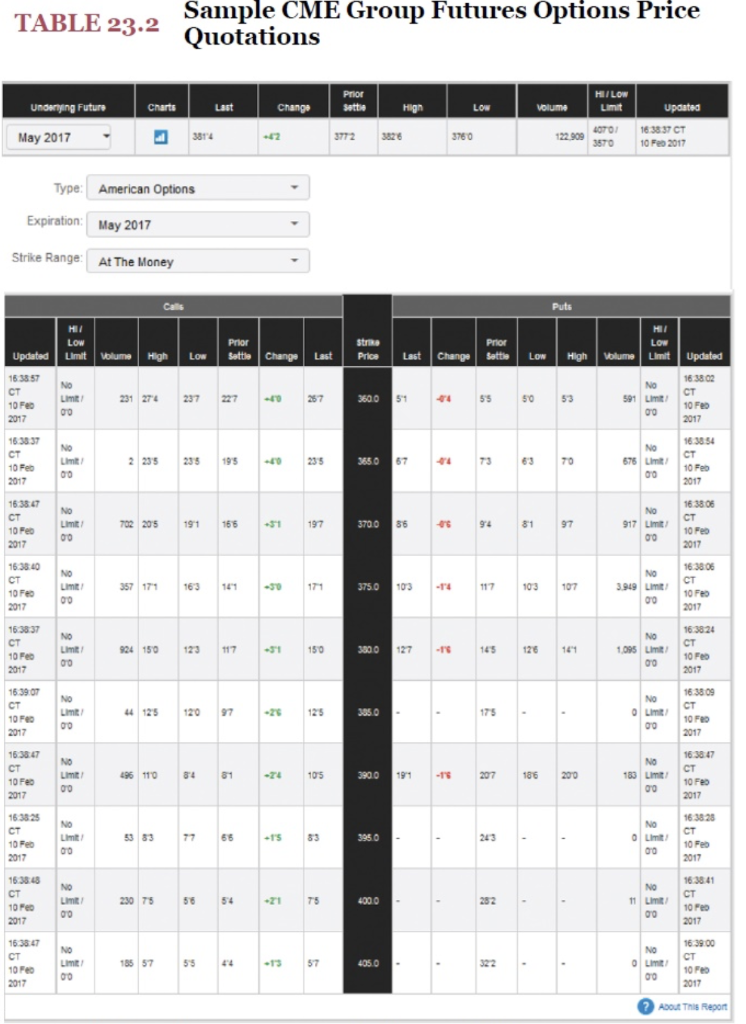

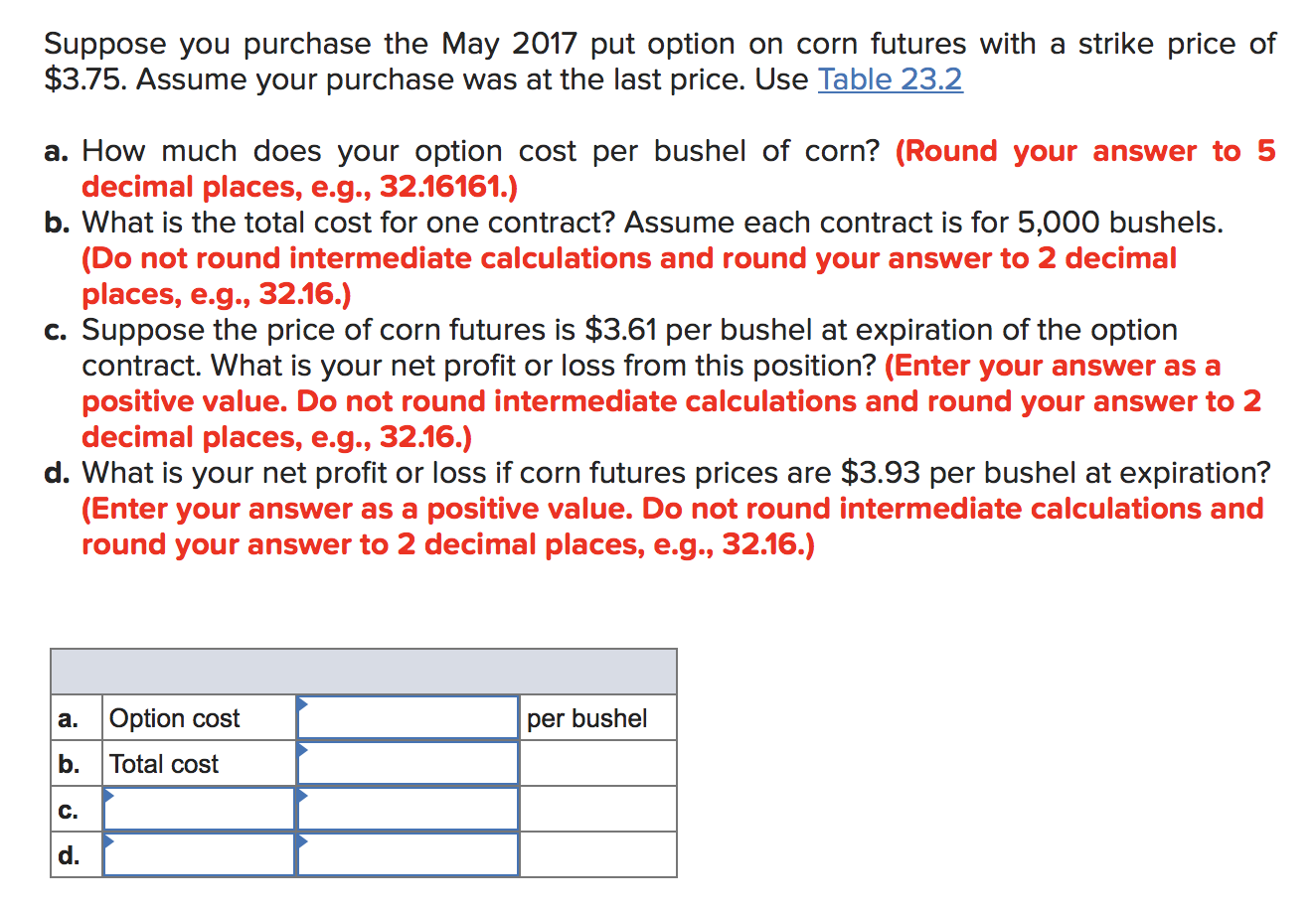

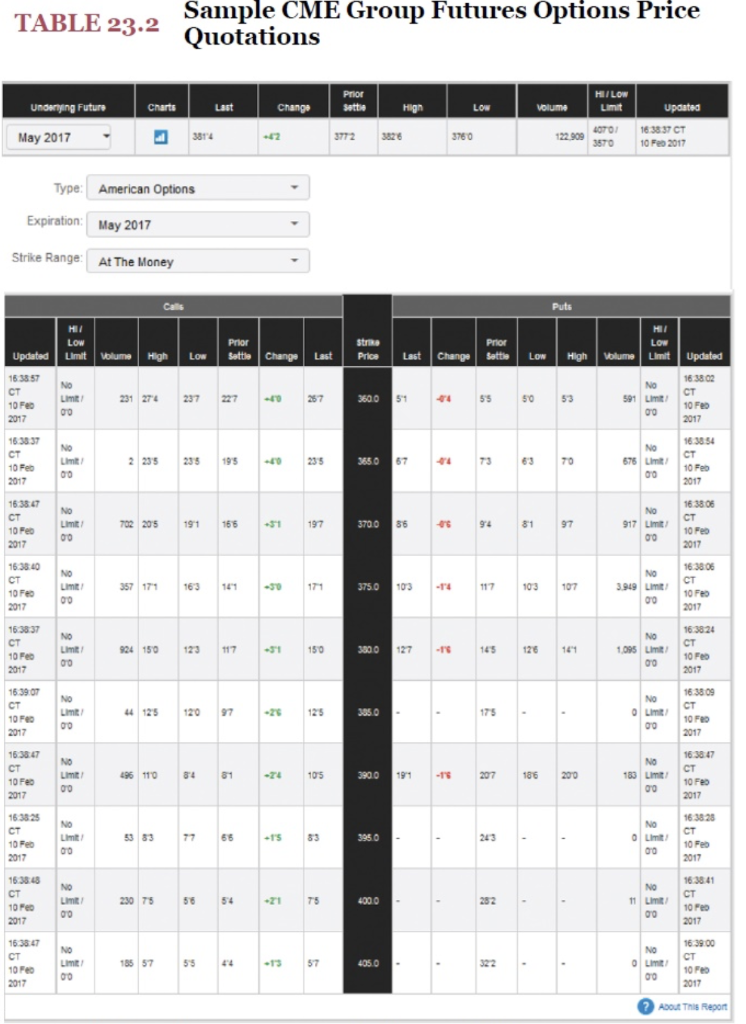

An asset costs $600,000 and will be depreciated in a straight-line manner over its three- year life. It will have no salvage value. The lessor can borrow at 6.5 percent and the lessee can borrow at 8 percent. The corporate tax rate is 21 percent for both companies. a. What lease payment will make the lessee and the lessor equally well off? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Lease payment b. Assume that the lessee pays no taxes and the lessor is in the 21 percent tax bracket. For what range of lease payments does the lease have a positive NPV for both parties? (Enter your answers from lowest to highest. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Lease payment to Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.75. Assume your purchase was at the last price. Use Table 23.2 a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.61 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.93 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Option cost per bushel b. Total cost C. d. TABLE 23.2 Sample CME Group Futures Options Price Quotations Undenying Future Last chang gh HI/LOW | Limit Low Updated May 2017 3814 3772 1760 2200407 . Type: American Options Expiration: May 2017 Strike Range: At The Money Puts Low = Chang change Last Prics Last change LOK Volume Volume z4 23 + 25 4 55 50 53 CT 2 195 - 25 65.0 73 = 72 191 166 197 86 94 9 163 101 171 103 -4 117 10 101 3.919 c Lim 994 150 123 117 - 150 san. 127 145 126 14 1,39s LI 44 125 1202 125 036.0 . 175 . 2017 Lim 496 110 z 105 + 2011 3 53 33 55 +'s 53 245 - 2307 LI 56 54 T 4000 5 > - - ? 1855 55 14 CT an 57 405.0 About Thy Report