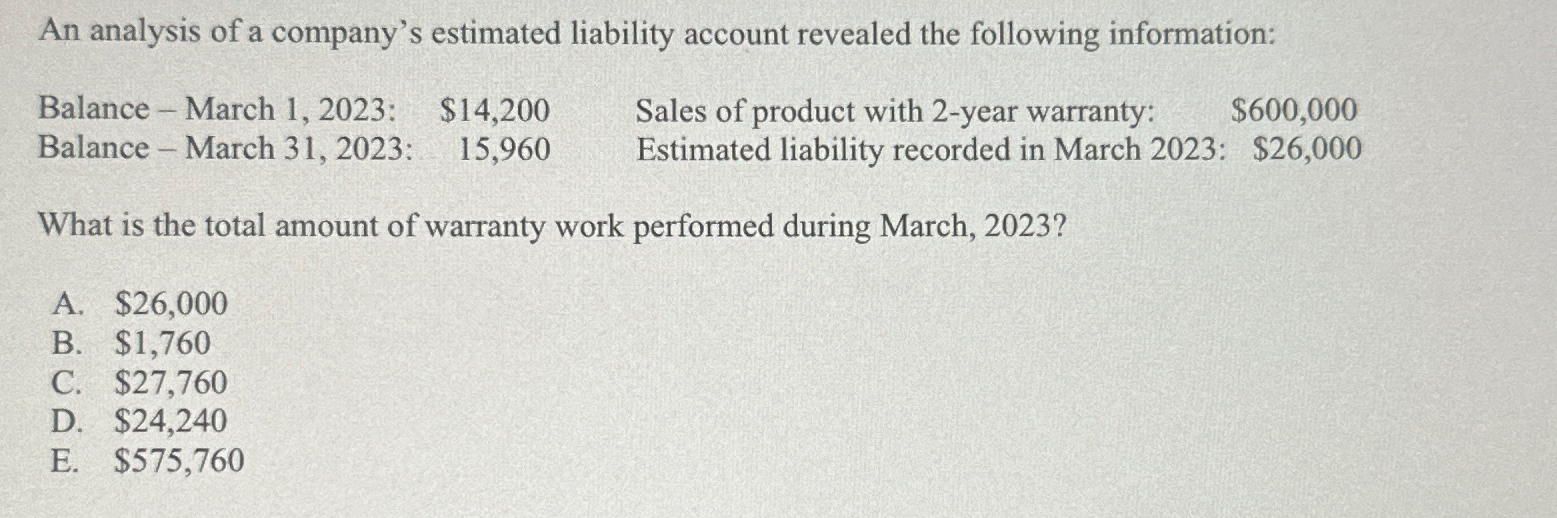

An analysis of a company's estimated liability account revealed the following information: Balance March 1, 2023: Balance March 31, 2023: $14,200 15,960 Sales of

An analysis of a company's estimated liability account revealed the following information: Balance March 1, 2023: Balance March 31, 2023: $14,200 15,960 Sales of product with 2-year warranty: $600,000 Estimated liability recorded in March 2023: $26,000 What is the total amount of warranty work performed during March, 2023? A. $26,000 B. $1,760 C. $27,760 D. $24,240 E. $575,760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total amount of warranty work performed during March 2023we need to analyze the changes in the estimated liability account Heres how ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards