Question

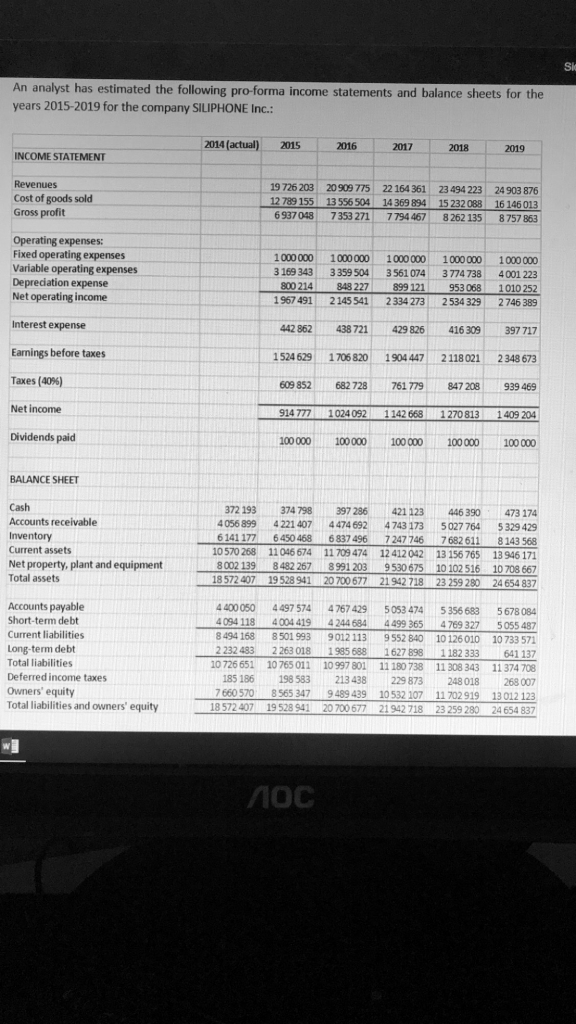

An analyst has estimated the following pro-forma income statements and balance sheets for the years 2015-2019 for the company SILIPHONE Inc.: The analyst tells you

An analyst has estimated the following pro-forma income statements and balance sheets for the

years 2015-2019 for the company SILIPHONE Inc.:

The analyst tells you that Cash is part of the firms operating current assets. The firms interest

bearing debt consists of Short-term debt and Long-term debt. The analyst is using a weighted

average cost of capital (WACC) of 10% and he believes the long-term growth rate in free cash flows

will equal 5%.

a) Estimate firm free cash flows for the years 2015-2019.

b) Compute both the enterprise value and the equity value of SILIPHONE.

Si An analyst has estimated the following pro-forma income statements and balance sheets for the years 2015-2019 for the company SILIPHONE Inc.: 2014(actual) 2015 2016 2017 2018 2019 INCOME STATEMENT Revenues Cost of goods sold Gross profit 19 726 203 20 909 775 22 164 361 23 494 223 24 903 876 789155 13556504 14 369 894 15 232 088 16 146 01 9370487353 271 7 794 467 8 262 135 8 757 863 Operating expenses: Fixed operating expenses Variable operating expenses Depreciation expense Net operating income 1000000 1000000 1000000 1000000 1000 000 3 169 343 3359504 561074 3 774 738 4001 223 00 214 848 227 899 121 953068 1010 252 1967 491 2145541 2334 273 2534 329 2746 389 Interest expense Earnings before taxes Taxes (40%) Net income Dividends paid 442 862438 721 429 826 416309 397 717 1 524 6291706 820 1904 447 2118021 2348 673 609 852 682 728 761 779 847208 939 469 914 777 1024092 1142668 1270813 1409 204 100000 100000 100 000 100000 100000 BALANCE SHEET Cash Accounts receivable Inventory Current assets Net property, plant and equipment Total assets 372 193374 798397 286 4056 899 421 123 4 474 6924743 1735027 764 446 390 473 174 5 329 429 4 221 407 141 177 6450 468 6837 496 72477467682611 8243 568 10 570 268 11046 674 11 709 474 12412042 13156765 13946 171 8 002 139 8482 267 8991 203 9530 675 10 102 516 10708 667 18 572407 19 528941 20700677 21942718 23 259 280 24 654 837 Accounts payable Short-term debt Current liabilities Long-term debt Total liabilities Deferred income taxes Owners' equity Total liabilities and owners' equity 400050 4 497 574 4 767 429 5053 474 5 356 6835678 084 4 118 4004 419 4244 684 4499 365 4769 327 5055 487 8 494 168 8501 9939012 113 9552 840 10 126 010 10 733 57 2232 433 2263018 1985 688 1627898 1182 333 641 137 10 726651 10 765 011 10 997 801 11 180 738 11 308 343 11 374 708 185 186198 583 213438 229 873248018268 007 7660570 8 565 347 9489 439 10 532 107 11 702919 13012 123 18572 407 19 528 941 20 700677 21 942718 23 259 280 24654 837 10C Si An analyst has estimated the following pro-forma income statements and balance sheets for the years 2015-2019 for the company SILIPHONE Inc.: 2014(actual) 2015 2016 2017 2018 2019 INCOME STATEMENT Revenues Cost of goods sold Gross profit 19 726 203 20 909 775 22 164 361 23 494 223 24 903 876 789155 13556504 14 369 894 15 232 088 16 146 01 9370487353 271 7 794 467 8 262 135 8 757 863 Operating expenses: Fixed operating expenses Variable operating expenses Depreciation expense Net operating income 1000000 1000000 1000000 1000000 1000 000 3 169 343 3359504 561074 3 774 738 4001 223 00 214 848 227 899 121 953068 1010 252 1967 491 2145541 2334 273 2534 329 2746 389 Interest expense Earnings before taxes Taxes (40%) Net income Dividends paid 442 862438 721 429 826 416309 397 717 1 524 6291706 820 1904 447 2118021 2348 673 609 852 682 728 761 779 847208 939 469 914 777 1024092 1142668 1270813 1409 204 100000 100000 100 000 100000 100000 BALANCE SHEET Cash Accounts receivable Inventory Current assets Net property, plant and equipment Total assets 372 193374 798397 286 4056 899 421 123 4 474 6924743 1735027 764 446 390 473 174 5 329 429 4 221 407 141 177 6450 468 6837 496 72477467682611 8243 568 10 570 268 11046 674 11 709 474 12412042 13156765 13946 171 8 002 139 8482 267 8991 203 9530 675 10 102 516 10708 667 18 572407 19 528941 20700677 21942718 23 259 280 24 654 837 Accounts payable Short-term debt Current liabilities Long-term debt Total liabilities Deferred income taxes Owners' equity Total liabilities and owners' equity 400050 4 497 574 4 767 429 5053 474 5 356 6835678 084 4 118 4004 419 4244 684 4499 365 4769 327 5055 487 8 494 168 8501 9939012 113 9552 840 10 126 010 10 733 57 2232 433 2263018 1985 688 1627898 1182 333 641 137 10 726651 10 765 011 10 997 801 11 180 738 11 308 343 11 374 708 185 186198 583 213438 229 873248018268 007 7660570 8 565 347 9489 439 10 532 107 11 702919 13012 123 18572 407 19 528 941 20 700677 21 942718 23 259 280 24654 837 10CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started