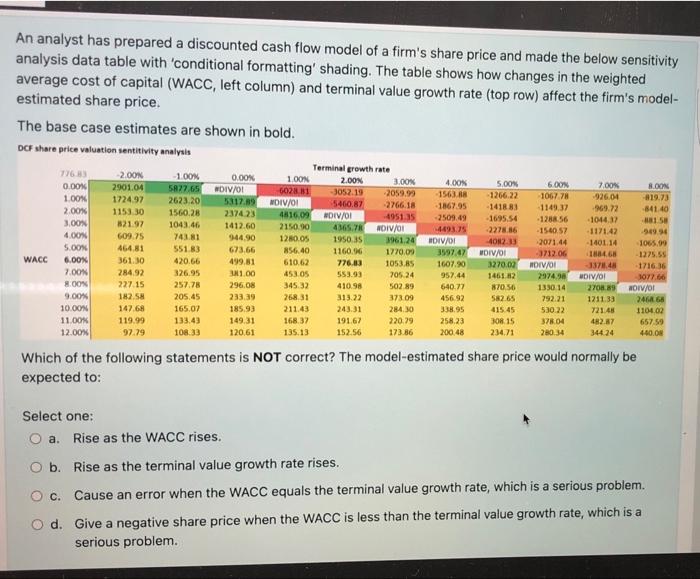

An analyst has prepared a discounted cash flow model of a firm's share price and made the below sensitivity analysis data table with 'conditional formatting' shading. The table shows how changes in the weighted average cost of capital (WACC, left column) and terminal value growth rate (top row) affect the firm's model- estimated share price. The base case estimates are shown in bold. DCF share price valuation sentitivity analysis Terminal growth rate 776.83 -2.00% -1.00% 0.00% 4.00% 5.00% 6.00% 1.00% 2.00% 6028.81 -3052.19 7.00% 0.00% 8.00% 2901.04 5877.65 #DIV/0! 3.00% -2059.99 -1563.88 -2766.18 -1867.95 -1266.22 1067.78 -926.04 819.73 1.00% 1724.97 2623.20 5317.89 5460.87 1149.37 -969.72 841.40 2.00% 1153.30 1560.28 2374.23 4816.09 #DIV/0! -1418 83 -1695.54 -4951.35 -2509.49 -1288.56 -1044.37 881.58 3.00% 821.97 1043.46 1412.60 2150.90 4365.78 #DIV/01 4493.75 -1171.42 949.94 4.00% 609.75 743.81 944.90 1280.05 -2278.86 -1540.57 -4082-33 1950.35 3961.24 #DIV/0! 1065.99 5.00% 464.81 551.83 673.66 2071.44 -1401.14 -3712.06 856.40 1160.96 1770.09 3597.47 #DIV/0! 1884.68 1275.55 6.00% 361.30 420.66 499.81 610.62 776.83 1053.85 1607.90 3270.02 #DIV/0! -3378.48 1716.36 7.00% 284.92 326.95 381.00 453.05 553.93 705.24 957.44 1461.82 2974.98 #DIV/0! 3077.66 8:00% 227.15 257.78 296.08 345.32 410.98 502.89 640.77 870.56 1330 14 2708.89 9.00% 182.58 205.45 233.39 268.31 313.22 373.09 456.92 582.65 792.21 1211.33 2468 66 10.00% 147.68 165.07 185.93 211.43 243.31 284.30 338.95 415.45 530.22 721.48 1104.02 11.00% 119.99 133.43 149.31 168.37 191.67 220.79 258.23 308.15 378.04 482.87 657.59 12.00% 97.79 108.33 120.61 135.13 152.56 173.86 200,48 234.71 280.34 344.24 440.0 Which of the following statements is NOT correct? The model-estimated share price would normally be expected to: Select one: a. Rise as the WACC rises. O b. Rise as the terminal value growth rate rises. c. Cause an error when the WACC equals the terminal value growth rate, which is a serious problem. d. Give a negative share price when the WACC is less than the terminal value growth rate, which is a serious problem. WACC #DIV/0! #DIV/0