Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An Australian stock paying no dividends is trading in Australian dollars for A$63.31, and the annual Australian interest rate is 2.75% with annual compounding.

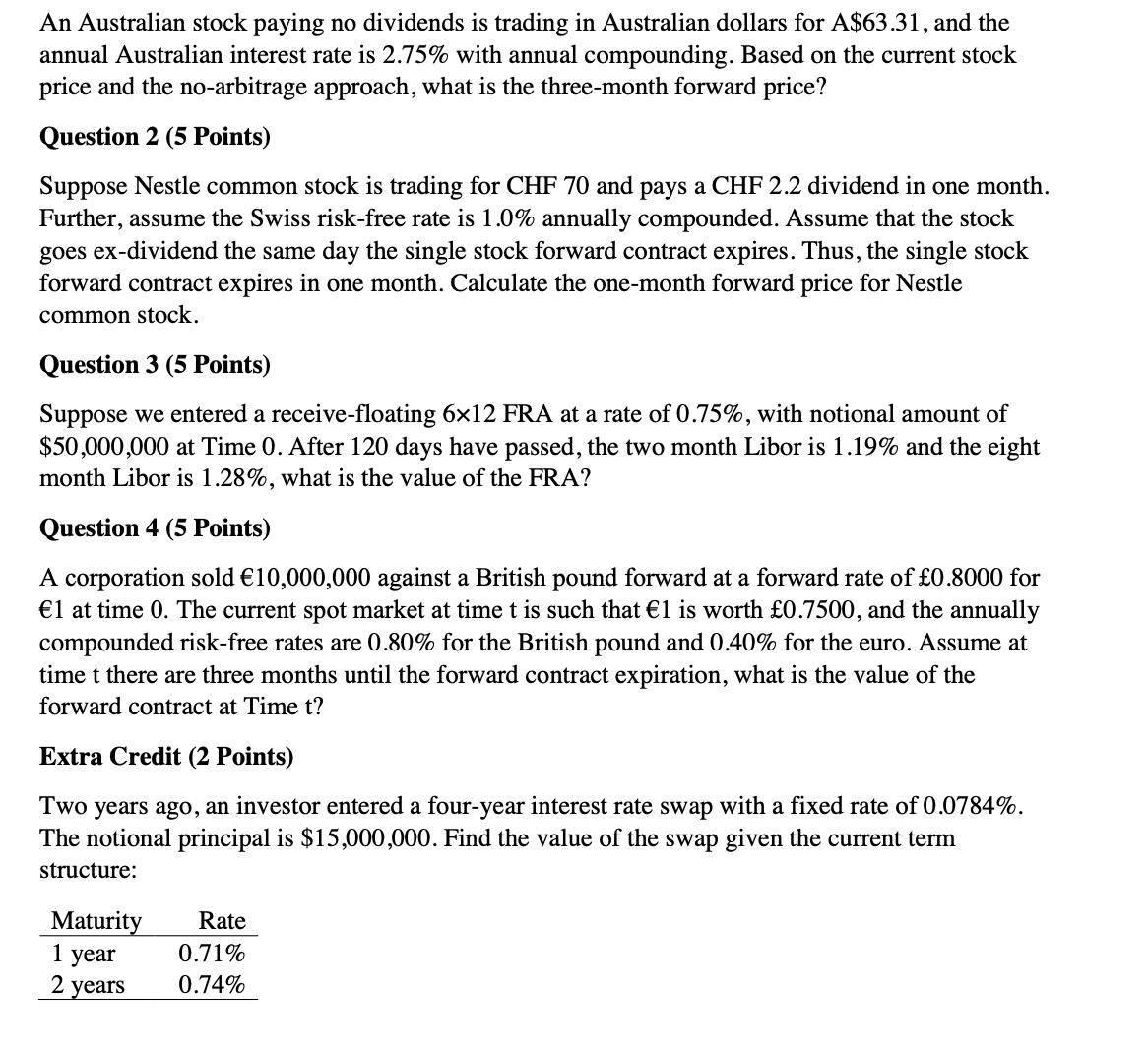

An Australian stock paying no dividends is trading in Australian dollars for A$63.31, and the annual Australian interest rate is 2.75% with annual compounding. Based on the current stock price and the no-arbitrage approach, what is the three-month forward price? Question 2 (5 Points) Suppose Nestle common stock is trading for CHF 70 and pays a CHF 2.2 dividend in one month. Further, assume the Swiss risk-free rate is 1.0% annually compounded. Assume that the stock goes ex-dividend the same day the single stock forward contract expires. Thus, the single stock forward contract expires in one month. Calculate the one-month forward price for Nestle common stock. Question 3 (5 Points) Suppose we entered a receive-floating 6x12 FRA at a rate of 0.75%, with notional amount of $50,000,000 at Time 0. After 120 days have passed, the two month Libor is 1.19% and the eight month Libor is 1.28%, what is the value of the FRA? Question 4 (5 Points) A corporation sold 10,000,000 against a British pound forward at a forward rate of 0.8000 for 1 at time 0. The current spot market at time t is such that 1 is worth 0.7500, and the annually compounded risk-free rates are 0.80% for the British pound and 0.40% for the euro. Assume at time t there are three months until the forward contract expiration, what is the value of the forward contract at Time t? Extra Credit (2 Points) Two years ago, an investor entered a four-year interest rate swap with a fixed rate of 0.0784%. The notional principal is $15,000,000. Find the value of the swap given the current term structure: Maturity Rate 1 year 0.71% 2 years 0.74%

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help with that Lets proceed with the remaining questions Question 2 To calculate the onemonth forward price for Nestle common stock we can use the formula F S PVDert Where F the forward pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started