An Australian investor will allocate 30% of the portfolio to Fixed Income Securities (FIS) using active mutual funds. The investor uses Refinitiv to identify

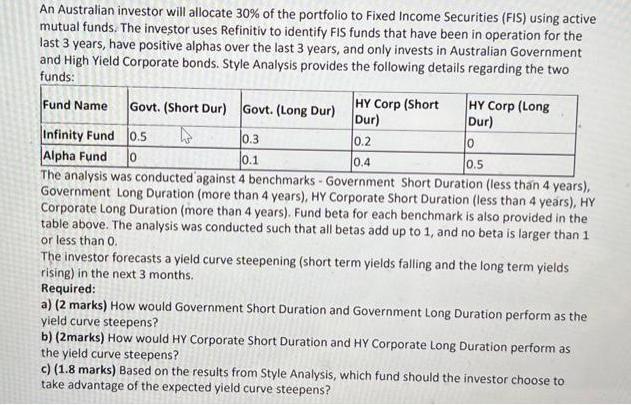

An Australian investor will allocate 30% of the portfolio to Fixed Income Securities (FIS) using active mutual funds. The investor uses Refinitiv to identify FIS funds that have been in operation for the last 3 years, have positive alphas over the last 3 years, and only invests in Australian Government and High Yield Corporate bonds. Style Analysis provides the following details regarding the two funds: Fund Name Govt. (Short Dur) Govt. (Long Dur) HY Corp (Short Dur) 0.2 0.5 HY Corp (Long Dur) Infinity Fund 0.3 Alpha Fund 10 0.1 0.4 The analysis was conducted against 4 benchmarks - Government Short Duration (less than 4 years), Government Long Duration (more than 4 years), HY Corporate Short Duration (less than 4 years), HY Corporate Long Duration (more than 4 years). Fund beta for each benchmark is also provided in the table above. The analysis was conducted such that all betas add up to 1, and no beta is larger than 1 or less than 0. The investor forecasts a yield curve steepening (short term yields falling and the long term yields rising) in the next 3 months. 0 0.5 Required: a) (2 marks) How would Government Short Duration and Government Long Duration perform as the yield curve steepens? b) (2marks) How would HY Corporate Short Duration and HY Corporate Long Duration perform as the yield curve steepens? c) (1.8 marks) Based on the results from Style Analysis, which fund should the investor choose to take advantage of the expected yield curve steepens?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Government Short Duration will likely outperform Government Long Duration as the yield curve ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started