Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An appraisal from developer of three alternative investment construction project, A, B and C is being made and the minimum desirable rate of return

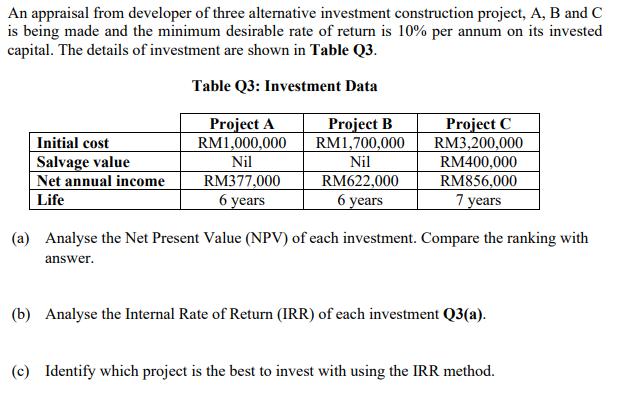

An appraisal from developer of three alternative investment construction project, A, B and C is being made and the minimum desirable rate of return is 10% per annum on its invested capital. The details of investment are shown in Table Q3. Table Q3: Investment Data Initial cost Salvage value Net annual income Life Project A RM1,000,000 Nil RM377,000 6 years Project B RM1,700,000 Nil RM622,000 6 years Project C RM3,200,000 RM400,000 RM856,000 7 years (a) Analyse the Net Present Value (NPV) of each investment. Compare the ranking with answer. (b) Analyse the Internal Rate of Return (IRR) of each investment Q3(a). (c) Identify which project is the best to invest with using the IRR method.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the Net Present Value NPV and Internal Rate of Return IRR of each investment we need to calculate the present value of the net annual incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started