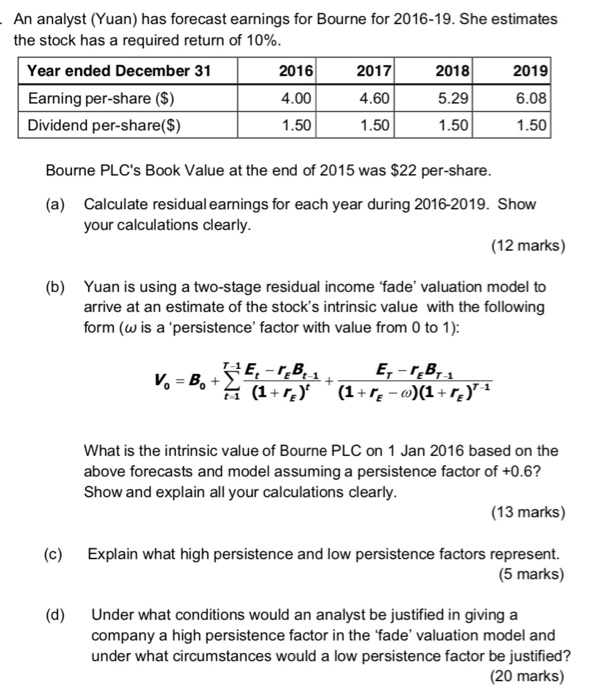

An analyst (Yuan) has forecast earnings for Bourne for 2016-19. She estimates the stock has a required return of 10% 2018 Year ended December 31 2016 2017 2019 4.00 Earning per-share ($) 5.29 6.08 4.60 1.50 1.50 1.50 Dividend per-share(S) 1.50 Bourne PLC's Book Value at the end of 2015 was $22 per-share (a) Calculate residual earnings for each year during 2016-2019. Show your calculations clearly (12 marks) (b) Yuan is using a two-stage residual income 'fade' valuation model to arrive at an estimate of the stock's intrinsic value with the following form ( is a 'persistence, factor with value from 0 to 1): T-1 T-1 What is the intrinsic value of Bourne PLC on 1 Jan 2016 based on the above forecasts and model assuming a persistence factor of +0.6? Show and explain all your calculations clearly (13 marks) (c) Explain what high persistence and low persistence factors represent. (5 marks) (d) Under what conditions would an analyst be justified in giving a company a high persistence factor in the fade' valuation model and under what circumstances would a low persistence factor be justified? (20 marks) An analyst (Yuan) has forecast earnings for Bourne for 2016-19. She estimates the stock has a required return of 10% 2018 Year ended December 31 2016 2017 2019 4.00 Earning per-share ($) 5.29 6.08 4.60 1.50 1.50 1.50 Dividend per-share(S) 1.50 Bourne PLC's Book Value at the end of 2015 was $22 per-share (a) Calculate residual earnings for each year during 2016-2019. Show your calculations clearly (12 marks) (b) Yuan is using a two-stage residual income 'fade' valuation model to arrive at an estimate of the stock's intrinsic value with the following form ( is a 'persistence, factor with value from 0 to 1): T-1 T-1 What is the intrinsic value of Bourne PLC on 1 Jan 2016 based on the above forecasts and model assuming a persistence factor of +0.6? Show and explain all your calculations clearly (13 marks) (c) Explain what high persistence and low persistence factors represent. (5 marks) (d) Under what conditions would an analyst be justified in giving a company a high persistence factor in the fade' valuation model and under what circumstances would a low persistence factor be justified? (20 marks)