Question

An automobile manufacturing company in Country X is considering the construction and operation of a large plant on the eastern seaboard of the United States.

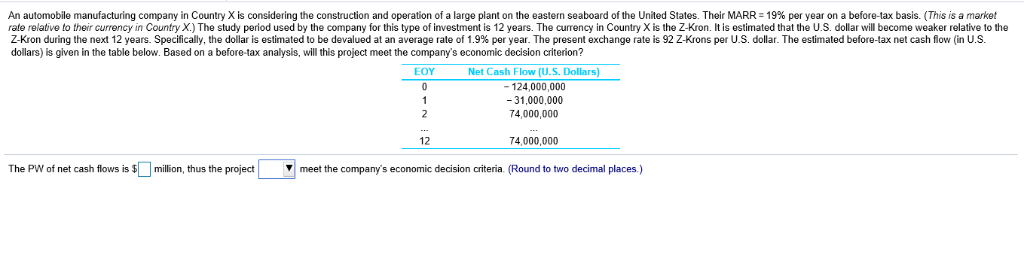

An automobile manufacturing company in Country X is considering the construction and operation of a large plant on the eastern seaboard of the United States. Their

MARRequals=1919%

per year on a before-tax basis.

(This

is a market rate relative to their currency in Country

X.)

The study period used by the company for this type of investment is

1212

years. The currency in Country X is the Z-Kron. It is estimated that the U.S. dollar will become weaker relative to the Z-Kron during the next

1212

years. Specifically, the dollar is estimated to be devalued at an average rate of

1.91.9%

per year. The present exchange rate is 92 Z-Krons per U.S. dollar. The estimated before-tax net cash flow (in U.S. dollars) is given in the table below. Based on a before-tax analysis, will this project meet the company's economic decision criterion?

| EOY | Net Cash Flow (U.S. Dollars) |

| 0 | minus124 comma 000 comma 000124,000,000 |

| 1 | minus31 comma 000 comma 00031,000,000 |

| 2 | 74 comma 000 comma 00074,000,000 |

| ... | ... |

| 1212 | 74 comma 000 comma 00074,000,000 |

The PW of net cash flows is

$nothing

million, thus the project

will not

will

meet the company's economic decision criteria.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started