Answered step by step

Verified Expert Solution

Question

1 Approved Answer

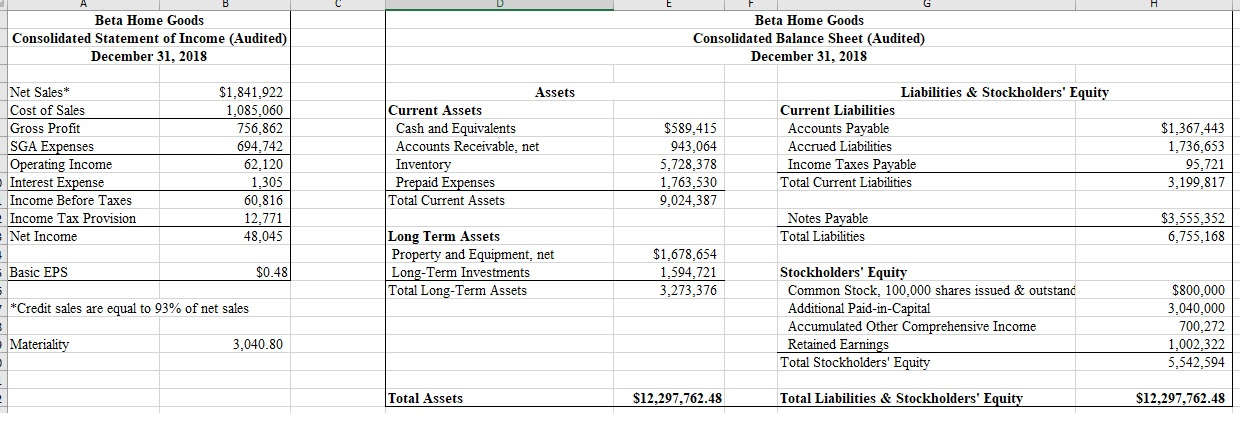

An auditor calculating Betas quick ratio should exclude which of the following item(s) from current assets? Cash and equivalents Inventory Prepaid Expenses B & C

-

An auditor calculating Betas quick ratio should exclude which of the following item(s) from current assets?

An auditor calculating Betas quick ratio should exclude which of the following item(s) from current assets? - Cash and equivalents

- Inventory

- Prepaid Expenses

- B & C only

- The numerator of Betas receivables turnover is equal to

- Eighty-seven percent of Betas cost of sales

- Eighty-seven percent of Betas net sales

- Ninety-three percent of Betas cost of sales

- Ninety-three percent of Betas net sales

- An auditor calculating Betas inventory turnover should include which financial statement item in the denominator?

- Cost of goods sold

- Inventory

- Sales

- Total current assets

- An auditor calculating Betas current ratio should include which financial statement item in the numerator?

- Current assets

- Current liabilities

- Interest expense

- Long-term debt

- Assuming a 365 day year, Betas days outstanding in accounts receivables is __ days.

- 61.55

- 162.58

- 164.84

- Betas quick ratio is __ %.

- 0.42

- 2.21

- 2.53

- Betas return on equity (ROE) is __ %.

- 0.37

- 0.40

- 0.75

- Betas profit margin is __ %.

- 2.21

- 2.61

- 32.91

- Assume Betas usual credit terms are 2/10, net 30. Betas days outstanding in accounts receivables suggests bad debts likely are __ to accounts receivable.

- Immaterial

- Material

- Neither A nor B: Bad debts have no relationship with accounts receivable

- Betas profit margin, relative to the industry of average of 1%, suggests a __ level of detection risk.

- Low

- High

- Neither A nor B: profit margin is irrelevant to detection risk

- Betas ROA, relative to the industry average of 0.1%, suggests a __ level of inherent risk.

- Low

- High

- Neither A nor B: ROA is irrelevant to assessing inherent risk

- Betas current ratio may be distorted because the company

- Has not fully depreciated and amortized all of its fixed assets

- Did not present diluted EPS in its financial statements

- Likely has a high level of bad debts

I just want to verify that my answers are correct or not.

Beta Home Goods Beta Home Goods Consolidated Balance Sheet (Audited) Consolidated Statement of Income (Audited) December 31, 2018 December 31, 2018 Net Sales $1,841,922 1,085,060 Liabilities & Stockholders' Equity Assets Current Liabilities Accounts Payable Current Assets Cash and Equivalents Cost of Sales $589,415 $1,367,443 Gross Profit 756,862 694,742 62,120 1,305 SGA Expenses Operating Income Interest Expense 1,736,653 95,721 3,199,817 Accounts Receivable, net Inventory Prepaid Expenses Total Current Assets 943,064 5,728,378 1,763,530 9,024,387 Accrued Liabilities Income Taxes Payable Total Current Liabilities Income Before Taxes 60,816 12,771 Income Tax Provision Net Income $3,555,352 6,755,168 Notes Payable Long Term Assets Property and Equipment, net Long-Term Investments Total Long-Term Assets 48,045 Total Liabilities $1,678,654 $0.48 Stockholders' Equity Basic EPS 1,594,721 $800,000 3,040,000 700,272 1,002,322 5,542,594 3,273,376 Common Stock, 100,000 shares issued & outstand Additional Paid-in-Capital Accumulated Other Comprehensive Income Retained Earnings Total Stockholders' Equity Credit sales are equal to 93% of net sales |Materiality 3,040.80 Total Liabilities & Stockholders' Equity Total Assets $12,297,762.48 $12,297,762.48Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started