Question

An analyst gathers the following information about Engadine and two of its peers. Share Price (per share) Number of Shares outstanding Cash Debt (market

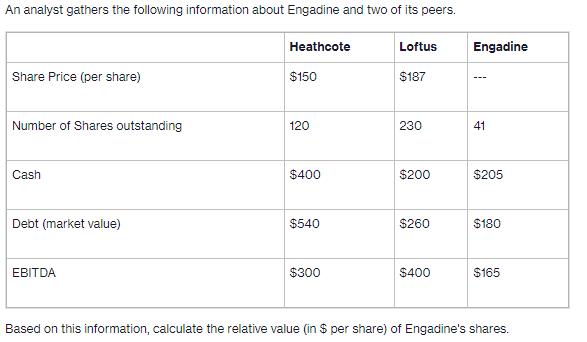

An analyst gathers the following information about Engadine and two of its peers. Share Price (per share) Number of Shares outstanding Cash Debt (market value) EBITDA Heathcote $150 120 $400 $540 $300 Loftus $187 230 $200 $260 $400 Engadine --- 41 $205 $180 $165 Based on this information, calculate the relative value (in $ per share) of Engadine's shares. An analyst gathers the following information about Engadine and two of its peers. Share Price (per share) Number of Shares outstanding Cash Debt (market value) EBITDA Heathcote $150 120 $400 $540 $300 Loftus $187 230 $200 $260 $400 Engadine --- 41 $205 $180 $165 Based on this information, calculate the relative value (in $ per share) of Engadine's shares.

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting an introduction to concepts, methods and uses

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

13th Edition

978-0538776080, 324651147, 538776080, 9780324651140, 978-0324789003

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App