Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An appraiser is looking for comparable sales and finds a property that recently sold for $ 2 1 5 , 0 0 0 . She

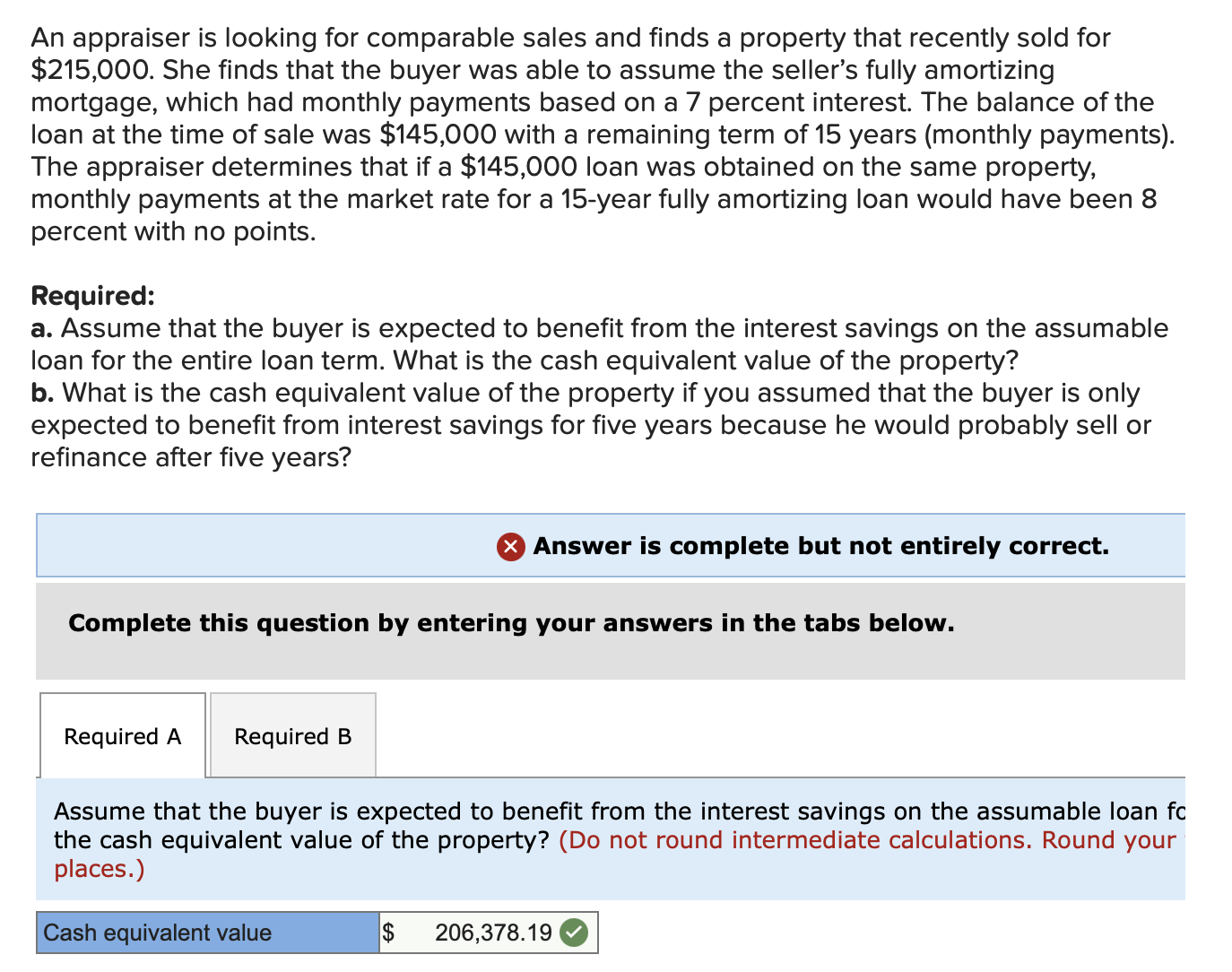

An appraiser is looking for comparable sales and finds a property that recently sold for

$ She finds that the buyer was able to assume the seller's fully amortizing

mortgage, which had monthly payments based on a percent interest. The balance of the

loan at the time of sale was $ with a remaining term of years monthly payments

The appraiser determines that if a $ loan was obtained on the same property,

monthly payments at the market rate for a year fully amortizing loan would have been

percent with no points.

Required:

a Assume that the buyer is expected to benefit from the interest savings on the assumable

loan for the entire loan term. What is the cash equivalent value of the property? Answer is $

b What is the cash equivalent value of the property if you assumed that the buyer is only

expected to benefit from binterest savings for five years because he would probably sell or

refinance after five years? NEED ANSWER FOR

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Assume that the buyer is expected to benefit from the interest savings on the assumable loan fc

the cash equivalent value of the property? Do not round intermediate calculations. Round your

places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started