Question

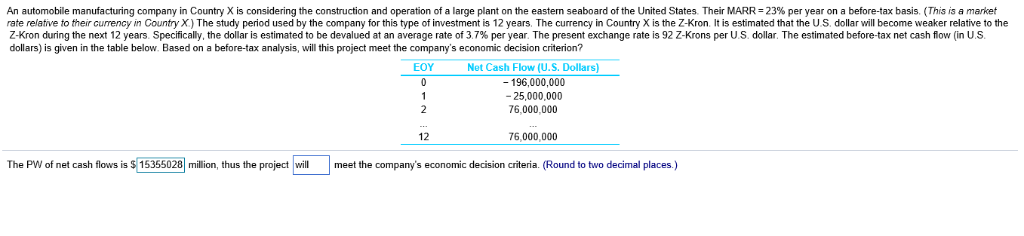

An automobile manufacturing company in Country X is considering the construction and operation of a large plant on the eastern seaboard of the United States.

An automobile manufacturing company in Country X is considering the construction and operation of a large plant on the eastern seaboard of the United States. Their

MARRequals=2323%

per year on a before-tax basis.

(This

is a market rate relative to their currency in Country

X.)

The study period used by the company for this type of investment is

1212

years. The currency in Country X is the Z-Kron. It is estimated that the U.S. dollar will become weaker relative to the Z-Kron during the next

1212

years. Specifically, the dollar is estimated to be devalued at an average rate of

3.73.7%

per year. The present exchange rate is 92 Z-Krons per U.S. dollar. The estimated before-tax net cash flow (in U.S. dollars) is given in the table below. Based on a before-tax analysis, will this project meet the company's economic decision criterion?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started