Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The manufacturing cost per unit of ARORA company is as follows: Direct materials: $16 Direct labor: $20 Variable manufacturing overhead: $4 Fixed manufacturing overhead

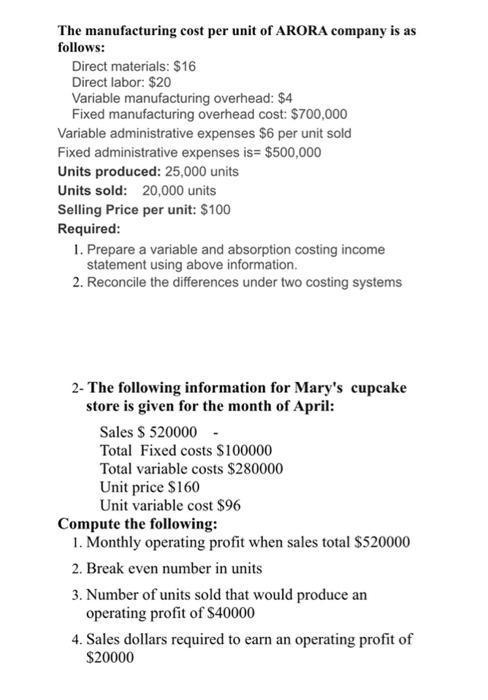

The manufacturing cost per unit of ARORA company is as follows: Direct materials: $16 Direct labor: $20 Variable manufacturing overhead: $4 Fixed manufacturing overhead cost: $700,000 Variable administrative expenses $6 per unit sold Fixed administrative expenses is= $500,000 Units produced: 25,000 units Units sold: 20,000 units Selling Price per unit: $100 Required: 1. Prepare a variable and absorption costing income statement using above information. 2. Reconcile the differences under two costing systems 2- The following information for Mary's cupcake store is given for the month of April: Sales $ 520000 - Total Fixed costs $100000 Total variable costs $280000 Unit price $160 Unit variable cost $96 Compute the following: 1. Monthly operating profit when sales total $520000 2. Break even number in units 3. Number of units sold that would produce an operating profit of $40000 4. Sales dollars required to earn an operating profit of $20000

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Given Differential 2 2 111 1 dy Find Degree of the giv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started