Answered step by step

Verified Expert Solution

Question

1 Approved Answer

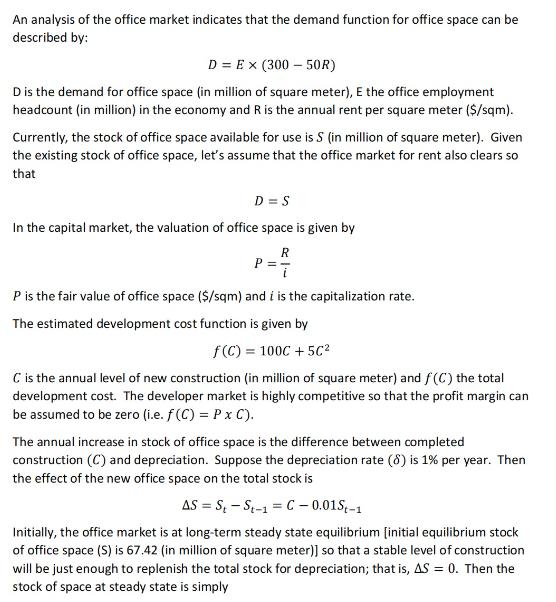

An analysis of the office market indicates that the demand function for office space can be described by: D = E (300-50R) D is

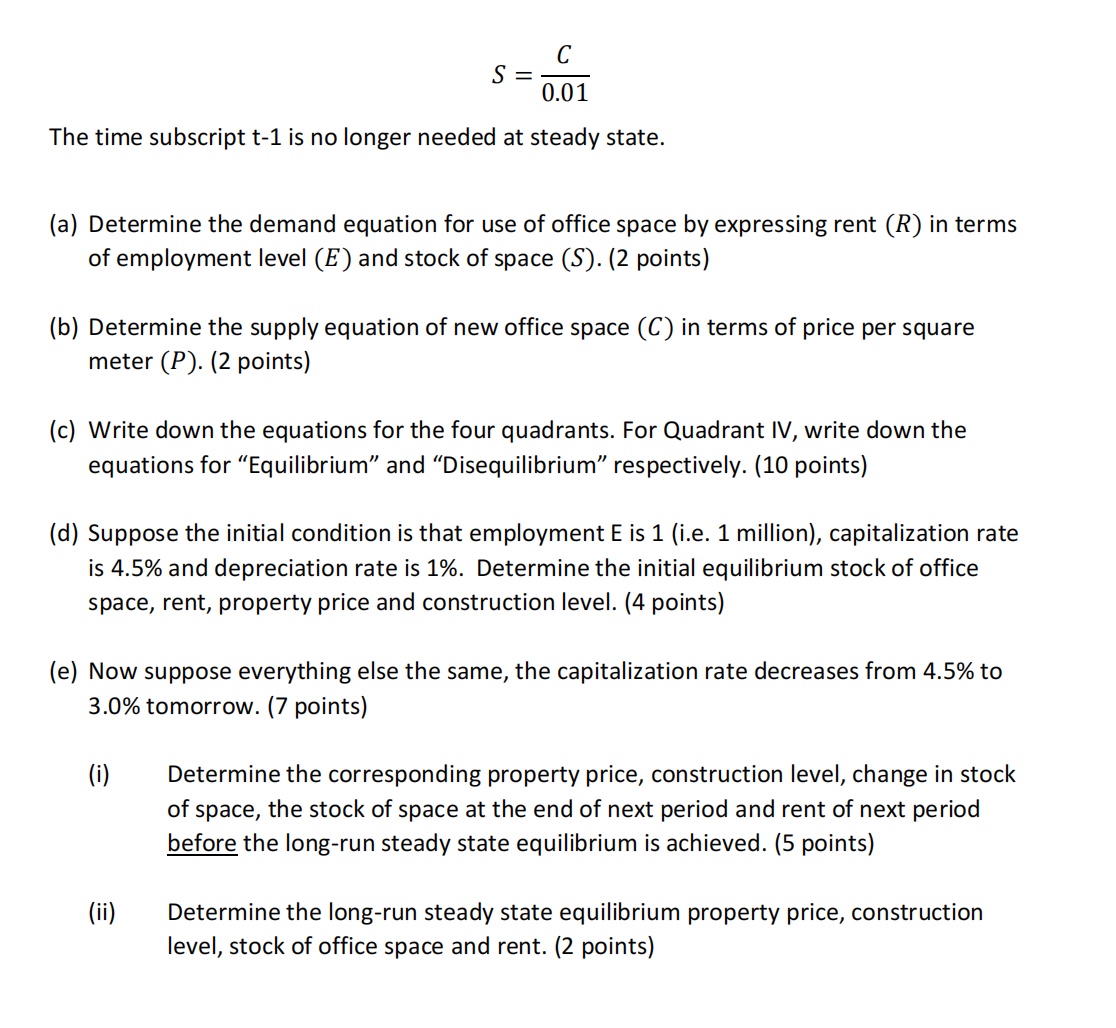

An analysis of the office market indicates that the demand function for office space can be described by: D = E (300-50R) D is the demand for office space (in million of square meter), E the office employment headcount (in million) in the economy and R is the annual rent per square meter ($/sqm). Currently, the stock of office space available for use is S (in million of square meter). Given the existing stock of office space, let's assume that the office market for rent also clears so that D=S In the capital market, the valuation of office space is given by R P P is the fair value of office space ($/sqm) and i is the capitalization rate. The estimated development cost function is given by f(c) = 100C +5C C is the annual level of new construction (in million of square meter) and f(C) the total development cost. The developer market is highly competitive so that the profit margin can be assumed to be zero (i.e. f (C) = P x C). The annual increase in stock of office space is the difference between completed construction (C) and depreciation. Suppose the depreciation rate (8) is 1% per year. Then the effect of the new office space on the total stock is AS S-S-1 C- 0.015-1 Initially, the office market is at long-term steady state equilibrium [initial equilibrium stock of office space (S) is 67.42 (in million of square meter)] so that a stable level of construction will be just enough to replenish the total stock for depreciation; that is, AS = 0. Then the stock of space at steady state is simply == C S = 0.01 The time subscript t-1 is no longer needed at steady state. (a) Determine the demand equation for use of office space by expressing rent (R) in terms of employment level (E) and stock of space (S). (2 points) (b) Determine the supply equation of new office space (C) in terms of price per square meter (P). (2 points) (c) Write down the equations for the four quadrants. For Quadrant IV, write down the equations for "Equilibrium" and "Disequilibrium" respectively. (10 points) (d) Suppose the initial condition is that employment E is 1 (i.e. 1 million), capitalization rate is 4.5% and depreciation rate is 1%. Determine the initial equilibrium stock of office space, rent, property price and construction level. (4 points) (e) Now suppose everything else the same, the capitalization rate decreases from 4.5% to 3.0% tomorrow. (7 points) (i) (!!) Determine the corresponding property price, construction level, change in stock of space, the stock of space at the end of next period and rent of next period before the long-run steady state equilibrium is achieved. (5 points) Determine the long-run steady state equilibrium property price, construction level, stock of office space and rent. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started