Question

An Australian firm, has a USD428 million payable in one year that it wants to hedge, and enters into a risk sharing arrangement with

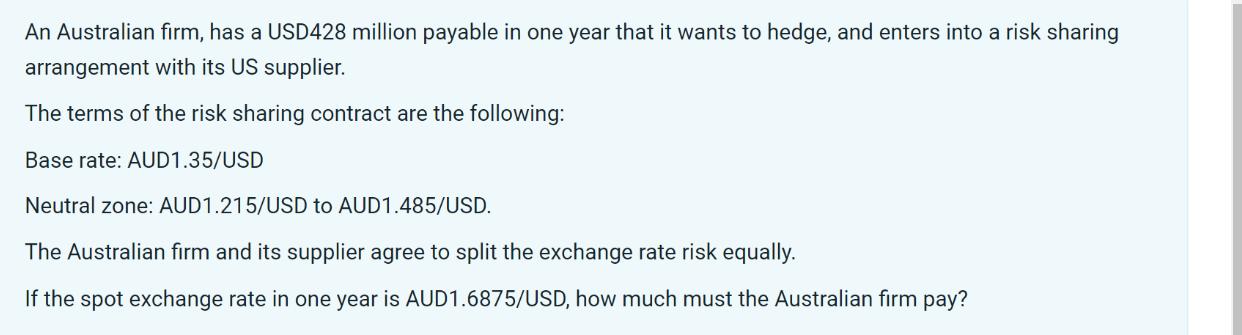

An Australian firm, has a USD428 million payable in one year that it wants to hedge, and enters into a risk sharing arrangement with its US supplier. The terms of the risk sharing contract are the following: Base rate: AUD1.35/USD Neutral zone: AUD1.215/USD to AUD1.485/USD. The Australian firm and its supplier agree to split the exchange rate risk equally. If the spot exchange rate in one year is AUD1.6875/USD, how much must the Australian firm pay?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate how much the Australian firm must pay in USD after one year we need to determine the ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics and Strategy

Authors: Jeffrey M. Perloff, James A. Brander

1st edition

978-0137036059, 133379094, 321566440, 137036051, 9780133379099, 978-0321566447

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App