Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An analyst's forecast for South East Air's free cash flows for next year is provided in the table. Assume that free cash flow is

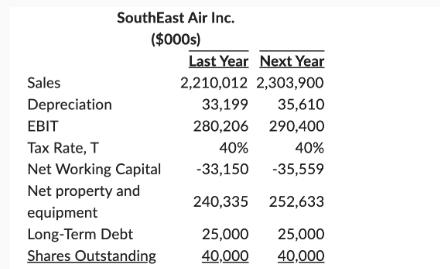

An analyst's forecast for South East Air's free cash flows for next year is provided in the table. Assume that free cash flow is paid at the end of each year and we are at the beginning of a year. Last year's values are for the year-end yesterday. The analyst expects SouthEast's cash flow to remain constant at next year's level in perpetuity. The WACC for SouthEast is 8%. Calculate the fair price for SouthEast's shares today. SouthEast Air Inc. ($000s) Sales Depreciation EBIT Tax Rate, T Net Working Capital Net property and equipment Long-Term Debt Shares Outstanding Last Year Next Year 2,210,012 2,303,900 33,199 35,610 280,206 290,400 40% 40% -33,150 -35,559 240,335 252,633 25,000 25,000 40,000 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the task is to calculate the fair price for SouthEast Airs shares today using a Discounted Cash Flow DCF analysis un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started