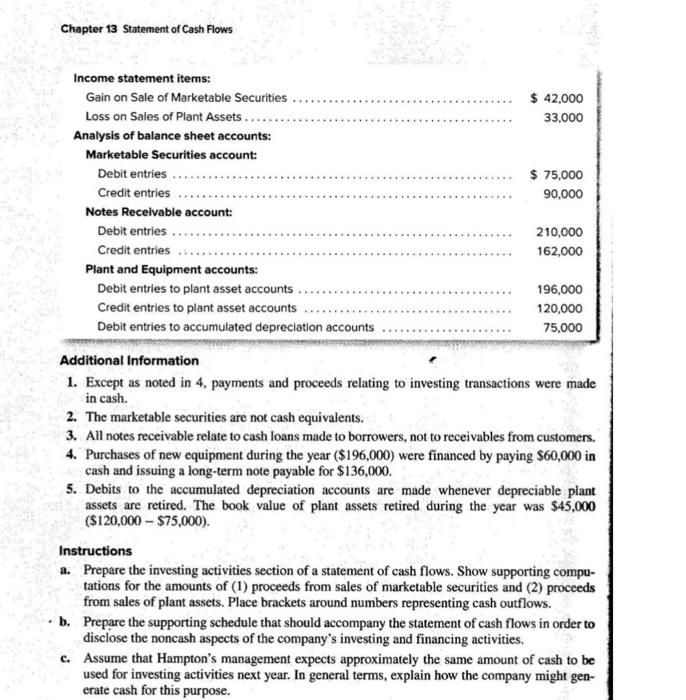

An analysis of the income statement and the balance sheet counts of Hampton, Inc., December 31 of the current year, provides the following indormation Chapter 13 Sol Cashow Income statement les Gain on Sale of Marketable Securities $ 42,000 Loss on Sales of Plantes.. 33.000 Analysis of balance sheet accounts: Marketable Securities account Debitectes $ 75.000 Credentries 90.000 Notes Receivable account Debitores 210.000 Credit entries 162.000 Plant and Equipment account Debit entries to pass accounts 195.000 Crediteeries to plant et accounts 120,000 Debil entries to cumulated depreciation accounts 75,000 Additional Information 1. Except as need in 4. payments and proceeds relating to investing transactions were made in casi 2. The marketable securities are not cash equivalents, 2. All notes receivable relate to cash made to borrowers, sotto receivables from customers 4. Purchases of new equipment during the year ($196,000) were financed by paying s60.000 is cash and issuing a long-term sote payable for $136.000 5. Dehis to the accumulated depreciation accounts are made whenever depreciable plane assets are retired. The book value of plantes retired during the year was 545.000 (5120,000-$75.000) Instructions Prepare the investing activities section of a statement of cash flow. Show supporting compe tations for the mounts of (1) proceeds from sales of marketable securities and (2) proces from sales of plante, Place beaches around the representing cash outflow Prepare the supporting schedule that should accompany the statement of cash flows in order to disclose the concash aspects of the company's investing and financing activities, Assume that He management expect approximately the same amount of custo be used for investing activities next year. In general terms, explain how the company migher crale cash for this purpose. Chapter 13 Statement of Cash Flows $ 42,000 33.000 $ 75,000 90,000 Income statement items: Gain on Sale of Marketable Securities Loss on Sales of Plant Assets .. Analysis of balance sheet accounts: Marketable Securities account: Debit entries Credit entries Notes Receivable account: Debit entries Credit entries Plant and Equipment accounts: Debit entries to plant asset accounts Credit entries to plant asset accounts Debit entries to accumulated depreciation accounts 210,000 162,000 196,000 120,000 75,000 Additional Information 1. Except as noted in 4. payments and proceeds relating to investing transactions were made in cash. 2. The marketable securities are not cash equivalents. 3. All notes receivable relate to cash loans made to borrowers, not to receivables from customers. 4. Purchases of new equipment during the year ($196,000) were financed by paying $60,000 in cash and issuing a long-term note payable for $136,000. 5. Debits to the accumulated depreciation accounts are made whenever depreciable plant assets are retired. The book value of plant assets retired during the year was $45,000 ($120,000 - $75,000). Instructions a. Prepare the investing activities section of a statement of cash flows. Show supporting compu- tations for the amounts of (1) proceeds from sales of marketable securities and (2) proceeds from sales of plant assets. Place brackets around numbers representing cash outflows. b. Prepare the supporting schedule that should accompany the statement of cash flows in order to disclose the noncash aspects of the company's investing and financing activities. c. Assume that Hampton's management expects approximately the same amount of cash to be used for investing activities next year. In general terms, explain how the company might gen- erate cash for this purpose