Question

An analyst has collected the following information regarding Christopher Co.: The yield to maturity on the companys bonds is 9 percent. The bond price selling

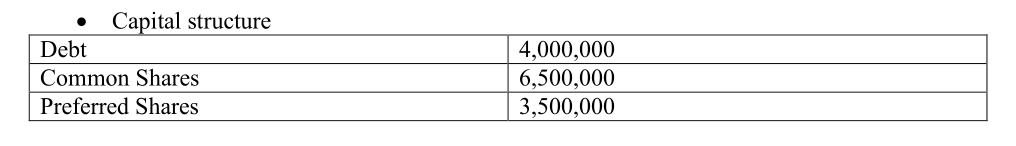

An analyst has collected the following information regarding Christopher Co.:  The yield to maturity on the companys bonds is 9 percent. The bond price selling a par value RM1,000 for 20 years periods. The companys last year's dividend was $2.80 for common shares. The company expects that its dividend will grow at a constant rate of 7 percent a year. The current common share price is $40. The tax rate is 40 percent. The company anticipates that it will need to raise new common share this year and total flotation costs will equal 10 percent of the amount issued. The preferred share is fixed at $1.60 with the market price at $25. Assume the company accounts for flotation costs by adjusting the cost of capital. Required: (a) Calculate the companys WACC. (b) Discuss the factors that might affect the accuracy of the WACC measurement. (c) Explain the limitation of WACC measurement.

The yield to maturity on the companys bonds is 9 percent. The bond price selling a par value RM1,000 for 20 years periods. The companys last year's dividend was $2.80 for common shares. The company expects that its dividend will grow at a constant rate of 7 percent a year. The current common share price is $40. The tax rate is 40 percent. The company anticipates that it will need to raise new common share this year and total flotation costs will equal 10 percent of the amount issued. The preferred share is fixed at $1.60 with the market price at $25. Assume the company accounts for flotation costs by adjusting the cost of capital. Required: (a) Calculate the companys WACC. (b) Discuss the factors that might affect the accuracy of the WACC measurement. (c) Explain the limitation of WACC measurement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started