Answered step by step

Verified Expert Solution

Question

1 Approved Answer

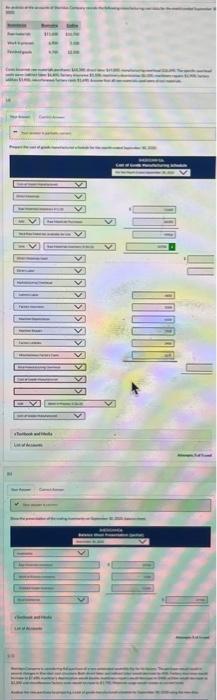

An analysis of the accounts of Sheridan Company reveals the following manufacturing cont data for the month ended September 30 2020 Inventories Raw materials Work

An analysis of the accounts of Sheridan Company reveals the following manufacturing cont data for the month ended September 30 2020 Inventories Raw materials Work in process Finished goods Casts incurred: raw eaterials purchases $68.300, direct labor $49.800 manufacturing overhead $26.8990. The specific overhead cmats were indirect labor $5 ROO, factory insurance $5,100, machinery depreciation $4.500 machinery repairs $2,900, factory utilities $3,900 cellaneoun factory costs $1.690. Assume that all raw materials used were direct materials Mar Answer Correct Ansever Your answer is partially correct. Prepare the cast of goodh manufactured schedule for the month ended September 30, 2020 Direct Materials Cast of Goods Manufactured Beginning Ending $11.600 $10,700 5,100 12.100 Add Raw Matrelain Inventory 9/1/20 (c1) Less Total Raw Materials Available for Lise Direct Labor Direct Materials Used Indirect Labor 9.700 Factory Instance Manufacturing Overhead Machine Repairs Factory Utes Machine Depreciation Raw Materials Purchases Miscellaneous Factory Costs Raw Materials Inventory 30/20 Tora Marfacturing Overhead List of Accounts Cast of Goods MITEES Cent of Goods Manufactured eTextbook and Media Your Answer Correct Answer Inverteries Your answer is currect Work in Process I Show the presentation of the ending inventories on September 30, 2020. balance sheet Total inventories Eas Materia inventary List of Accounts Finished Goods Indary eTextbook and Media SHERIDAN Co. Cost of Goods Manufacturing Schedule For the Month Ented September 30, 2020 SHERIDANCO. Balance Sheet Presentation (partial) September 30, 2020 LAPOL BOOTC 3100 11600 12300 68300 79900 10700 6000 65.00 FELLO Attempts: 5 of Sused 27100 Attempts: 5 of 5 used Sheridan Company is considering the purchase of a new automated assembly line for its factory. The purchase would result in several changes in Sheridan cost structure. Both direct labor and indirect labar would decrease by 40% Factory insurance would increase to $7600, machinery depreciation would double, machinery repairs would decrease to $400, utilities would decrease ta $2.200 and miscellaneous factory costs would increase to $1.790 Materials usage would remain at current levels. Analyze the new purchase by preparing a cost of goods manufactured schedule for September 30, 2020 using the new data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started