Question

An analysis of the account balances by the company's accountant provided the following additional information: 1. A physical count of supplies revealed $1,400 on

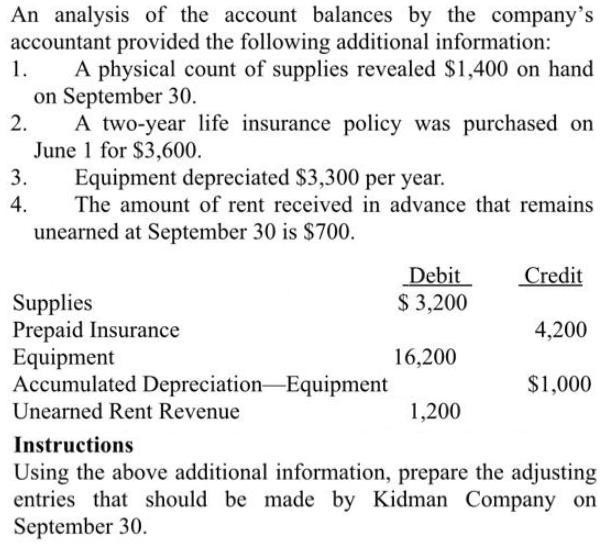

An analysis of the account balances by the company's accountant provided the following additional information: 1. A physical count of supplies revealed $1,400 on hand on September 30. 2. A two-year life insurance policy was purchased on June 1 for $3,600. Equipment depreciated $3,300 per year. The amount of rent received in advance that remains 3. 4. unearned at September 30 is $700. Debit $ 3,200 Credit Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment 4,200 16,200 $1,000 Unearned Rent Revenue 1,200 Instructions Using the above additional information, prepare the adjusting entries that should be made by Kidman Company on September 30.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution Adjusting Journal Entries Particulars Date Debit Credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel

IFRS Edition

9781119153726, 978-1118285909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App