Question

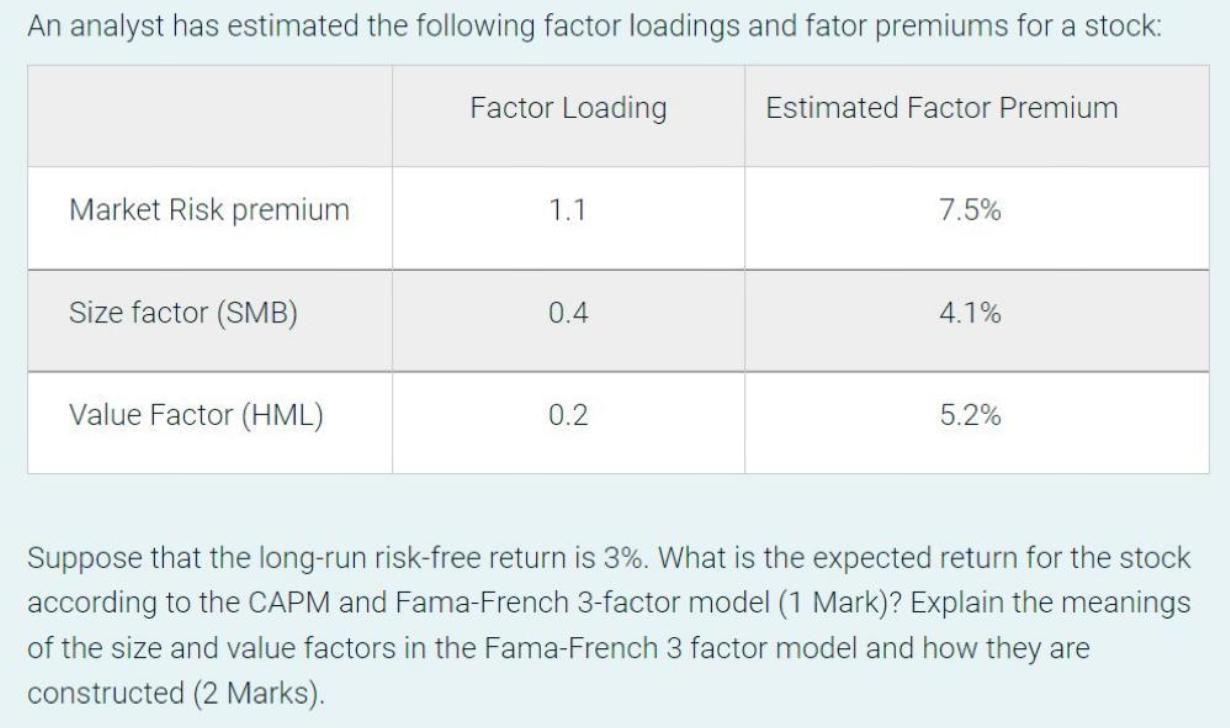

An analyst has estimated the following factor loadings and fator premiums for a stock: Market Risk premium Size factor (SMB) Value Factor (HML) Factor

An analyst has estimated the following factor loadings and fator premiums for a stock: Market Risk premium Size factor (SMB) Value Factor (HML) Factor Loading 1.1 0.4 0.2 Estimated Factor Premium 7.5% 4.1% 5.2% Suppose that the long-run risk-free return is 3%. What is the expected return for the stock according to the CAPM and Fama-French 3-factor model (1 Mark)? Explain the meanings of the size and value factors in the Fama-French 3 factor model and how they are constructed (2 Marks).

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS The expected return is given as follows The riskfree rate beta x the market risk premium SMB ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App