Answered step by step

Verified Expert Solution

Question

1 Approved Answer

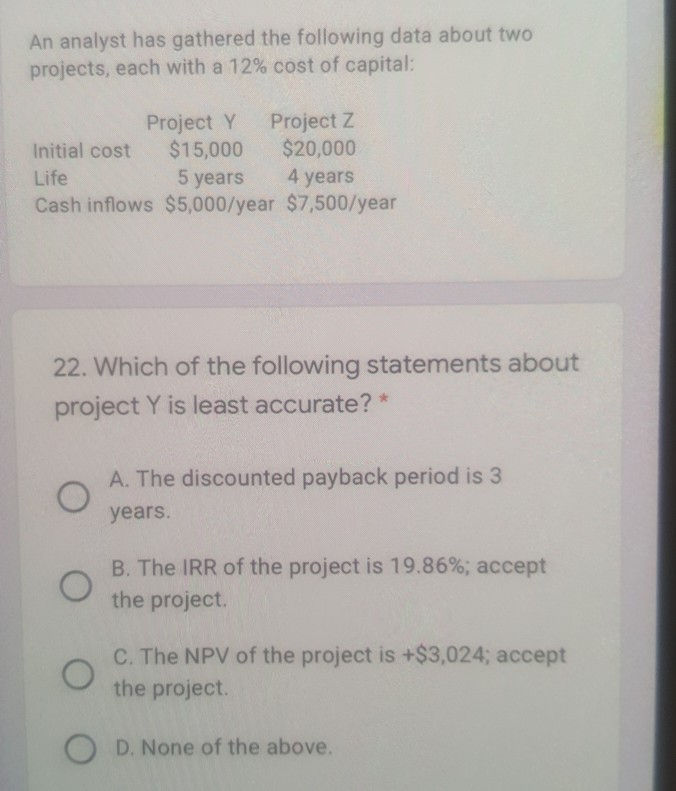

An analyst has gathered the following data about two projects, each with a 12% cost of capital: Project Y Project Z Initial cost $15,000 $20,000

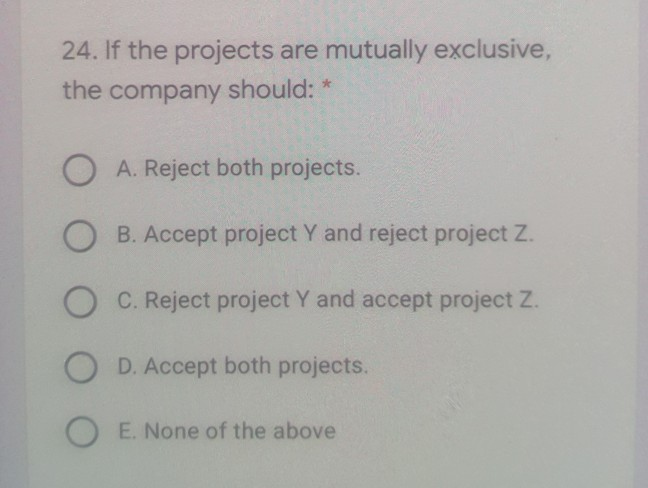

An analyst has gathered the following data about two projects, each with a 12% cost of capital: Project Y Project Z Initial cost $15,000 $20,000 Life 5 years 4 years Cash inflows $5,000/year $7,500/year 22. Which of the following statements about project Y is least accurate? A. The discounted payback period is 3 years. O B. The IRR of the project is 19.86%; accept the project C. The NPV of the project is +$3,024; accept the project O D. None of the above. 24. If the projects are mutually exclusive, the company should: * O A. Reject both projects. O B. Accept project Y and reject project Z. O C. Reject project Y and accept project Z. O D. Accept both projects. O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started